- South Korea

- /

- Capital Markets

- /

- KOSDAQ:A041190

Discovering December 2024's Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty with central banks adjusting interest rates and major indices showing mixed performance, small-cap stocks have faced particular challenges, underperforming relative to their larger counterparts. Despite this backdrop, the search for undiscovered gems with strong potential remains crucial for investors seeking opportunities in a fluctuating market environment. Identifying such stocks often involves looking beyond current market sentiment to find companies with solid fundamentals and growth prospects that may not yet be fully appreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Lelon Electronics | 20.09% | 6.53% | 15.44% | ★★★★★★ |

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Advancetek EnterpriseLtd | 56.32% | 41.67% | 65.57% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Woori Technology Investment (KOSDAQ:A041190)

Simply Wall St Value Rating: ★★★★★★

Overview: Woori Technology Investment Co., Ltd. is a venture capital firm that focuses on venture funds, mezzanine funds, project funds, and investments in small and medium-sized companies with a market cap of ₩633.09 billion.

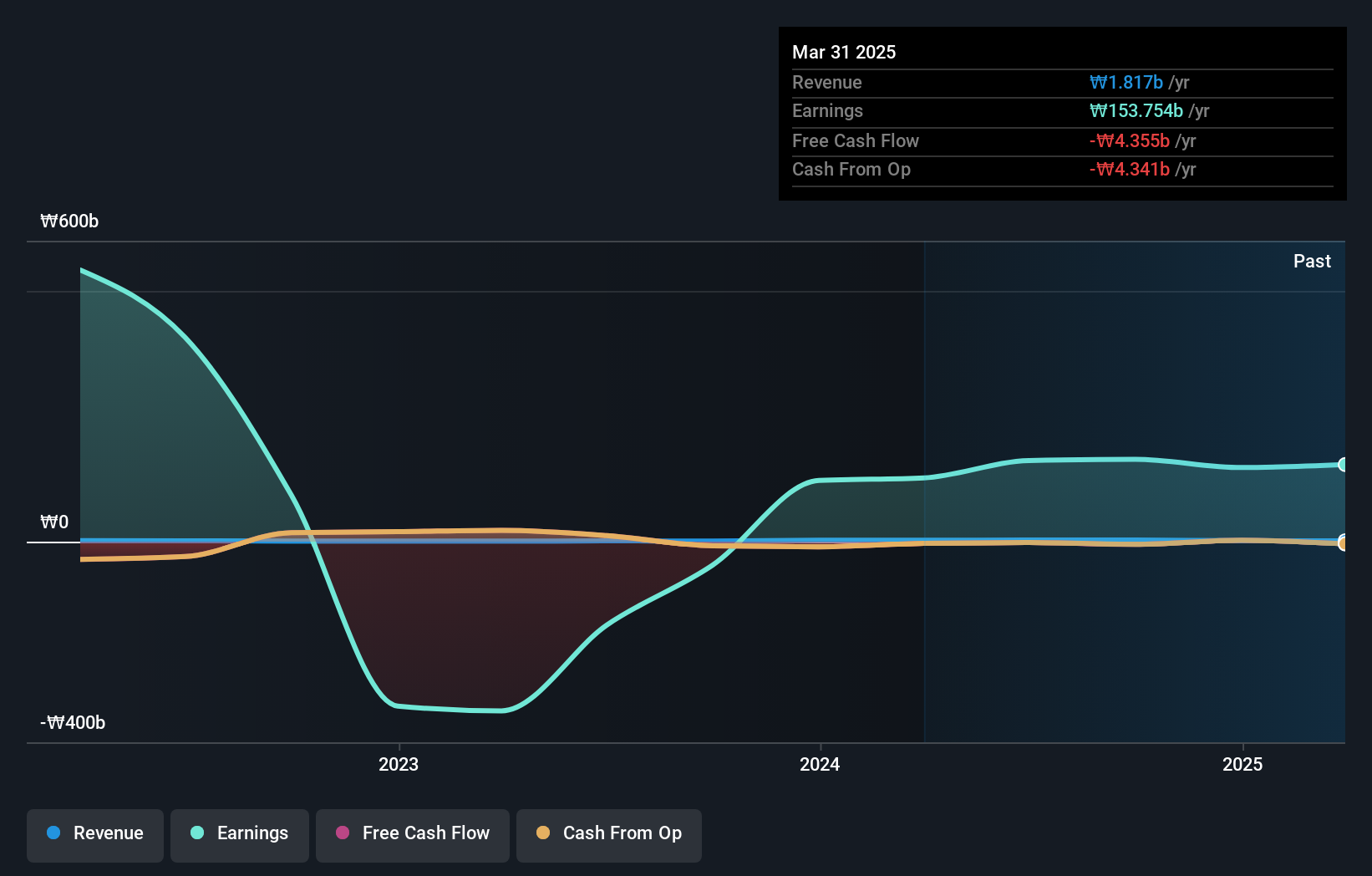

Operations: The primary revenue stream for Woori Technology Investment comes from its financial services segment, generating ₩3.31 billion. The company's net profit margin reflects its efficiency in managing costs relative to revenue.

Woori Technology Investment, a smaller player in the market, has recently turned profitable, marking a significant milestone. Despite its volatile share price over the past three months, it trades at 72.4% below its estimated fair value, suggesting potential undervaluation. The company is debt-free and has maintained high-quality earnings without concerns about interest coverage. However, with earnings declining by 1.6% annually over five years and limited revenue of ₩3 billion (approx US$2 million), it faces challenges in growth expectations despite recent profitability gains. The lack of free cash flow positivity could impact future flexibility or expansion efforts.

- Click here to discover the nuances of Woori Technology Investment with our detailed analytical health report.

Gain insights into Woori Technology Investment's past trends and performance with our Past report.

Hyundai Hyms (KOSDAQ:A460930)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hyundai Hyms Co., Ltd. is a South Korean company that specializes in the manufacturing and sale of shipbuilding equipment, with a market capitalization of approximately ₩453.02 billion.

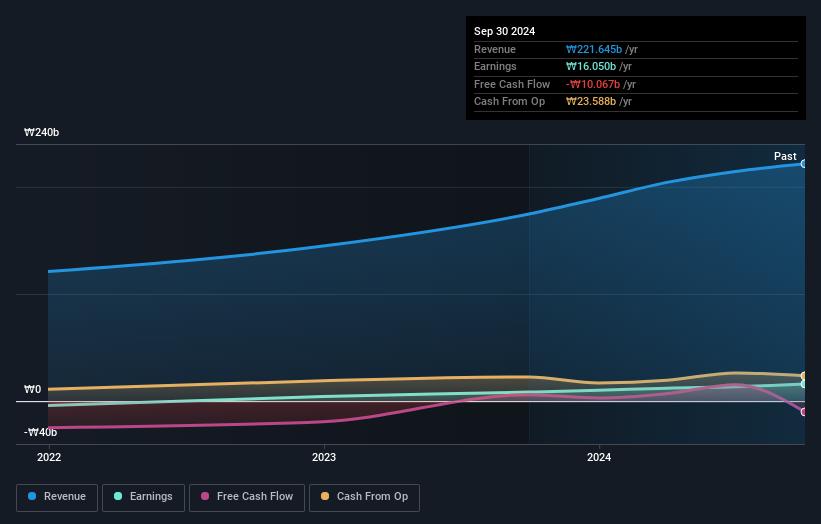

Operations: Hyundai Hyms generates its revenue primarily from the shipbuilding segment, amounting to approximately ₩221.64 billion.

Hyundai Hyms, a smaller player in the machinery sector, has shown impressive growth with earnings surging 89.9% over the past year, outpacing the industry average of -3.3%. Despite its volatile share price recently, Hyundai Hyms boasts high-quality earnings and a satisfactory net debt to equity ratio of 4.1%, indicating solid financial health. The company’s EBIT covers interest payments 10 times over, showcasing strong operational efficiency. Recently added to the S&P Global BMI Index on September 23, Hyundai Hyms is gaining recognition which could enhance its market visibility and investor interest moving forward.

Beijing Sanfo Outdoor Products (SZSE:002780)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Beijing Sanfo Outdoor Products Co., Ltd operates in the retail sector, focusing on outdoor sporting goods in China, with a market cap of CN¥2.30 billion.

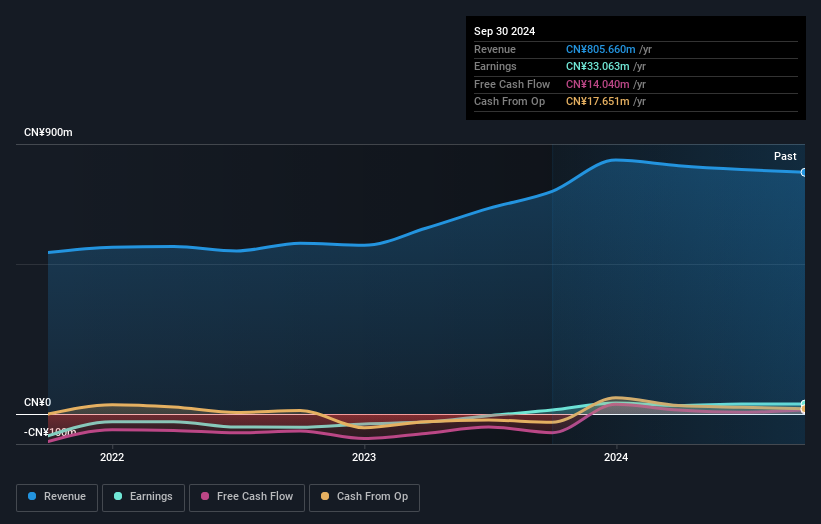

Operations: Beijing Sanfo Outdoor Products generates revenue primarily from the sale of outdoor sporting goods in China. The company's net profit margin shows variability, reflecting changes in operational efficiency and market conditions.

Beijing Sanfo Outdoor Products, a smaller player in the specialty retail space, has shown a remarkable earnings growth of 151% over the past year, significantly outpacing its industry. Despite this impressive performance, recent figures indicate some challenges with sales dropping to CNY 499.87 million from CNY 540.61 million and net income slipping to CNY 8.56 million compared to last year’s CN¥12.03 million. The company seems well-positioned financially with satisfactory debt levels at a net debt to equity ratio of 26.2%, although it faced a one-off loss of CN¥9.4M impacting its results recently.

Summing It All Up

- Discover the full array of 4626 Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Woori Technology Investment, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Woori Technology Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A041190

Woori Technology Investment

A venture capital firm specializing in venture fund, mezzanine fund project fund, venture capital and small & medium companies investments.

Flawless balance sheet and good value.

Market Insights

Community Narratives