- South Korea

- /

- Machinery

- /

- KOSDAQ:A277810

Global Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As global markets navigate the complexities of escalating geopolitical tensions and fluctuating trade dynamics, investors are keeping a close watch on economic indicators that hint at both opportunities and challenges. In such an environment, growth companies with high insider ownership can offer unique insights into potential resilience and strategic direction, as insiders often have a vested interest in the company's long-term success.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 17.4% | 23.5% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here we highlight a subset of our preferred stocks from the screener.

Rainbow RoboticsLtd (KOSDAQ:A277810)

Simply Wall St Growth Rating: ★★★★★☆

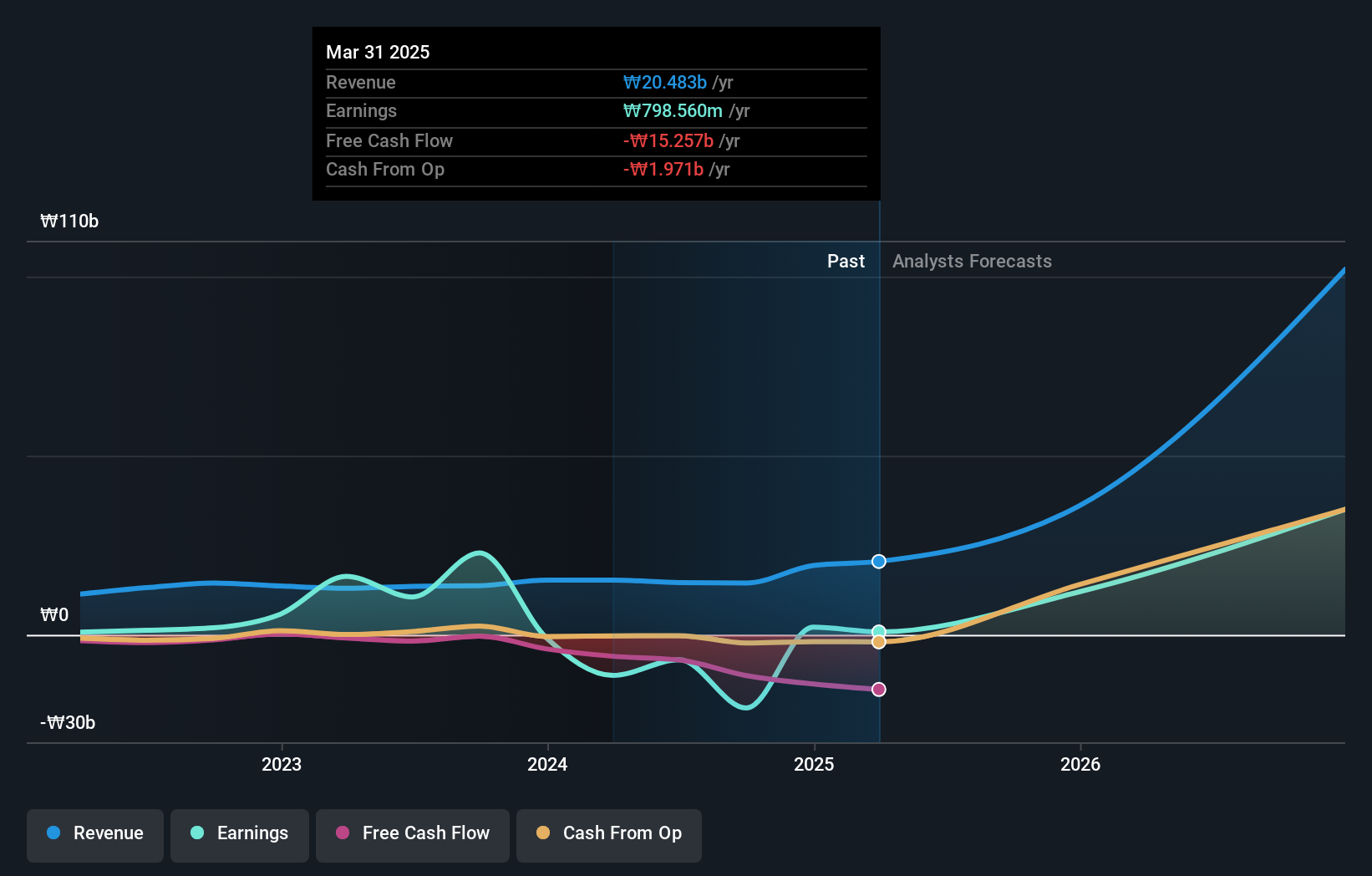

Overview: Rainbow Robotics Co., Ltd., a professional technological mechatronics company, specializes in providing robotic system engineering technology and has a market cap of ₩5.30 trillion.

Operations: The company's revenue from the Industrial Automation & Controls segment is ₩20.48 billion.

Insider Ownership: 23.6%

Earnings Growth Forecast: 123.7% p.a.

Rainbow Robotics Ltd. is poised for significant growth, with earnings forecasted to increase by 123.7% annually, outpacing the Korean market's 21% growth rate. Recent advancements in humanoid robotics showcased at the IEEE International Conference highlight its innovative capabilities. Despite a net loss of KRW 726 million in Q1 2025, its revenue is expected to grow by 90% per year, surpassing market expectations. However, there is no recent insider trading activity reported over three months.

- Get an in-depth perspective on Rainbow RoboticsLtd's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Rainbow RoboticsLtd implies its share price may be too high.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

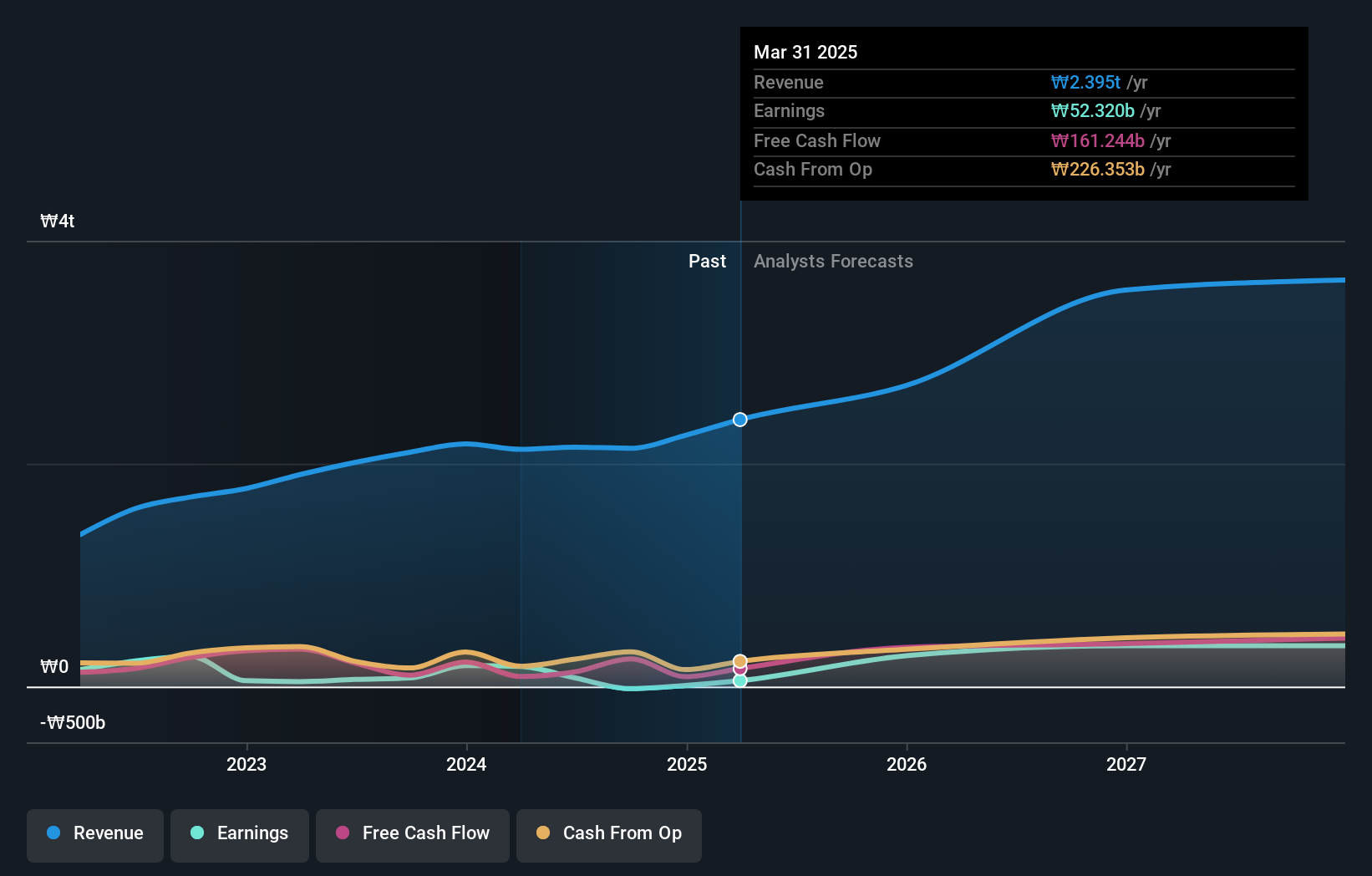

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩12.50 trillion.

Operations: The company's revenue segments include Platform, generating ₩338.85 billion, and Segment Adjustment, contributing ₩2.85 billion.

Insider Ownership: 32.5%

Earnings Growth Forecast: 38.6% p.a.

HYBE's earnings are forecast to grow significantly at 38.6% annually, surpassing the Korean market's 21% growth rate, though revenue growth is slower at 15.5%. Recent Q1 results show a substantial increase in sales and net income compared to last year. However, profit margins have decreased from 8.5% to 2.2%, influenced by large one-off items. No recent insider trading activity has been reported over the past three months, indicating stable insider sentiment.

- Click here to discover the nuances of HYBE with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that HYBE is priced higher than what may be justified by its financials.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) in China and internationally, with a market cap of CN¥20.09 billion.

Operations: The company's revenue segments include the manufacturing and sale of printed circuit boards (PCBs) both domestically and abroad.

Insider Ownership: 26.2%

Earnings Growth Forecast: 97.8% p.a.

Shenzhen Fastprint Circuit Tech Ltd. shows promising growth potential with expected earnings growth of 97.83% annually, outpacing the Chinese market's average. Despite lower revenue growth at 19.5%, it remains above the market's 12.4%. Recent Q1 results highlight increased sales but a significant drop in net income, suggesting margin pressures. The company has announced a reduced dividend, indicating possible cash flow management strategies, while insider trading activity remains stable with no substantial buying or selling reported recently.

- Click to explore a detailed breakdown of our findings in Shenzhen Fastprint Circuit TechLtd's earnings growth report.

- Our valuation report unveils the possibility Shenzhen Fastprint Circuit TechLtd's shares may be trading at a premium.

Next Steps

- Navigate through the entire inventory of 830 Fast Growing Global Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A277810

Rainbow RoboticsLtd

A professional technological mechatronics company, provides robotic system engineering technology.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives