- South Korea

- /

- Communications

- /

- KOSDAQ:A178320

High Growth Tech Stocks Including Seojin SystemLtd And Two Others

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating consumer confidence and mixed economic indicators, the global markets have shown moderate gains, with technology stocks playing a significant role in driving recent rallies. In this environment, identifying high-growth tech stocks like Seojin System Ltd and others can be crucial for investors seeking opportunities in sectors that may benefit from technological advancements and market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| TG Therapeutics | 30.06% | 45.28% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd is engaged in the production of telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market capitalization of ₩1.51 trillion.

Operations: Seojin System Co., Ltd generates revenue primarily from its EMS sector, contributing approximately ₩1.79 trillion, followed by the semiconductor sector with about ₩187.83 billion.

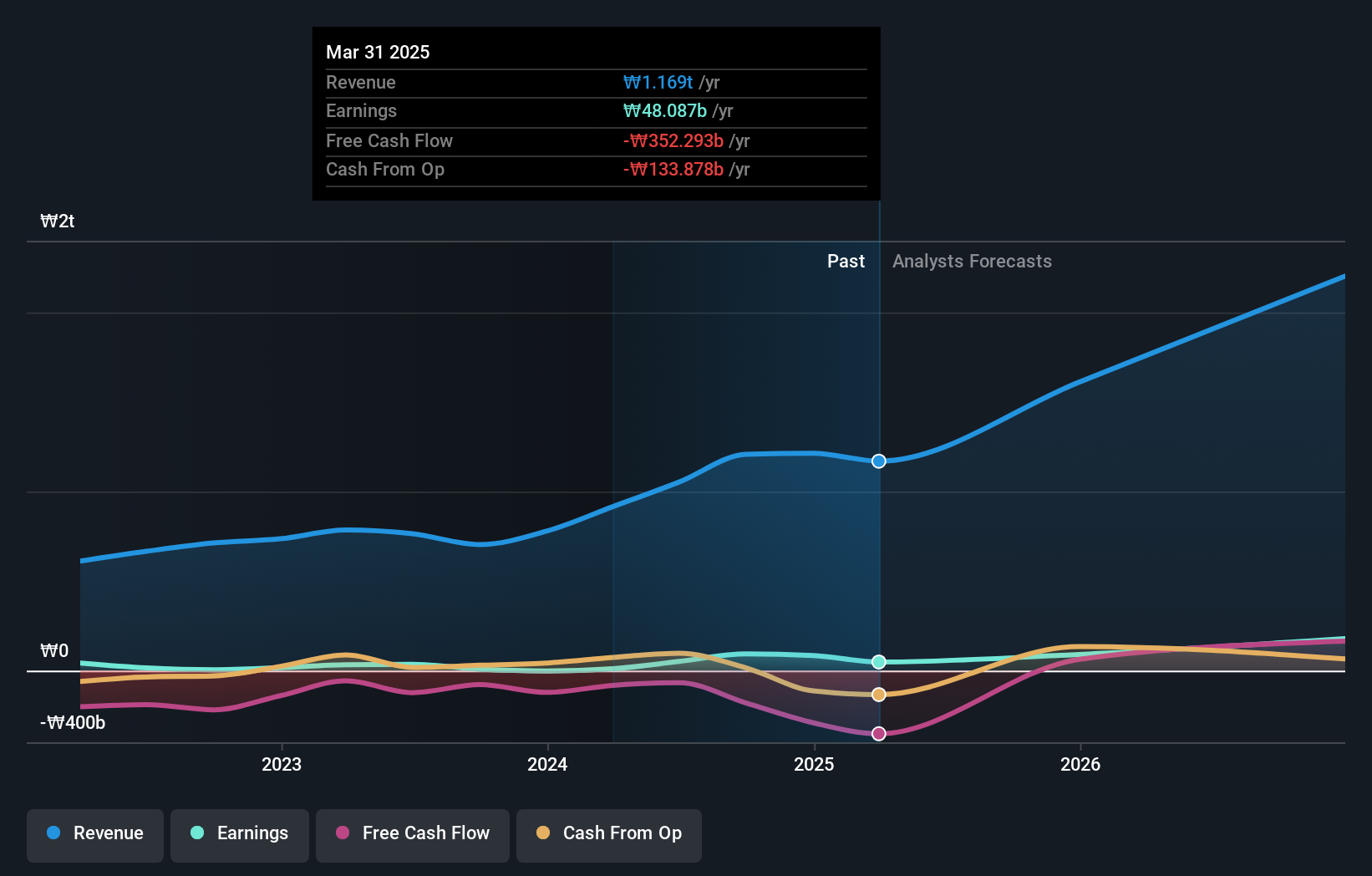

Seojin SystemLtd has demonstrated robust growth with a remarkable 1063% increase in earnings over the past year, significantly outpacing the Communications industry's -11.6% performance. This surge is underpinned by an aggressive R&D strategy, where expenses are meticulously aligned with emerging tech trends, ensuring their offerings remain competitive. Forecasted to grow at 35.4% annually, Seojin’s revenue trajectory exceeds the Korean market average of 9%. Furthermore, its earnings are expected to expand by 39.9% per year, surpassing the market forecast of 29.2%. However, it's crucial to note that debt is not well covered by operating cash flow, posing potential financial constraints on future operations.

- Click to explore a detailed breakdown of our findings in Seojin SystemLtd's health report.

Examine Seojin SystemLtd's past performance report to understand how it has performed in the past.

Forth Corporation (SET:FORTH)

Simply Wall St Growth Rating: ★★★★★★

Overview: Forth Corporation Public Company Limited, along with its subsidiaries, is involved in the manufacture and distribution of electronic equipment both in Thailand and internationally, with a market capitalization of approximately THB9.91 billion.

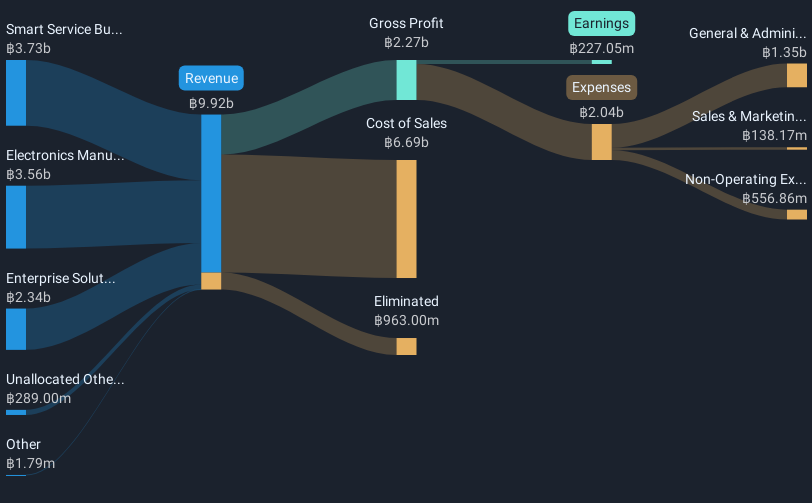

Operations: Forth Corporation generates revenue primarily through its Smart Service Business (THB3.73 billion), Enterprise Solutions Business (THB2.34 billion), and Electronics Manufacturing Service Business (THB3.56 billion).

Forth Corporation's recent financial performance reveals a challenging landscape with a significant drop in net income from THB 122.17 million to THB 15.64 million in the latest quarter, reflecting broader industry pressures. Despite these headwinds, the company is poised for recovery with forecasted revenue growth of 22.8% per year, outpacing the Thai market's average of 6.5%. This optimism is bolstered by an aggressive R&D commitment which aligns well with technological advancements and market demands, ensuring Forth remains competitive in its sector. Furthermore, an expected annual profit growth rate of 54.4% highlights potential for substantial earnings expansion moving forward, despite current volatility and a high debt level that could constrain flexibility.

Yokowo (TSE:6800)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Yokowo Co., Ltd. specializes in creating components and advanced devices for wireless communication and information transmission, serving both domestic and international markets, with a market cap of ¥41.63 billion.

Operations: The company's revenue streams are primarily driven by the VCCS segment, contributing ¥56.81 billion, followed by CTC at ¥13.86 billion and FC/MD at ¥9.93 billion. The focus on these segments highlights its emphasis on components for wireless communication and information transmission applications across various markets.

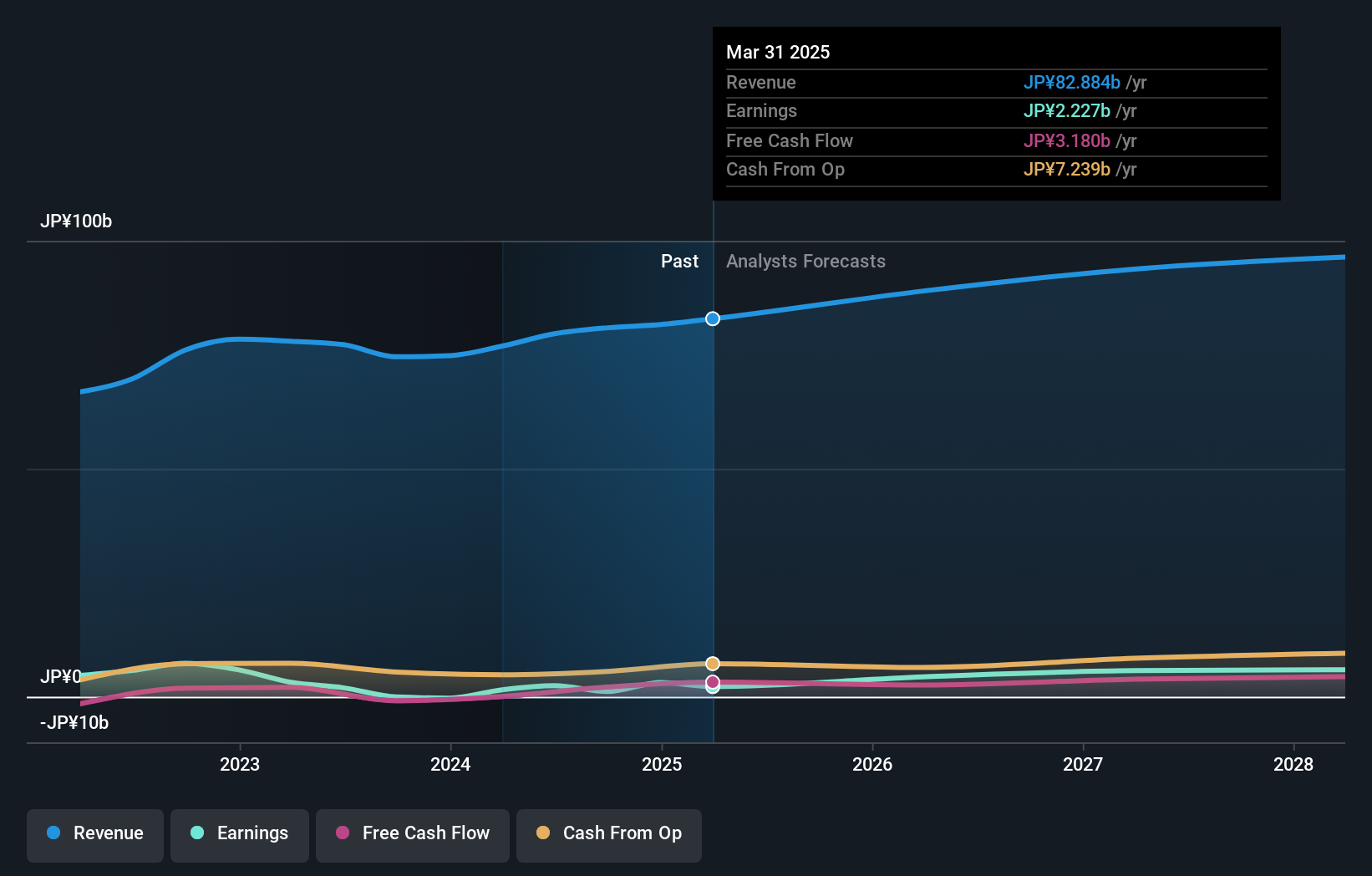

Yokowo's recent trajectory in the tech sector underscores its resilience and adaptability, with a notable annual revenue growth of 4.8% and an impressive earnings surge of 30.9% per year, outstripping Japan's market average growth of 7.9%. This performance is bolstered by strategic R&D investments, which have not only kept pace with but exceeded industry norms, positioning Yokowo at the forefront of technological innovation. The company's commitment to research has translated into tangible advances in their product offerings, ensuring they remain competitive amidst shifting market demands. As Yokowo continues to expand its client base and refine its technological edge, these factors collectively herald a promising outlook for sustained growth within the high-tech landscape.

- Click here to discover the nuances of Yokowo with our detailed analytical health report.

Assess Yokowo's past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 1261 High Growth Tech and AI Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A178320

Seojin SystemLtd

Provides telecom equipment, repeaters, mechanical products, and LED and other equipment.

Undervalued with high growth potential.

Market Insights

Community Narratives