- South Korea

- /

- Building

- /

- KOSE:A001780

Aluko (KRX:001780) Strong Profits May Be Masking Some Underlying Issues

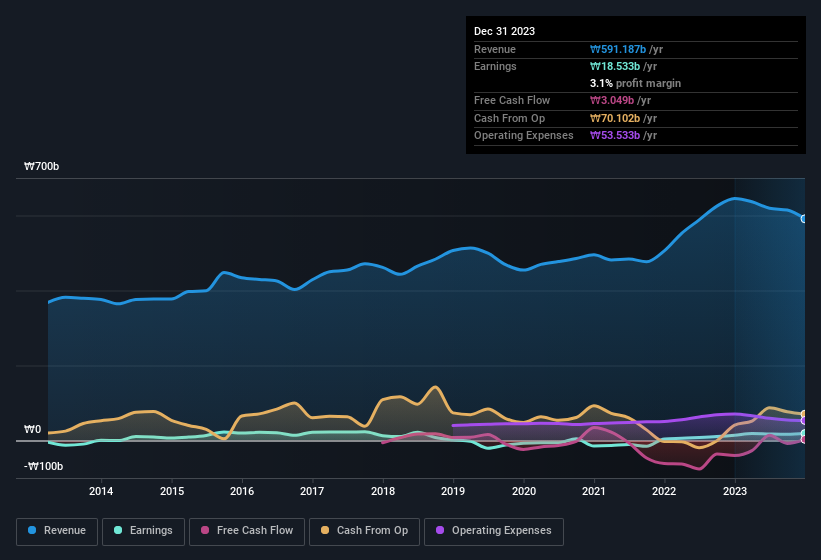

Aluko Co., Ltd.'s (KRX:001780) healthy profit numbers didn't contain any surprises for investors. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

View our latest analysis for Aluko

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. Aluko expanded the number of shares on issue by 7.2% over the last year. As a result, its net income is now split between a greater number of shares. To celebrate net income while ignoring dilution is like rejoicing because you have a single slice of a larger pizza, but ignoring the fact that the pizza is now cut into many more slices. You can see a chart of Aluko's EPS by clicking here.

How Is Dilution Impacting Aluko's Earnings Per Share (EPS)?

Aluko was losing money three years ago. On the bright side, in the last twelve months it grew profit by 33%. But EPS was less impressive, up only 30% in that time. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if Aluko can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Aluko.

The Impact Of Unusual Items On Profit

Finally, we should also consider the fact that unusual items boosted Aluko's net profit by ₩5.1b over the last year. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Aluko's Profit Performance

In its last report Aluko benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at Aluko's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 3 warning signs we've spotted with Aluko (including 1 which makes us a bit uncomfortable).

Our examination of Aluko has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001780

Aluko

Manufactures and sells aluminum products in South Korea and internationally.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives