- South Korea

- /

- Machinery

- /

- KOSDAQ:A083650

The Market Lifts BHI Co., Ltd. (KOSDAQ:083650) Shares 29% But It Can Do More

BHI Co., Ltd. (KOSDAQ:083650) shares have continued their recent momentum with a 29% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 37%.

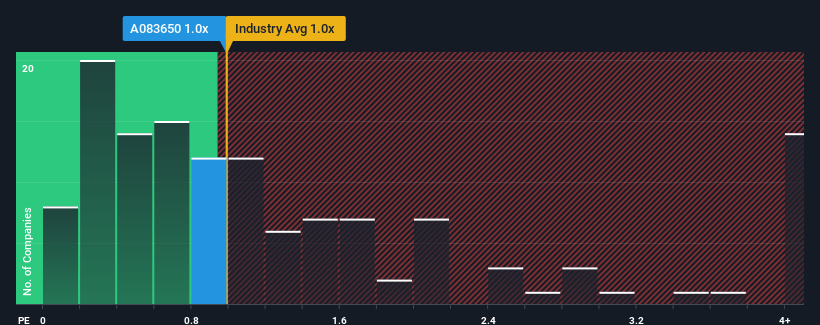

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about BHI's P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Machinery industry in Korea is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for BHI

How BHI Has Been Performing

BHI could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on BHI will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For BHI?

The only time you'd be comfortable seeing a P/S like BHI's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 8.8%. Pleasingly, revenue has also lifted 52% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 30% during the coming year according to the dual analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 24%, which is noticeably less attractive.

With this information, we find it interesting that BHI is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Its shares have lifted substantially and now BHI's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, BHI's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for BHI (1 can't be ignored!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BHI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A083650

BHI

Engages in the development, manufacture, and supply of power plant equipment worldwide.

Exceptional growth potential with proven track record.