- South Korea

- /

- Industrials

- /

- KOSE:A000150

Further Upside For Doosan Corporation (KRX:000150) Shares Could Introduce Price Risks After 26% Bounce

Doosan Corporation (KRX:000150) shares have continued their recent momentum with a 26% gain in the last month alone. The last month tops off a massive increase of 266% in the last year.

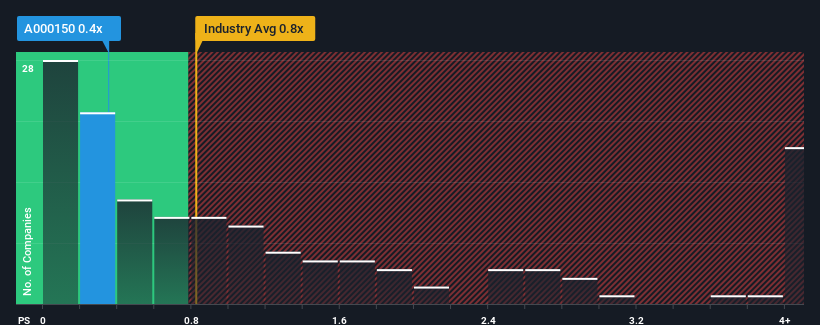

Even after such a large jump in price, there still wouldn't be many who think Doosan's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Korea's Industrials industry is similar at about 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Doosan

How Doosan Has Been Performing

Doosan hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Doosan.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Doosan would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.0%. Even so, admirably revenue has lifted 69% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.7% as estimated by the five analysts watching the company. This is still shaping up to be materially better than the broader industry which is also set to decline 6.7%.

In light of this, the fact Doosan's P/S sits in line with the majority of other companies is unanticipated but certainly not shocking. Even though the company may outperform the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices could be difficult to achieve as the weak outlook is already weighing down the shares.

What Does Doosan's P/S Mean For Investors?

Its shares have lifted substantially and now Doosan's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite Doosan's analyst forecasts being a less shaky outlook than the rest of the industry, its P/S is a bit lower than we expected. There's a chance that the market isn't looking too favourably on the potential risks which are preventing the P/S ratio from matching the more attractive outlook compared to its peers. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Doosan, and understanding should be part of your investment process.

If you're unsure about the strength of Doosan's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A000150

Doosan

Engages in the power generation facilities, industrial facilities, construction machinery, engines, and construction businesses in Korea, the United States, Asia, the Middle East, Europe, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives