- South Korea

- /

- Electrical

- /

- KOSDAQ:A108380

It's A Story Of Risk Vs Reward With DAEYANG ELECTRIC.Co.,Ltd. (KOSDAQ:108380)

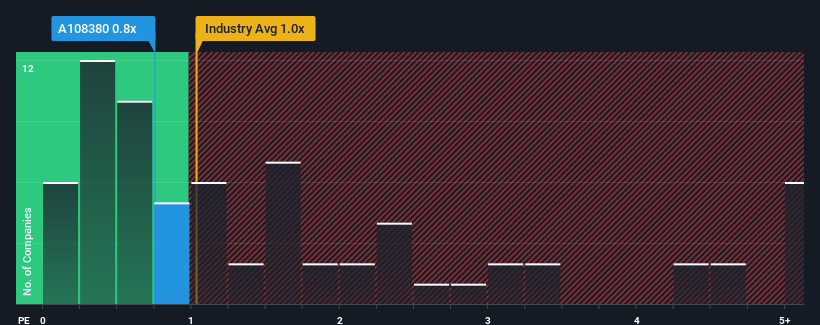

It's not a stretch to say that DAEYANG ELECTRIC.Co.,Ltd.'s (KOSDAQ:108380) price-to-sales (or "P/S") ratio of 0.8x right now seems quite "middle-of-the-road" for companies in the Electrical industry in Korea, where the median P/S ratio is around 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for DAEYANG ELECTRIC.Co.Ltd

How Has DAEYANG ELECTRIC.Co.Ltd Performed Recently?

With revenue growth that's superior to most other companies of late, DAEYANG ELECTRIC.Co.Ltd has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on DAEYANG ELECTRIC.Co.Ltd will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like DAEYANG ELECTRIC.Co.Ltd's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 8.4% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Turning to the outlook, the next year should demonstrate the company's robustness, generating growth of 12% as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to contract by 3.0%, which would indicate the company is doing very well.

In light of this, it's peculiar that DAEYANG ELECTRIC.Co.Ltd's P/S sits in-line with the majority of other companies. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From DAEYANG ELECTRIC.Co.Ltd's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that DAEYANG ELECTRIC.Co.Ltd currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears some are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for DAEYANG ELECTRIC.Co.Ltd you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A108380

DAEYANG ELECTRIC.Co.Ltd

Provides lighting, communication system, power system, underwater system, and sensors in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026