- South Korea

- /

- Machinery

- /

- KOSDAQ:A297090

Investors Still Waiting For A Pull Back In CS BEARING Co., Ltd. (KOSDAQ:297090)

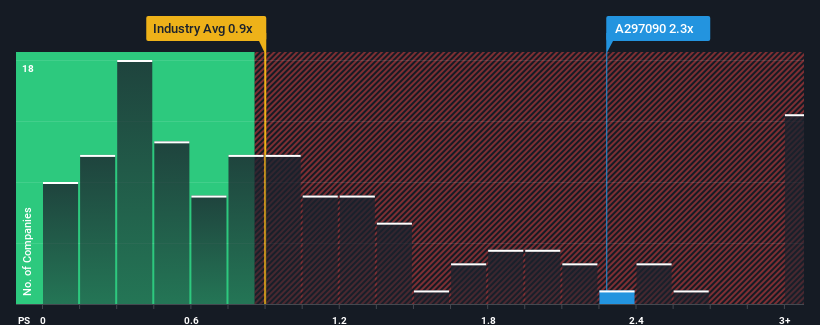

When close to half the companies in the Machinery industry in Korea have price-to-sales ratios (or "P/S") below 0.9x, you may consider CS BEARING Co., Ltd. (KOSDAQ:297090) as a stock to potentially avoid with its 2.3x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CS BEARING

How CS BEARING Has Been Performing

CS BEARING could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on CS BEARING will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, CS BEARING would need to produce impressive growth in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.2%. This means it has also seen a slide in revenue over the longer-term as revenue is down 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 88% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 37%, which is noticeably less attractive.

With this in mind, it's not hard to understand why CS BEARING's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From CS BEARING's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of CS BEARING's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for CS BEARING that you should be aware of.

If you're unsure about the strength of CS BEARING's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A297090

CS BEARING

Engages in the manufacture and sale of bearings in South Korea.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives