- South Korea

- /

- Construction

- /

- KOSE:A002410

Investors in Bumyang ConstructionLtd (KRX:002410) from three years ago are still down 52%, even after 21% gain this past week

Bumyang Construction Co.,Ltd. (KRX:002410) shareholders will doubtless be very grateful to see the share price up 168% in the last quarter. But that is small recompense for the exasperating returns over three years. Tragically, the share price declined 52% in that time. So the improvement may be a real relief to some. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added ₩15b to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Bumyang ConstructionLtd

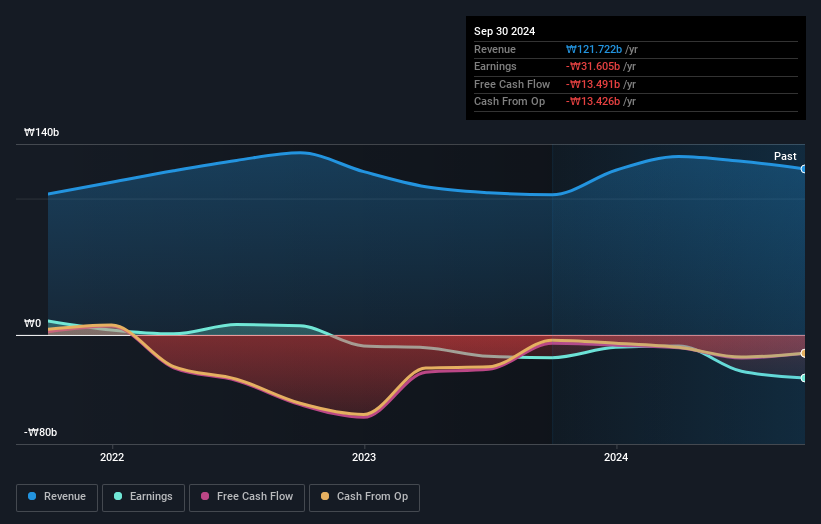

Given that Bumyang ConstructionLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Bumyang ConstructionLtd saw its revenue grow by 2.4% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 15% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Bumyang ConstructionLtd has rewarded shareholders with a total shareholder return of 40% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Bumyang ConstructionLtd (of which 3 can't be ignored!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bumyang ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002410

Bumyang ConstructionLtd

Engages in the housing construction, civil engineering construction, water heating construction contract businesses in South Korea.

Slight with worrying balance sheet.

Market Insights

Community Narratives