- South Korea

- /

- Construction

- /

- KOSE:A002410

Investors Continue Waiting On Sidelines For Bumyang Construction Co.,Ltd. (KRX:002410)

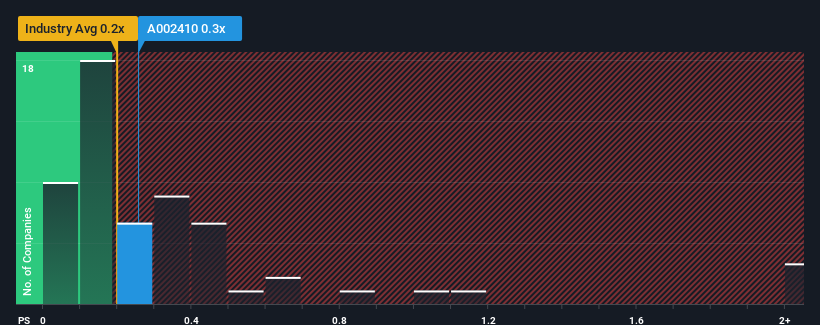

It's not a stretch to say that Bumyang Construction Co.,Ltd.'s (KRX:002410) price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" for companies in the Construction industry in Korea, where the median P/S ratio is around 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Bumyang ConstructionLtd

How Bumyang ConstructionLtd Has Been Performing

Bumyang ConstructionLtd has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bumyang ConstructionLtd will help you shine a light on its historical performance.How Is Bumyang ConstructionLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Bumyang ConstructionLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. Revenue has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 0.02%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Bumyang ConstructionLtd is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Bumyang ConstructionLtd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bumyang ConstructionLtd currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 4 warning signs for Bumyang ConstructionLtd (2 make us uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Bumyang ConstructionLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Bumyang ConstructionLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A002410

Bumyang ConstructionLtd

Engages in the housing construction, civil engineering construction, water heating construction contract businesses in South Korea.

Moderate with worrying balance sheet.