Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that mPLUS Corp. (KOSDAQ:259630) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for mPLUS

What Is mPLUS's Debt?

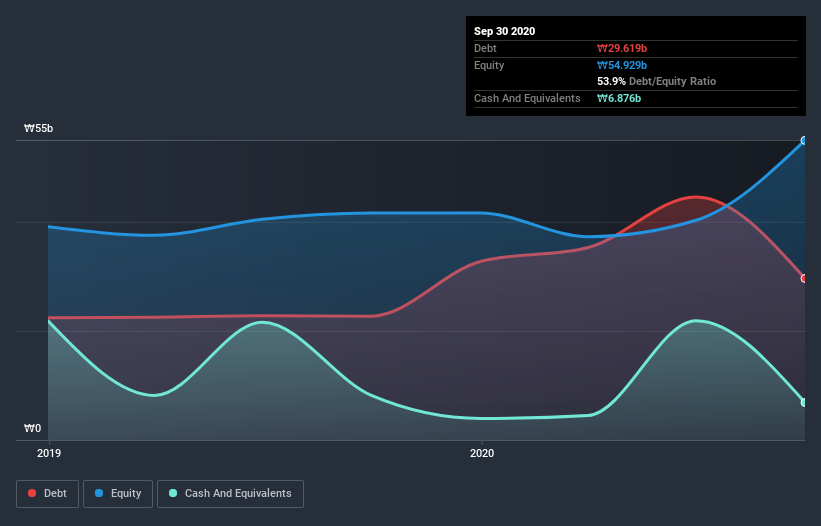

The image below, which you can click on for greater detail, shows that at September 2020 mPLUS had debt of ₩29.6b, up from ₩22.7b in one year. However, it does have ₩6.88b in cash offsetting this, leading to net debt of about ₩22.7b.

How Healthy Is mPLUS' Balance Sheet?

The latest balance sheet data shows that mPLUS had liabilities of ₩91.8b due within a year, and liabilities of ₩23.6b falling due after that. On the other hand, it had cash of ₩6.88b and ₩45.0b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₩63.5b.

This deficit isn't so bad because mPLUS is worth ₩177.7b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

mPLUS's debt is 3.6 times its EBITDA, and its EBIT cover its interest expense 2.6 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. More concerning, mPLUS saw its EBIT drop by 2.8% in the last twelve months. If it keeps going like that paying off its debt will be like running on a treadmill -- a lot of effort for not much advancement. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine mPLUS's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, mPLUS saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Mulling over mPLUS's attempt at converting EBIT to free cash flow, we're certainly not enthusiastic. But at least its level of total liabilities is not so bad. Overall, we think it's fair to say that mPLUS has enough debt that there are some real risks around the balance sheet. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 4 warning signs with mPLUS (at least 2 which are potentially serious) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade mPLUS, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A259630

mPLUS

Manufactures and sells secondary battery manufacturing equipment in South Korea, China, Asia, the Americas, Europe, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives