- South Korea

- /

- Machinery

- /

- KOSDAQ:A297090

Subdued Growth No Barrier To CS BEARING Co., Ltd. (KOSDAQ:297090) With Shares Advancing 26%

CS BEARING Co., Ltd. (KOSDAQ:297090) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

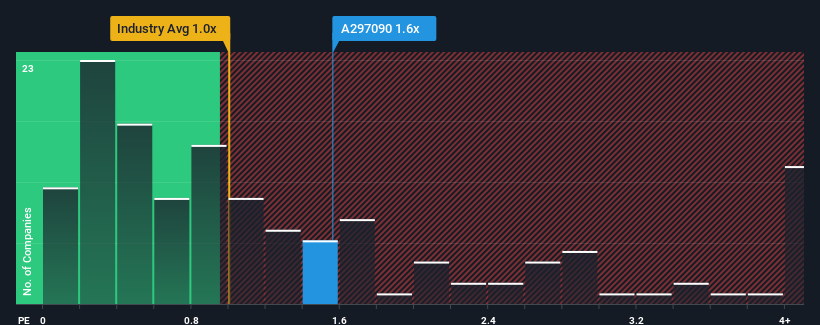

Since its price has surged higher, given close to half the companies operating in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 1x, you may consider CS BEARING as a stock to potentially avoid with its 1.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

We've discovered 1 warning sign about CS BEARING. View them for free.Check out our latest analysis for CS BEARING

What Does CS BEARING's Recent Performance Look Like?

CS BEARING certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think CS BEARING's future stacks up against the industry? In that case, our free report is a great place to start.How Is CS BEARING's Revenue Growth Trending?

In order to justify its P/S ratio, CS BEARING would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 38% last year. As a result, it also grew revenue by 10% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 10% as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 21% growth forecast for the broader industry.

In light of this, it's alarming that CS BEARING's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On CS BEARING's P/S

CS BEARING's P/S is on the rise since its shares have risen strongly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see CS BEARING trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 1 warning sign for CS BEARING that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A297090

CS BEARING

Engages in the manufacture and sale of bearings in South Korea.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives