- South Korea

- /

- Construction

- /

- KOSDAQ:A319400

Discover These 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In a week where major U.S. stock indexes like the S&P 500 and Nasdaq Composite reached record highs, small-cap stocks, as measured by the Russell 2000 Index, faced a decline after previously outperforming their larger peers. Amidst this mixed market performance and economic indicators such as rebounding job growth and anticipated Federal Reserve rate cuts, investors may find opportunities in lesser-known stocks that possess strong fundamentals and potential for growth in niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

HYUNDAI MOVEX (KOSDAQ:A319400)

Simply Wall St Value Rating: ★★★★★★

Overview: HYUNDAI MOVEX Co., Ltd. engages in the IT and logistics system sectors both domestically in South Korea and internationally, with a market cap of approximately ₩377.95 billion.

Operations: The company generates revenue from its IT and logistics system businesses, with a market cap of approximately ₩377.95 billion.

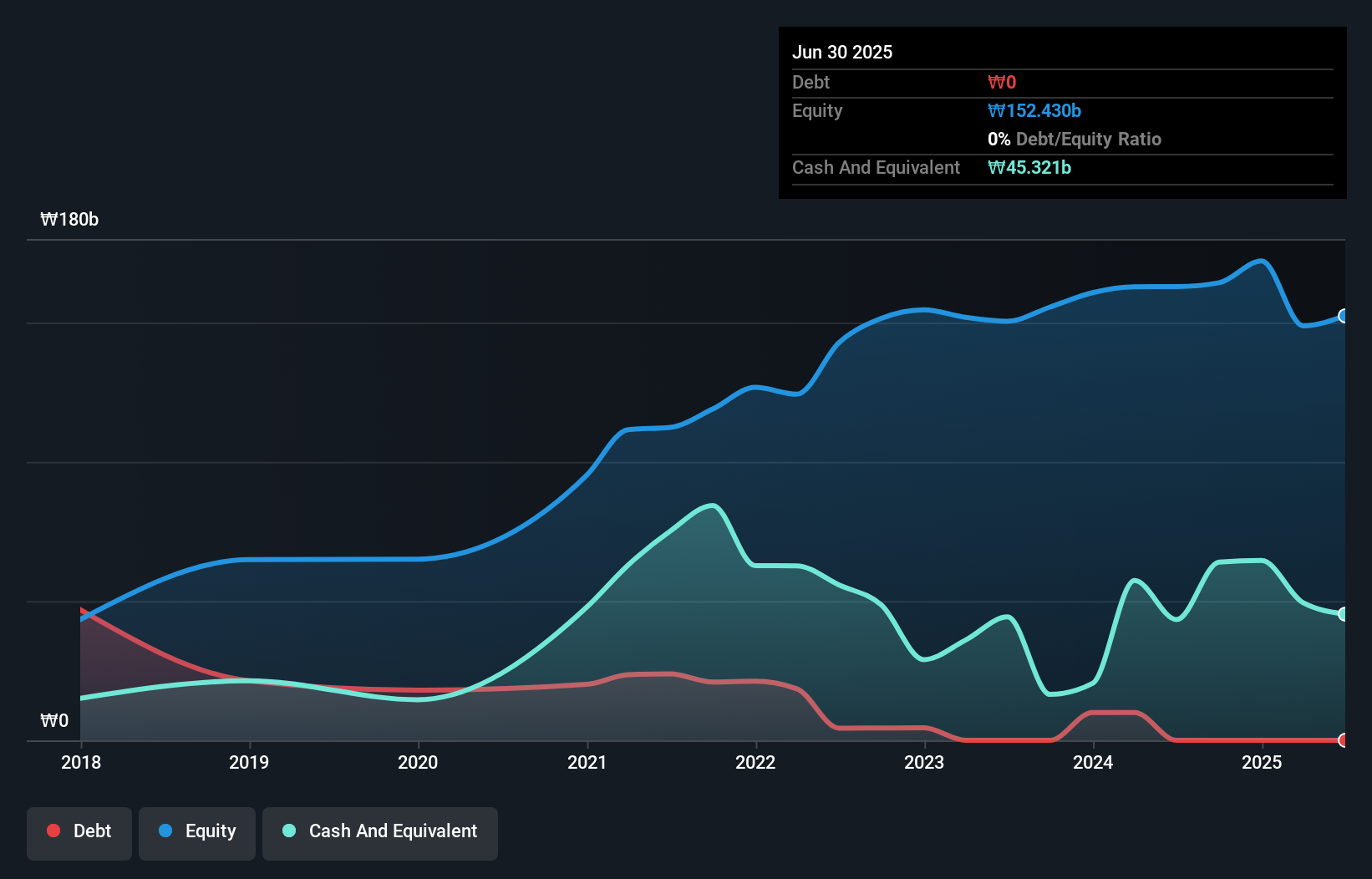

Hyundai Movex, a dynamic player in its industry, has shown remarkable growth with earnings surging 607% over the past year. This performance is well above the construction industry's average of 12%. The company operates debt-free, a significant shift from five years ago when its debt-to-equity ratio was 29%. Trading at a substantial discount of 96% below estimated fair value suggests potential undervaluation. Recently, Hyundai Movex initiated a share repurchase program worth KRW 25 billion to enhance shareholder value, having already acquired shares worth KRW 3.31 billion by September's end. These strategic moves underscore its commitment to strengthening market position and investor confidence.

- Take a closer look at HYUNDAI MOVEX's potential here in our health report.

Examine HYUNDAI MOVEX's past performance report to understand how it has performed in the past.

Aurisco PharmaceuticalLtd (SHSE:605116)

Simply Wall St Value Rating: ★★★★★☆

Overview: Aurisco Pharmaceutical Co., Ltd. is involved in the research, manufacturing, and marketing of pharmaceutical intermediates, specialty active pharmaceutical ingredients (APIs), and formulations for the global pharmaceutical market, with a market capitalization of CN¥8.82 billion.

Operations: Aurisco generates revenue primarily from the sale of pharmaceutical intermediates, specialty active pharmaceutical ingredients (APIs), and formulations. The company's net profit margin stands at 15.3%, reflecting its profitability in the competitive pharmaceutical sector.

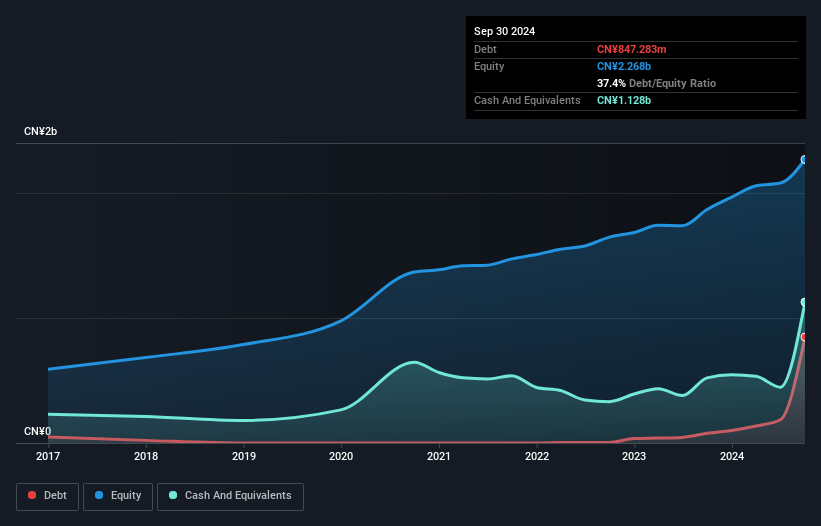

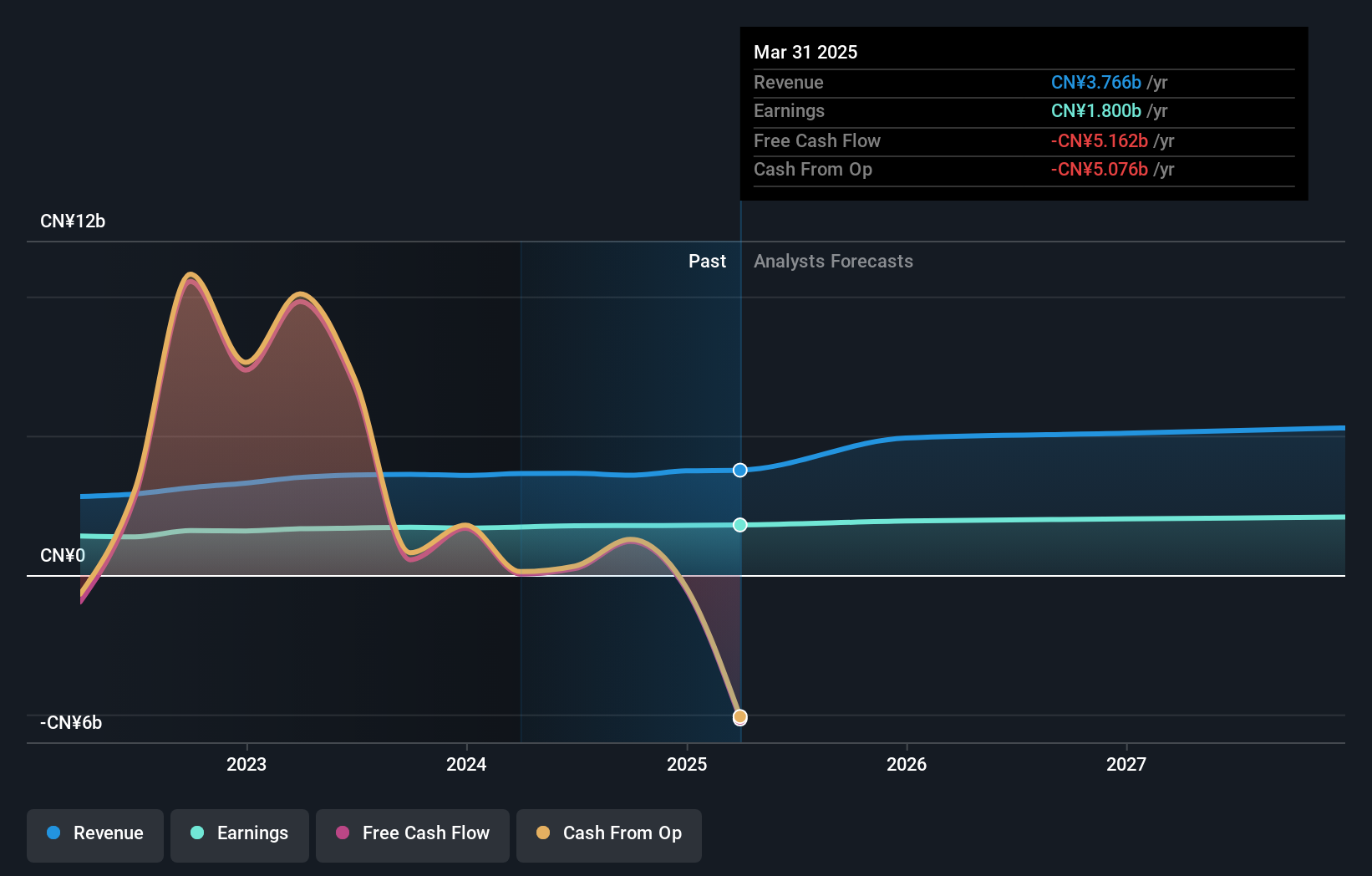

Aurisco Pharma, a relatively smaller player in the pharmaceutical sector, has demonstrated robust performance with earnings growth of 32.5% over the past year, outpacing the industry average of -2.5%. The company's debt-to-equity ratio has risen to 37.4% over five years but remains manageable as it holds more cash than total debt. Recent financials reveal net income at CNY 283.79 million for nine months ending September 2024, up from CNY 232.55 million last year, alongside basic earnings per share climbing to CNY 0.7 from CNY 0.57—a sign of its strong operational efficiency and market positioning despite some leverage increase concerns.

- Delve into the full analysis health report here for a deeper understanding of Aurisco PharmaceuticalLtd.

Gain insights into Aurisco PharmaceuticalLtd's past trends and performance with our Past report.

Jiangsu Zhangjiagang Rural Commercial Bank (SZSE:002839)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhangjiagang Rural Commercial Bank Co., Ltd offers a range of banking products and services in China with a market capitalization of CN¥9.89 billion.

Operations: The bank generates revenue primarily through interest income and fee-based services. It has shown a net profit margin of 28.5%, reflecting its profitability in the financial sector.

Jiangsu Zhangjiagang Rural Commercial Bank, with assets totaling CN¥215.9 billion and equity of CN¥18.3 billion, is a notable player in the banking sector. It has a robust allowance for bad loans at 424% and maintains an appropriate level of non-performing loans at just 1%. The bank's earnings grew by 3.7% last year, outpacing the industry average of 2.7%, and are forecast to grow by over 9% annually. With total deposits standing at CN¥170.2 billion against loans of CN¥131.6 billion, it relies primarily on low-risk funding sources like customer deposits for stability in its operations.

Taking Advantage

- Delve into our full catalog of 4628 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HYUNDAI MOVEX might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A319400

HYUNDAI MOVEX

Operates in the information technology (IT) and logistics system businesses in South Korea and internationally.

Flawless balance sheet with solid track record.