- South Korea

- /

- Electrical

- /

- KOSDAQ:A108380

DAEYANG ELECTRIC.Co.,Ltd. (KOSDAQ:108380) Stock Rockets 28% But Many Are Still Ignoring The Company

DAEYANG ELECTRIC.Co.,Ltd. (KOSDAQ:108380) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 52%.

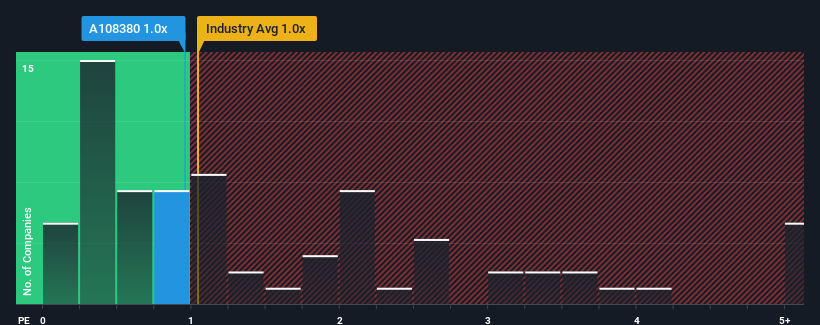

Although its price has surged higher, you could still be forgiven for feeling indifferent about DAEYANG ELECTRIC.Co.Ltd's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in Korea is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for DAEYANG ELECTRIC.Co.Ltd

How DAEYANG ELECTRIC.Co.Ltd Has Been Performing

Recent times have been pleasing for DAEYANG ELECTRIC.Co.Ltd as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. Those who are bullish on DAEYANG ELECTRIC.Co.Ltd will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on DAEYANG ELECTRIC.Co.Ltd.How Is DAEYANG ELECTRIC.Co.Ltd's Revenue Growth Trending?

DAEYANG ELECTRIC.Co.Ltd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. As a result, it also grew revenue by 21% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 11% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 6.0%, which is noticeably less attractive.

With this information, we find it interesting that DAEYANG ELECTRIC.Co.Ltd is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On DAEYANG ELECTRIC.Co.Ltd's P/S

DAEYANG ELECTRIC.Co.Ltd appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, DAEYANG ELECTRIC.Co.Ltd's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware DAEYANG ELECTRIC.Co.Ltd is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A108380

DAEYANG ELECTRIC.Co.Ltd

Provides lighting, communication system, power system, underwater system, and sensors in South Korea and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives