- South Korea

- /

- Machinery

- /

- KOSDAQ:A083650

BHI Co., Ltd.'s (KOSDAQ:083650) Shares Leap 33% Yet They're Still Not Telling The Full Story

BHI Co., Ltd. (KOSDAQ:083650) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 41%.

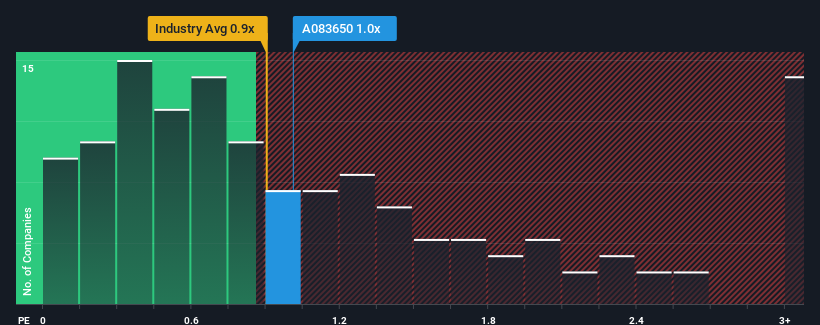

In spite of the firm bounce in price, it's still not a stretch to say that BHI's price-to-sales (or "P/S") ratio of 1x right now seems quite "middle-of-the-road" compared to the Machinery industry in Korea, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for BHI

What Does BHI's Recent Performance Look Like?

While the industry has experienced revenue growth lately, BHI's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on BHI will help you uncover what's on the horizon.How Is BHI's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like BHI's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 15%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 39% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 50% over the next year. With the industry only predicted to deliver 36%, the company is positioned for a stronger revenue result.

With this information, we find it interesting that BHI is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BHI's P/S?

BHI's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at BHI's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

It is also worth noting that we have found 1 warning sign for BHI that you need to take into consideration.

If you're unsure about the strength of BHI's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if BHI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A083650

BHI

Engages in the development, manufacture, and supply of power plant equipment worldwide.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives