- South Korea

- /

- Machinery

- /

- KOSDAQ:A282880

COWINTECH Co. Ltd.'s (KOSDAQ:282880) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

COWINTECH's (KOSDAQ:282880) stock is up by a considerable 12% over the past month. However, we wonder if the company's inconsistent financials would have any adverse impact on the current share price momentum. In this article, we decided to focus on COWINTECH's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for COWINTECH

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for COWINTECH is:

7.3% = ₩21b ÷ ₩286b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every ₩1 of its shareholder's investments, the company generates a profit of ₩0.07.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

COWINTECH's Earnings Growth And 7.3% ROE

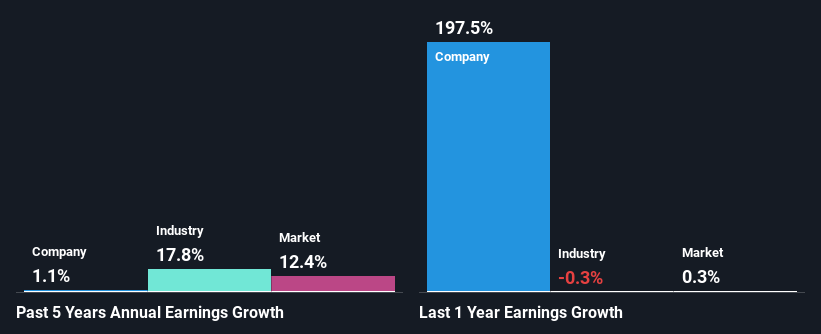

On the face of it, COWINTECH's ROE is not much to talk about. However, its ROE is similar to the industry average of 7.1%, so we won't completely dismiss the company. However, COWINTECH has seen a flattish net income growth over the past five years, which is not saying much. Bear in mind, the company's ROE is not very high. Hence, this provides some context to the flat earnings growth seen by the company.

Next, on comparing with the industry net income growth, we found that COWINTECH's reported growth was lower than the industry growth of 18% over the last few years, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about COWINTECH's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is COWINTECH Efficiently Re-investing Its Profits?

COWINTECH's low three-year median payout ratio of 18% (implying that the company keeps82% of its income) should mean that the company is retaining most of its earnings to fuel its growth and this should be reflected in its growth number, but that's not the case.

In addition, COWINTECH has been paying dividends over a period of five years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 10% over the next three years. As a result, the expected drop in COWINTECH's payout ratio explains the anticipated rise in the company's future ROE to 13%, over the same period.

Summary

In total, we're a bit ambivalent about COWINTECH's performance. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A282880

COWINTECH

Engages in the manufacture and installation of equipment for automation.

Proven track record and fair value.

Market Insights

Community Narratives