- South Korea

- /

- Electrical

- /

- KOSDAQ:A140670

Some Shareholders Feeling Restless Over RS Automation Co.,Ltd.'s (KOSDAQ:140670) P/S Ratio

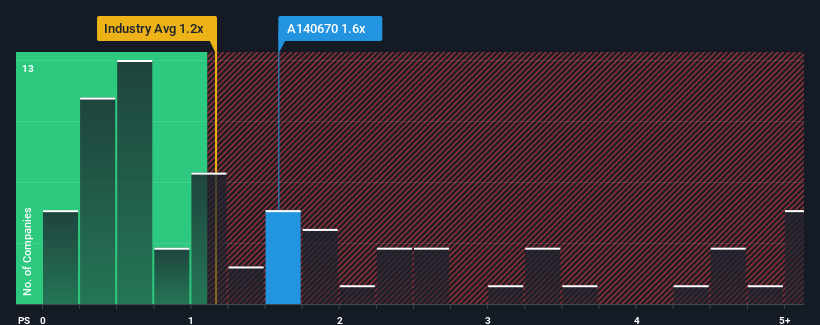

There wouldn't be many who think RS Automation Co.,Ltd.'s (KOSDAQ:140670) price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S for the Electrical industry in Korea is similar at about 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for RS AutomationLtd

What Does RS AutomationLtd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at RS AutomationLtd over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on RS AutomationLtd's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like RS AutomationLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. The last three years don't look nice either as the company has shrunk revenue by 34% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to shrink 1.0% in the next 12 months, the company's downward momentum is still inferior based on recent medium-term annualised revenue results.

With this information, it's perhaps strange that RS AutomationLtd is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that RS AutomationLtd currently trades on a higher than expected P/S since its recent three-year revenues are even worse than the forecasts for a struggling industry. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for RS AutomationLtd (1 makes us a bit uncomfortable!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A140670

RS AutomationLtd

Designs, develops, manufactures, sells, and services automation equipment and systems in South Korea and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026