- Israel

- /

- Specialty Stores

- /

- TASE:DLTI

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, and expectations of a similar move by the Fed, small-cap stocks have faced challenges with the Russell 2000 Index underperforming against larger indices. Amidst this backdrop of economic shifts and fluctuating market sentiments, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking opportunities in less visible corners of the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Berger Paints Bangladesh | 3.40% | 10.41% | 7.51% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

VITZROCELLLtd (KOSDAQ:A082920)

Simply Wall St Value Rating: ★★★★★★

Overview: VITZROCELL Co., Ltd. is involved in the production and sale of lithium batteries in South Korea with a market capitalization of ₩450.28 billion.

Operations: The company's primary revenue stream is from its battery business, generating ₩186.45 billion.

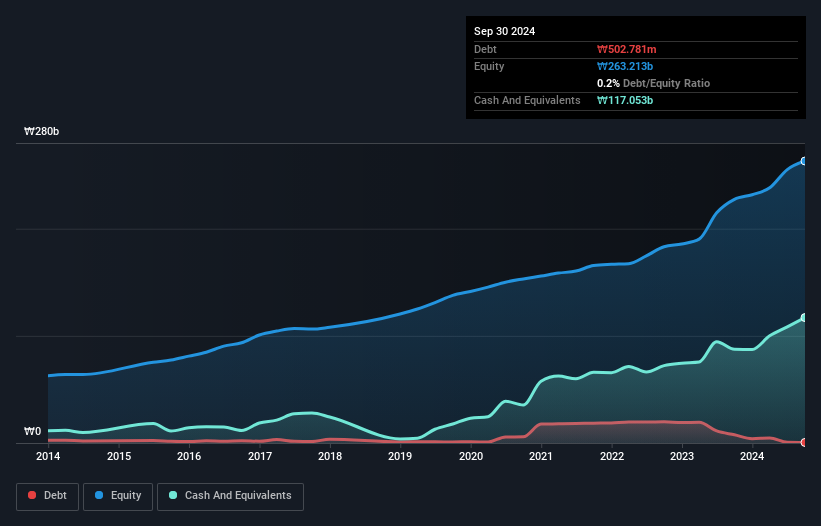

Vitzrocell Ltd., a smaller player in its field, has shown consistent earnings growth of 18% annually over the past five years, although recent yearly growth of 3.6% lagged behind the Electrical industry’s 14%. The company reported third-quarter sales of KRW 48.79 billion and net income of KRW 8.14 billion, both up from last year. Earnings per share rose to KRW 366 from KRW 337 a year ago. With its debt-to-equity ratio dropping from 0.7 to a leaner 0.2 over five years and trading at about a quarter below estimated fair value, Vitzrocell seems financially sound with high-quality earnings and positive free cash flow.

- Click here and access our complete health analysis report to understand the dynamics of VITZROCELLLtd.

Evaluate VITZROCELLLtd's historical performance by accessing our past performance report.

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company engaged in the manufacturing and distribution of powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and other international markets with a market capitalization of SGD661.96 million.

Operations: Hong Leong Asia generates significant revenue from its Powertrain Solutions segment, amounting to SGD3.57 billion, and Building Materials segment, contributing SGD665.81 million. The company's net profit margin reflects the efficiency of its operations and profitability trends over time.

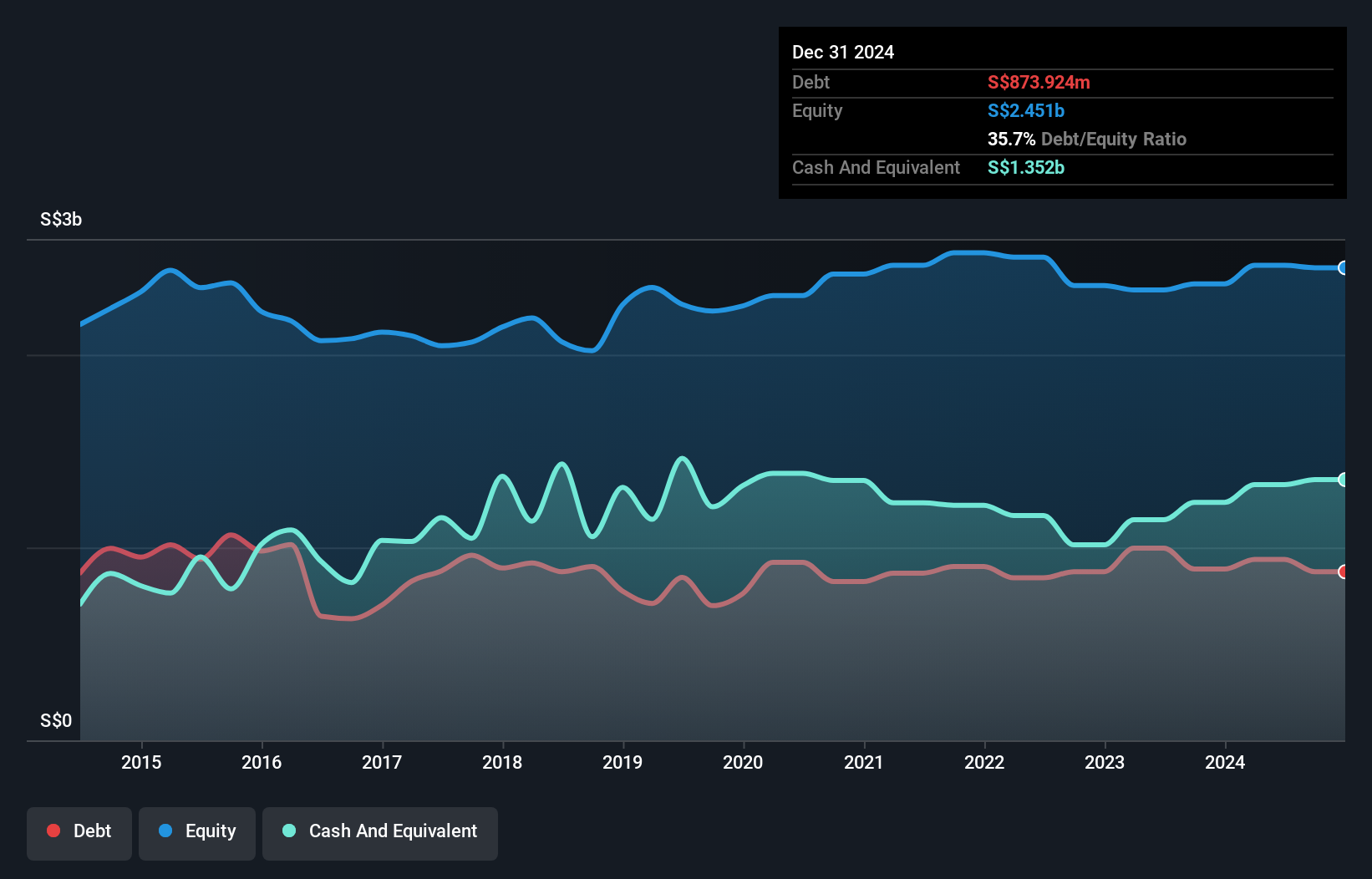

Hong Leong Asia, a compact player in the machinery sector, has demonstrated robust earnings growth of 94% over the past year, outpacing its industry peers who faced a 6% downturn. Trading at approximately 53% below estimated fair value suggests potential for upside. The company’s debt situation appears manageable with interest payments well-covered by EBIT at a ratio of 3.4 times. Additionally, it boasts high-quality past earnings and maintains profitability without cash runway concerns. Recent board changes include appointing Ng Chee Khern as an Independent Non-Executive Director to strengthen sustainability governance starting January 2025.

- Navigate through the intricacies of Hong Leong Asia with our comprehensive health report here.

Examine Hong Leong Asia's past performance report to understand how it has performed in the past.

Delta Israel Brands (TASE:DLTI)

Simply Wall St Value Rating: ★★★★★★

Overview: Delta Israel Brands Ltd. designs, develops, markets, and sells various clothing products in Israel with a market cap of ₪1.68 billion.

Operations: Delta Israel Brands generates revenue primarily from its clothing product sales. The company's net profit margin has shown a notable trend, reflecting its financial performance over time.

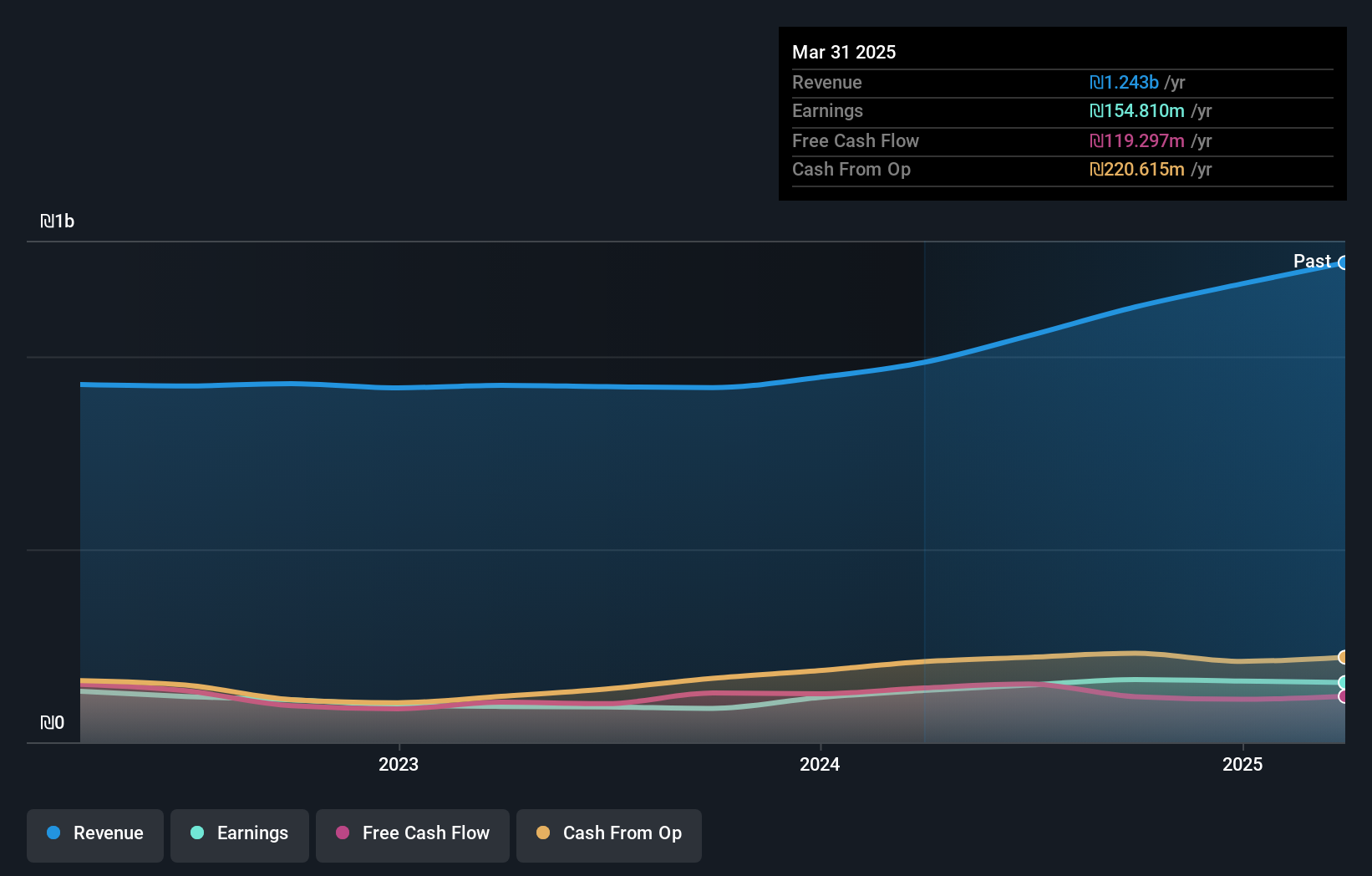

Delta Israel Brands stands out with impressive earnings growth of 85.2% over the past year, significantly outpacing the Specialty Retail industry's -22.2%. The company reported third-quarter sales of ILS 288.83 million, up from ILS 214.38 million a year prior, and net income rose to ILS 30.58 million from ILS 16.27 million last year, reflecting its strong performance trajectory. Trading at a substantial discount—69.3% below estimated fair value—Delta Israel seems well-positioned in its market segment without debt concerns as it has reduced its debt-to-equity ratio from 79% five years ago to zero today, enhancing financial stability and potential for future growth.

Seize The Opportunity

- Reveal the 4495 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLTI

Delta Israel Brands

Designs, develops, markets, and sells various clothing products in Israel.

Outstanding track record with flawless balance sheet.