- South Korea

- /

- Electrical

- /

- KOSDAQ:A217820

Even after rising 11% this past week, Wonik Pne (KOSDAQ:217820) shareholders are still down 76% over the past three years

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Wonik Pne Co., Ltd. (KOSDAQ:217820); the share price is down a whopping 77% in the last three years. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 61% in the last year. Furthermore, it's down 23% in about a quarter. That's not much fun for holders.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Wonik Pne

Wonik Pne wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Wonik Pne grew revenue at 28% per year. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 21% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Ultimately, revenue growth doesn't amount to much if the business can't scale well. If the company is low on cash, it may have to raise capital soon.

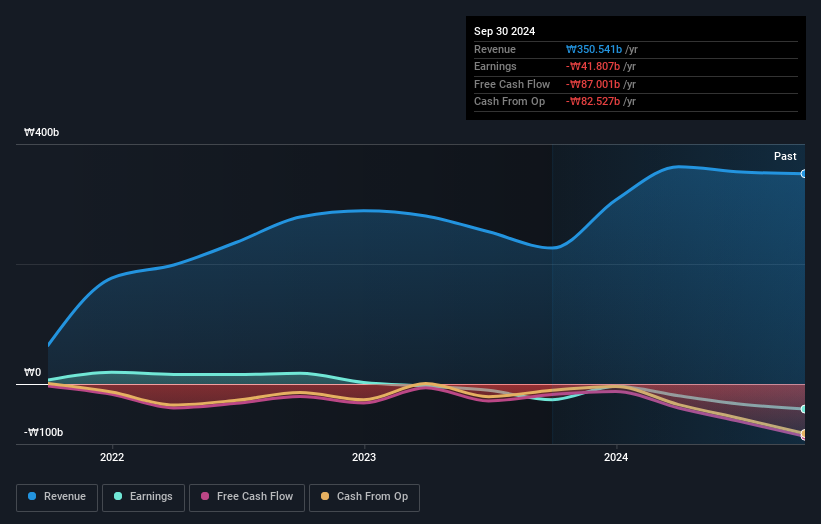

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Wonik Pne stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 6.9% in the twelve months, Wonik Pne shareholders did even worse, losing 61%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Wonik Pne has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wonik Pne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A217820

Wonik Pne

Manufactures and sells rechargeable battery process automation and laser-aided automation equipment in South Korea.

Low and slightly overvalued.

Market Insights

Community Narratives