- South Korea

- /

- Machinery

- /

- KOSDAQ:A104460

Investors Give DYPNF Co.,Ltd (KOSDAQ:104460) Shares A 30% Hiding

To the annoyance of some shareholders, DYPNF Co.,Ltd (KOSDAQ:104460) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

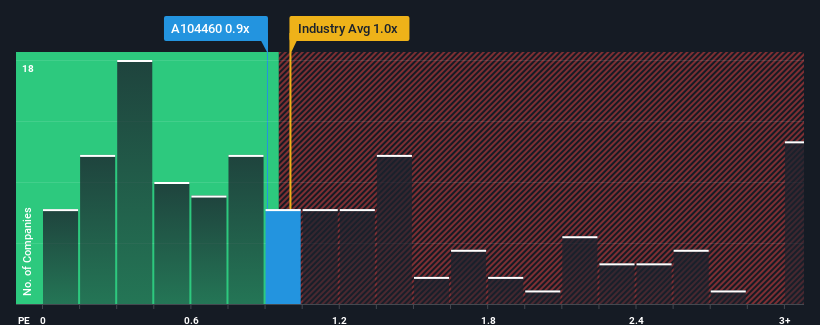

Even after such a large drop in price, it's still not a stretch to say that DYPNFLtd's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Machinery industry in Korea, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for DYPNFLtd

What Does DYPNFLtd's Recent Performance Look Like?

DYPNFLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on DYPNFLtd will help you uncover what's on the horizon.How Is DYPNFLtd's Revenue Growth Trending?

DYPNFLtd's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 4.6% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 28% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 102% over the next year. With the industry only predicted to deliver 32%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that DYPNFLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for DYPNFLtd looks to be in line with the rest of the Machinery industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, DYPNFLtd's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with DYPNFLtd, and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on DYPNFLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A104460

DYPNFLtd

Manufactures and sells powder transport equipment in South Korea, the United States, the Middle East, Southeast Asia, Europe, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives