- South Korea

- /

- Banks

- /

- KOSE:A316140

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a complex landscape of economic developments, Asian indices have shown resilience, with China's CSI 300 Index and the Shanghai Composite Index posting gains amidst mixed economic signals. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an appealing consideration for those looking to diversify their portfolios in Asia's dynamic market.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.45% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.10% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.34% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.45% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

Samyung Trading (KOSE:A002810)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samyung Trading Co., Ltd. primarily supplies organic and inorganic chemical products worldwide, with a market cap of ₩306.20 billion.

Operations: Samyung Trading Co., Ltd. generates revenue from various segments, including Shoemaker at ₩204.14 million, Auto Parts at ₩252.37 million, Spectacle Lens at ₩18.91 million, and Other than Sensor at ₩10.98 million.

Dividend Yield: 4%

Samyung Trading offers a promising dividend profile with its dividend yield in the top 25% of the KR market. Despite only six years of payments, dividends have been reliable and growing with minimal volatility. The company's payout ratios suggest sustainability, as dividends are well covered by both earnings (21.3%) and cash flows (69%). Recent earnings showed an increase in net income to ₩16.63 billion, supporting continued dividend reliability despite a decline in sales.

- Unlock comprehensive insights into our analysis of Samyung Trading stock in this dividend report.

- Upon reviewing our latest valuation report, Samyung Trading's share price might be too optimistic.

