- South Korea

- /

- Machinery

- /

- KOSE:A001560

Unpleasant Surprises Could Be In Store For Cheil Grinding Wheel Ind. Co., Ltd.'s (KRX:001560) Shares

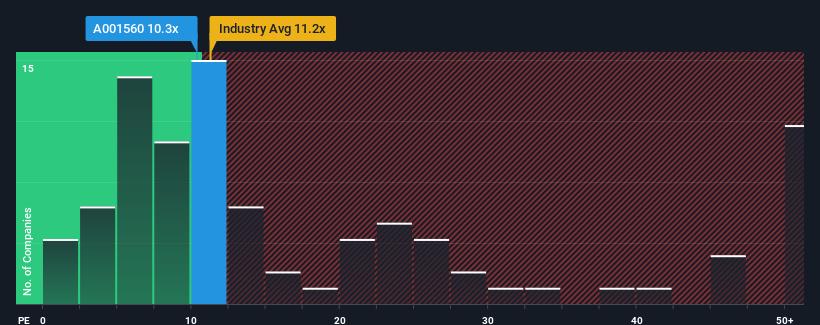

It's not a stretch to say that Cheil Grinding Wheel Ind. Co., Ltd.'s (KRX:001560) price-to-earnings (or "P/E") ratio of 10.3x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Cheil Grinding Wheel Ind's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Cheil Grinding Wheel Ind

How Is Cheil Grinding Wheel Ind's Growth Trending?

The only time you'd be comfortable seeing a P/E like Cheil Grinding Wheel Ind's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 37% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 28% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 34% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Cheil Grinding Wheel Ind's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Cheil Grinding Wheel Ind's P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cheil Grinding Wheel Ind currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cheil Grinding Wheel Ind you should know about.

You might be able to find a better investment than Cheil Grinding Wheel Ind. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A001560

Cheil Grinding Wheel Ind

Manufactures and sells grinding wheel products in South Korea.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives