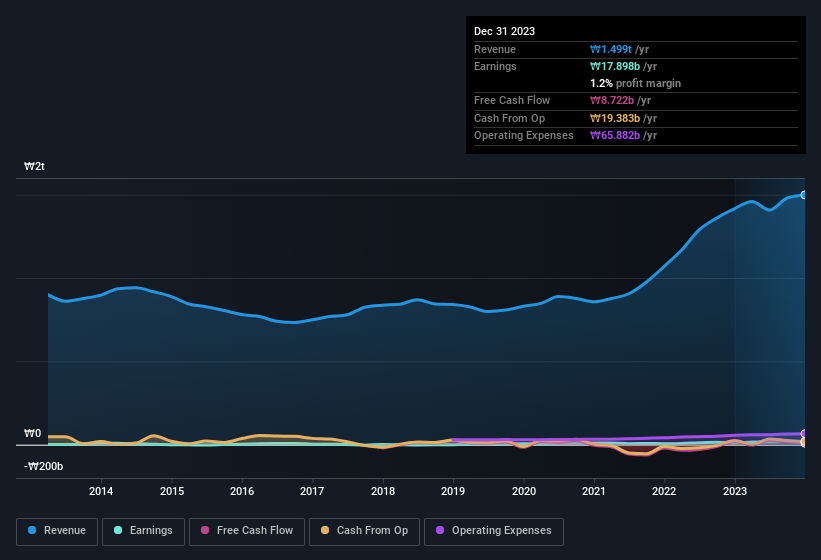

GAON CABLE Co., Ltd. (KRX:000500) announced strong profits, but the stock was stagnant. We did some digging, and we found some concerning factors in the details.

View our latest analysis for GAON CABLE

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. GAON CABLE expanded the number of shares on issue by 16% over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out GAON CABLE's historical EPS growth by clicking on this link.

How Is Dilution Impacting GAON CABLE's Earnings Per Share (EPS)?

GAON CABLE has improved its profit over the last three years, with an annualized gain of 88% in that time. In comparison, earnings per share only gained 20% over the same period. And at a glance the 71% gain in profit over the last year impresses. On the other hand, earnings per share are only up 18% in that time. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, earnings per share growth should beget share price growth. So it will certainly be a positive for shareholders if GAON CABLE can grow EPS persistently. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of GAON CABLE.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that GAON CABLE's profit suffered from unusual items, which reduced profit by ₩6.6b in the last twelve months. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And that's hardly a surprise given these line items are considered unusual. Assuming those unusual expenses don't come up again, we'd therefore expect GAON CABLE to produce a higher profit next year, all else being equal.

Our Take On GAON CABLE's Profit Performance

To sum it all up, GAON CABLE took a hit from unusual items which pushed its profit down; without that, it would have made more money. But unfortunately the dilution means that shareholders now own a smaller proportion of the company (assuming they maintained the same number of shares). That will weigh on earnings per share, even if it is not reflected in net income. Given the contrasting considerations, we don't have a strong view as to whether GAON CABLE's profits are an apt reflection of its underlying potential for profit. So while earnings quality is important, it's equally important to consider the risks facing GAON CABLE at this point in time. Every company has risks, and we've spotted 2 warning signs for GAON CABLE you should know about.

Our examination of GAON CABLE has focussed on certain factors that can make its earnings look better than they are. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000500

GAON CABLE

A cable company, provides industrial power cables in South Korea.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives