- South Korea

- /

- Machinery

- /

- KOSDAQ:A064820

Subdued Growth No Barrier To Cape Industries Ltd. (KOSDAQ:064820) With Shares Advancing 25%

Despite an already strong run, Cape Industries Ltd. (KOSDAQ:064820) shares have been powering on, with a gain of 25% in the last thirty days. The last month tops off a massive increase of 143% in the last year.

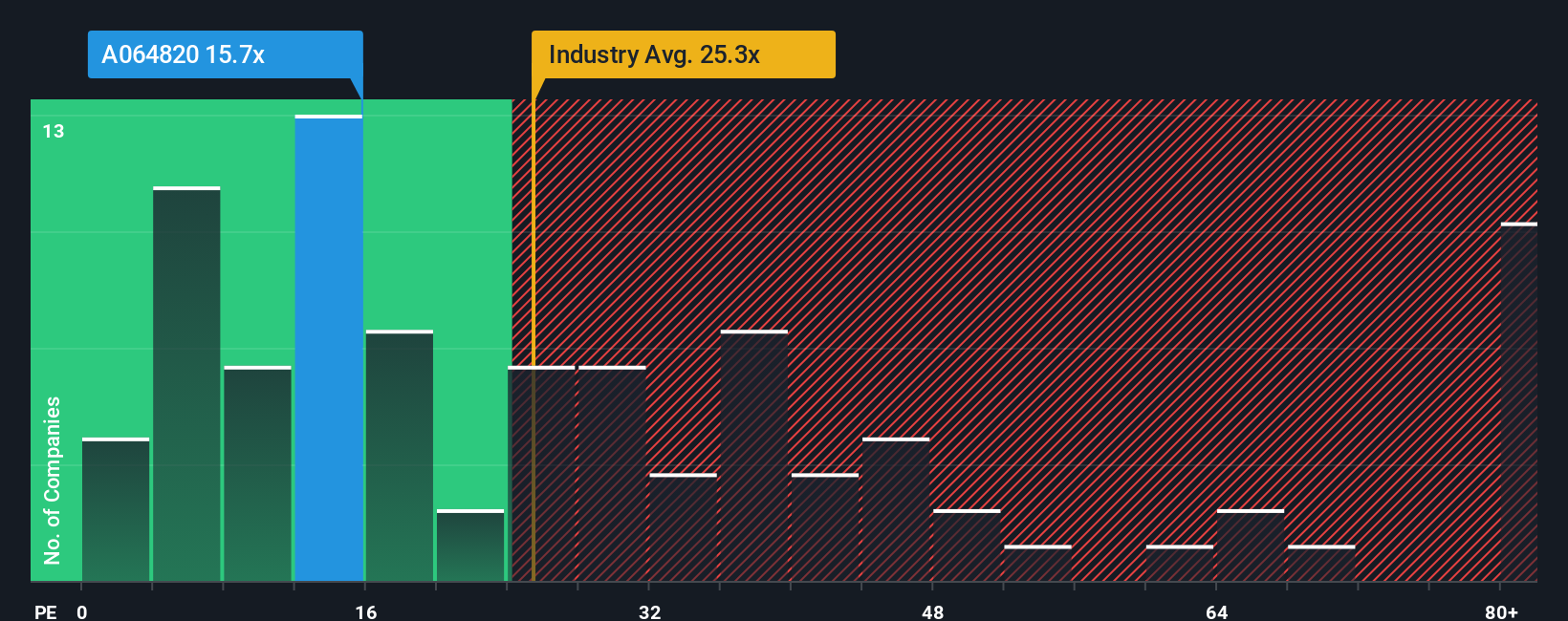

In spite of the firm bounce in price, it's still not a stretch to say that Cape Industries' price-to-earnings (or "P/E") ratio of 15.7x right now seems quite "middle-of-the-road" compared to the market in Korea, where the median P/E ratio is around 15x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Earnings have risen firmly for Cape Industries recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

View our latest analysis for Cape Industries

How Is Cape Industries' Growth Trending?

Cape Industries' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a worthy increase of 7.7%. However, due to its less than impressive performance prior to this period, EPS growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 33% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Cape Industries' P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Bottom Line On Cape Industries' P/E

Cape Industries appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Cape Industries revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 5 warning signs for Cape Industries (4 are concerning!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A064820

Cape Industries

Engages in the manufacture and sale of cylinder liners for ships in South Korea and internationally.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives