- South Korea

- /

- Construction

- /

- KOSE:A001880

Should You Rely On Daelim Construction's (KRX:001880) Earnings Growth?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. Today we'll focus on whether this year's statutory profits are a good guide to understanding Daelim Construction (KRX:001880).

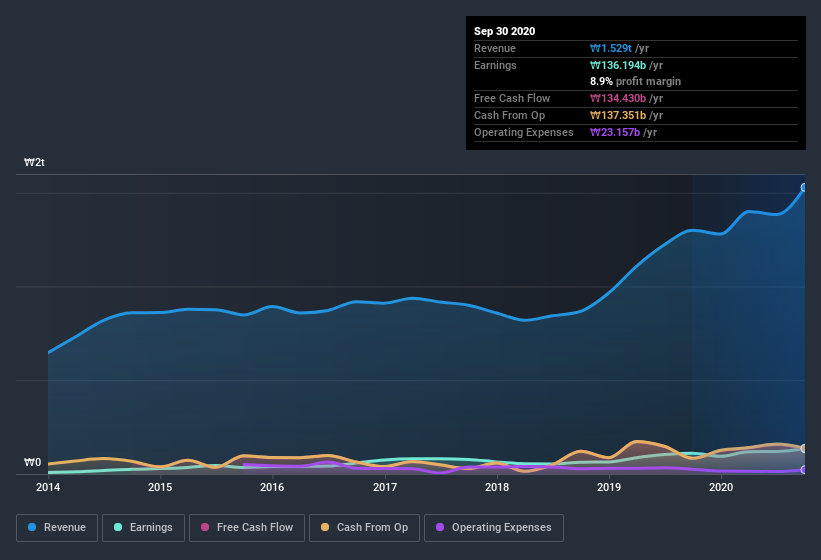

It's good to see that over the last twelve months Daelim Construction made a profit of ₩136.2b on revenue of ₩1.53t. One positive is that it has grown both its profit and its revenue, over the last few years.

See our latest analysis for Daelim Construction

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. In this article we'll look at how Daelim Construction is impacting shareholders by issuing new shares. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Daelim Construction.

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. As it happens, Daelim Construction issued 45% more new shares over the last year. That means its earnings are split among a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out Daelim Construction's historical EPS growth by clicking on this link.

How Is Dilution Impacting Daelim Construction's Earnings Per Share? (EPS)

As you can see above, Daelim Construction has been growing its net income over the last few years, with an annualized gain of 76% over three years. And the 23% profit boost in the last year certainly seems impressive at first glance. On the other hand, earnings per share are only up 9.8% in that time. So you can see that the dilution has had a fairly significant impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So Daelim Construction shareholders will want to see that EPS figure continue to increase. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Our Take On Daelim Construction's Profit Performance

As we discussed above, Daelim Construction's dilution over the last year has a major impact on its per-share earnings. As a result, we think it may well be the case that Daelim Construction's underlying earnings power is lower than its statutory profit. But on the bright side, its earnings per share have grown at an extremely impressive rate over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Case in point: We've spotted 1 warning sign for Daelim Construction you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Daelim Construction's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Daelim Construction or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About KOSE:A001880

DL Construction

DL Construction Co., Ltd., a general construction company, engages in the construction and civil engineering business in South Korea.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives