- South Korea

- /

- Construction

- /

- KOSE:A002150

Dohwa Engineering Co., Ltd.'s (KRX:002150) Has Had A Decent Run On The Stock market: Are Fundamentals In The Driver's Seat?

Most readers would already know that Dohwa Engineering's (KRX:002150) stock increased by 3.7% over the past three months. As most would know, long-term fundamentals have a strong correlation with market price movements, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on Dohwa Engineering's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Dohwa Engineering

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Dohwa Engineering is:

8.0% = ₩20b ÷ ₩254b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.08.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Dohwa Engineering's Earnings Growth And 8.0% ROE

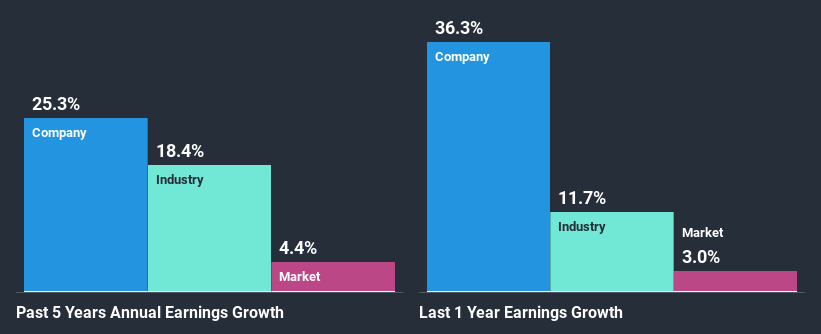

When you first look at it, Dohwa Engineering's ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 9.6%. Particularly, the exceptional 25% net income growth seen by Dohwa Engineering over the past five years is pretty remarkable. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. Such as - high earnings retention or an efficient management in place.

As a next step, we compared Dohwa Engineering's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 18%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Dohwa Engineering fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Dohwa Engineering Using Its Retained Earnings Effectively?

Dohwa Engineering has a three-year median payout ratio of 45% (where it is retaining 55% of its income) which is not too low or not too high. By the looks of it, the dividend is well covered and Dohwa Engineering is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Additionally, Dohwa Engineering has paid dividends over a period of three years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

Overall, we feel that Dohwa Engineering certainly does have some positive factors to consider. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Dohwa Engineering or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSE:A002150

Dohwa Engineering

Operates as an engineering consulting company in South Korea and internationally.

Adequate balance sheet average dividend payer.