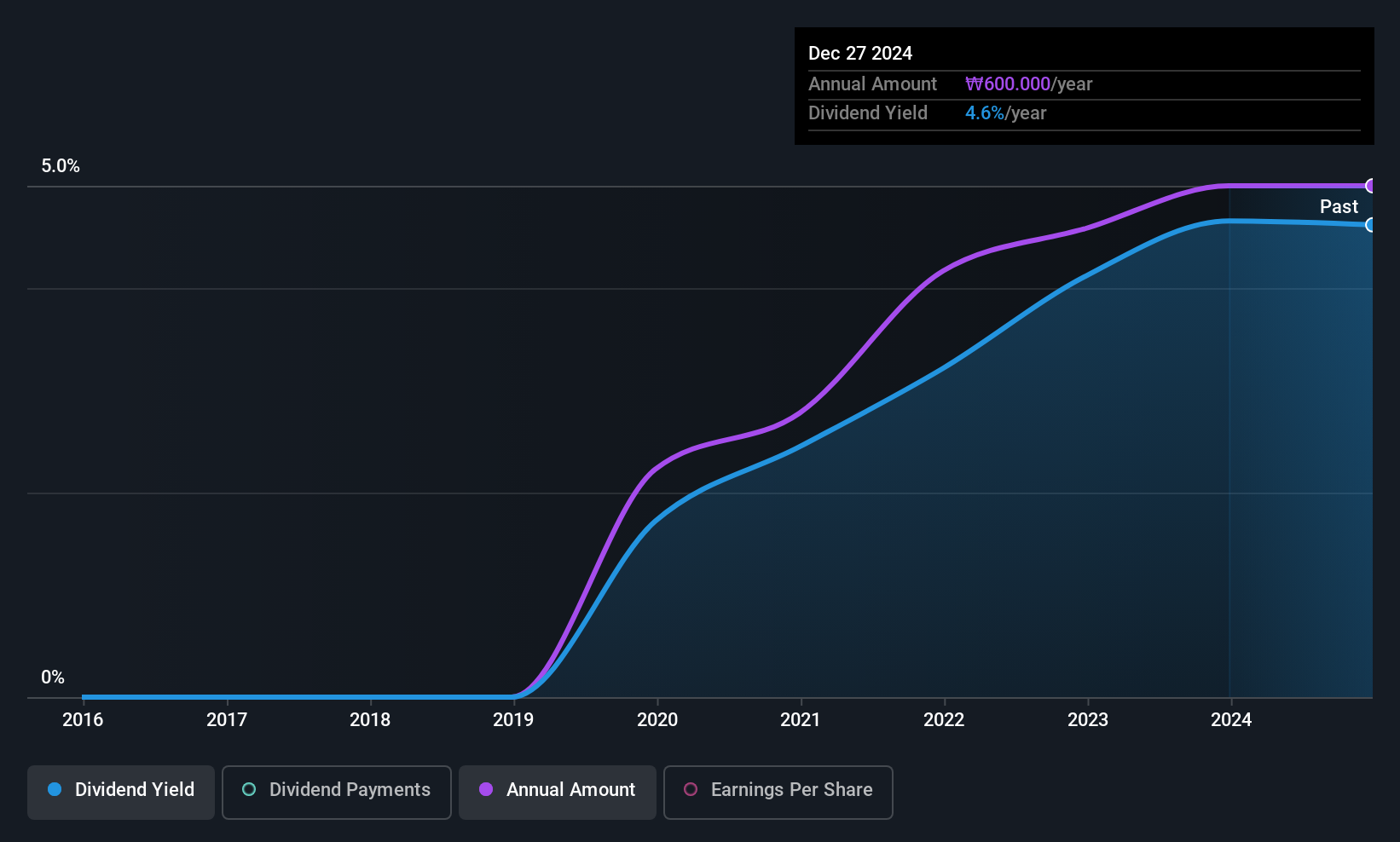

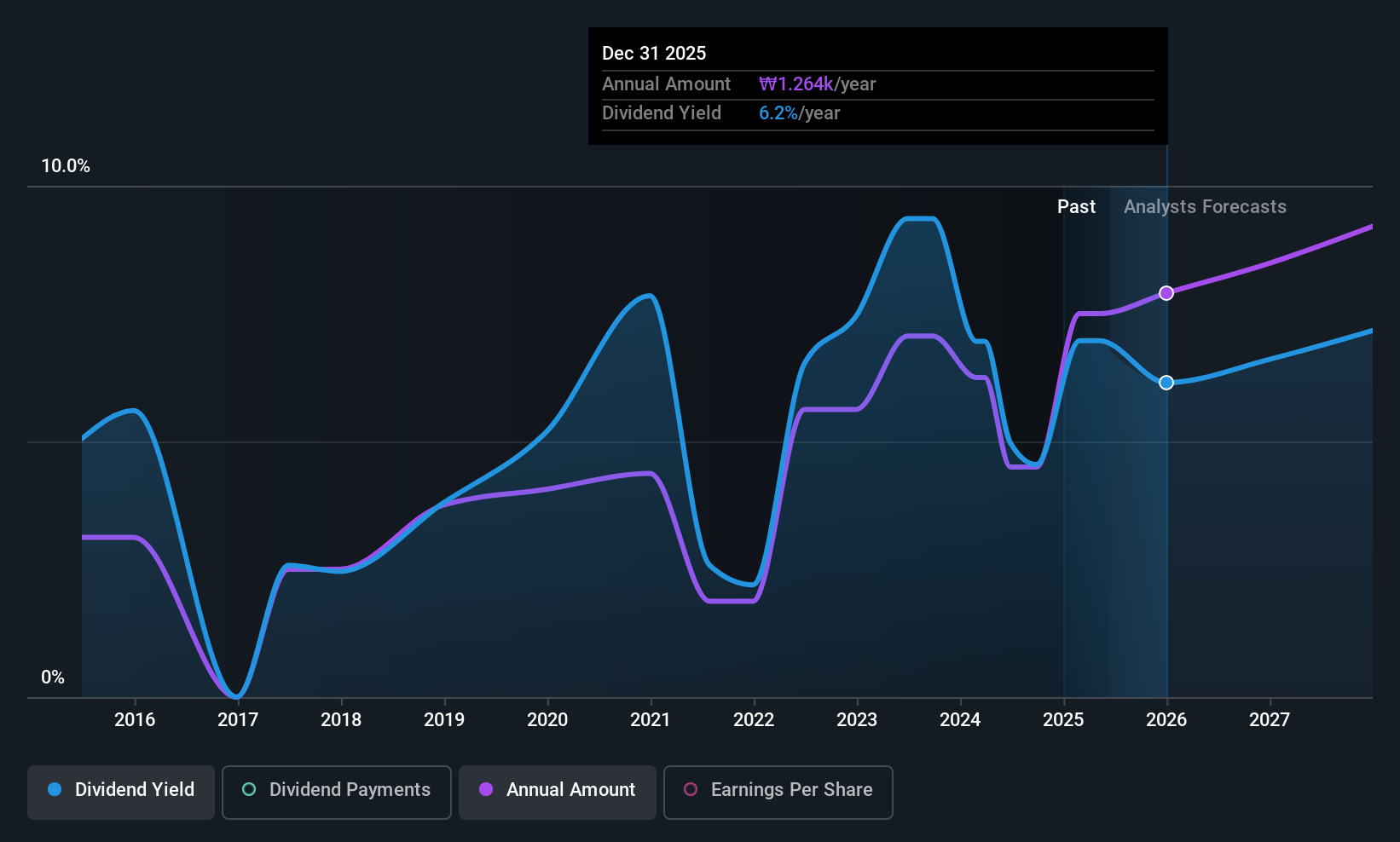

Woori Financial Group (KOSE:A316140)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Woori Financial Group Inc., along with its subsidiaries, operates as a commercial bank offering a range of financial services to individual, business, and institutional customers in Korea, with a market cap of ₩18.64 trillion.

Operations: Woori Financial Group Inc. generates revenue primarily from its Banking segment, which accounts for ₩7.81 billion, followed by its Credit Cards segment at ₩520.77 million, Capital at ₩291.32 million, and Investment Securities at ₩66.84 million.

Dividend Yield: 4.7%

Woori Financial Group's dividend yield ranks in the top 25% of the KR market, supported by a low payout ratio of 33.2%, indicating strong coverage by earnings. However, its dividend history has been unreliable and volatile over the past decade. Recent financials show a decline in net income to ₩615.64 billion for Q1 2025, impacting earnings per share compared to last year. A recent buyback completed for ₩25.64 billion may influence future dividends positively.

- Navigate through the intricacies of Woori Financial Group with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Woori Financial Group's share price might be too pessimistic.

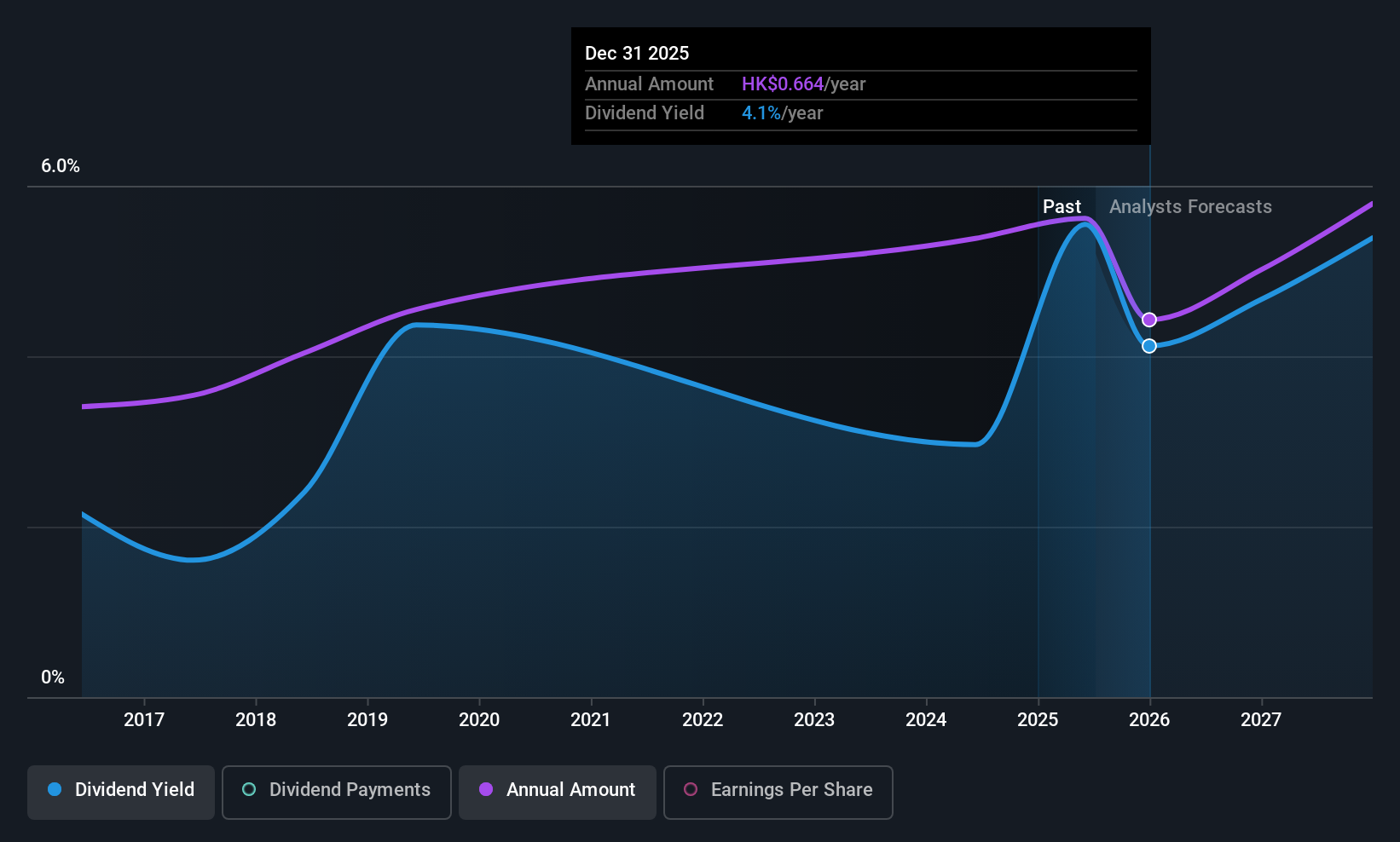

Samsonite Group (SEHK:1910)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsonite Group S.A. designs, manufactures, sources, and distributes luggage and travel accessories across Asia, North America, Europe, and Latin America with a market cap of HK$22.10 billion.

Operations: Samsonite Group's revenue segments are distributed as follows: Asia contributes $1.31 billion, North America $1.23 billion, Europe $787.60 million, and Latin America $198.40 million.

Dividend Yield: 5.3%

Samsonite Group's dividend yield is below the top 25% in Hong Kong, but its payout ratio of 49.5% and cash payout ratio of 36.4% suggest dividends are well-covered by earnings and cash flows. Despite a volatile dividend history, payments have increased over the past decade. Recent financials show declining net income to US$48.2 million for Q1 2025, but a US$150 million dividend was affirmed at the June AGM with payment scheduled for July 15, 2025.

- Click to explore a detailed breakdown of our findings in Samsonite Group's dividend report.

- According our valuation report, there's an indication that Samsonite Group's share price might be on the cheaper side.

Where To Now?

- Delve into our full catalog of 1208 Top Asian Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Woori Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A316140

Woori Financial Group

Operates as a commercial bank which provides various financial services to individual, business, and institutional customers in Korea.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives