- South Korea

- /

- Electrical

- /

- KOSDAQ:A119850

Here's Why GnCenergy (KOSDAQ:119850) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like GnCenergy (KOSDAQ:119850). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide GnCenergy with the means to add long-term value to shareholders.

View our latest analysis for GnCenergy

How Fast Is GnCenergy Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for GnCenergy to have grown EPS from ₩268 to ₩896 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

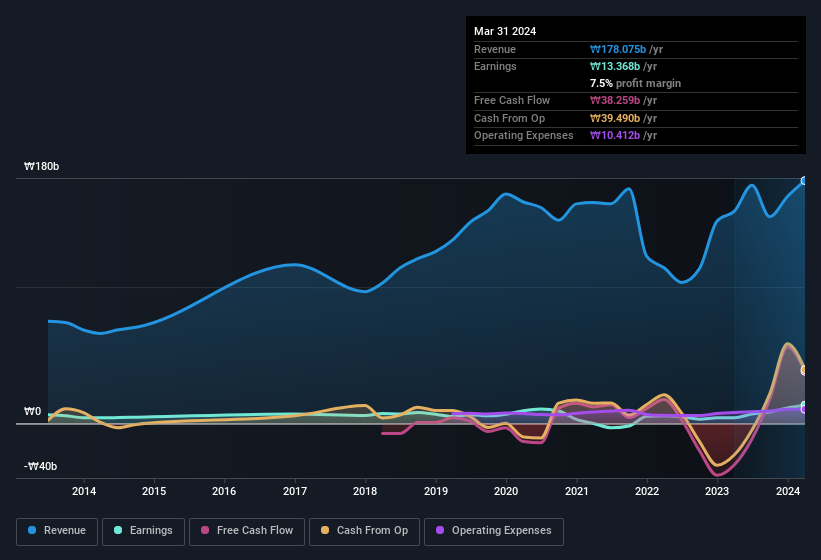

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of GnCenergy shareholders is that EBIT margins have grown from 4.0% to 6.8% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

GnCenergy isn't a huge company, given its market capitalisation of ₩115b. That makes it extra important to check on its balance sheet strength.

Are GnCenergy Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that GnCenergy insiders own a meaningful share of the business. In fact, they own 38% of the shares, making insiders a very influential shareholder group. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. To give you an idea, the value of insiders' holdings in the business are valued at ₩43b at the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is GnCenergy Worth Keeping An Eye On?

GnCenergy's earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering GnCenergy for a spot on your watchlist. You still need to take note of risks, for example - GnCenergy has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

Although GnCenergy certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of South Korean companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A119850

GnCenergy

Engages in the manufacture and sale of power generators in Korea.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives