- South Korea

- /

- Machinery

- /

- KOSDAQ:A059270

Haisung Aero-Robotics Co., Ltd. (KOSDAQ:059270) Shares May Have Slumped 28% But Getting In Cheap Is Still Unlikely

Haisung Aero-Robotics Co., Ltd. (KOSDAQ:059270) shares have had a horrible month, losing 28% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 19% in the last year.

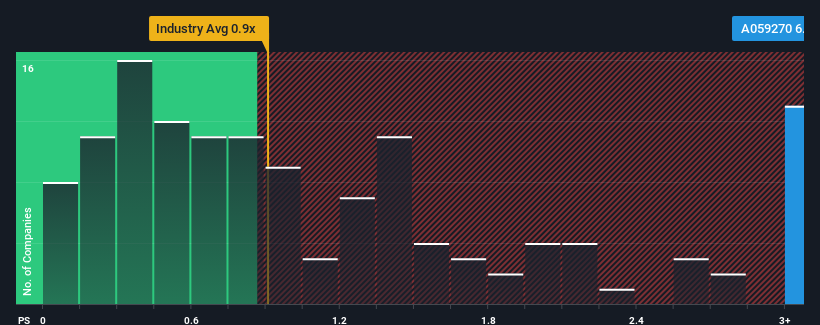

In spite of the heavy fall in price, when almost half of the companies in Korea's Machinery industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Haisung Aero-Robotics as a stock not worth researching with its 6.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Haisung Aero-Robotics

What Does Haisung Aero-Robotics' Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for Haisung Aero-Robotics, which is generally not a bad outcome. One possibility is that the P/S ratio is high because investors think this good revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Haisung Aero-Robotics' earnings, revenue and cash flow.How Is Haisung Aero-Robotics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Haisung Aero-Robotics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.7% last year. Still, lamentably revenue has fallen 10% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 38% shows it's an unpleasant look.

In light of this, it's alarming that Haisung Aero-Robotics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Haisung Aero-Robotics' P/S

A significant share price dive has done very little to deflate Haisung Aero-Robotics' very lofty P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Haisung Aero-Robotics revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It is also worth noting that we have found 3 warning signs for Haisung Aero-Robotics (1 can't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Haisung Aero-Robotics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Haisung Aero-Robotics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A059270

Haisung Aero-Robotics

Designs and manufactures reducers and gears in South Korea and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026