- South Korea

- /

- Construction

- /

- KOSDAQ:A054940

EXA E&C's (KOSDAQ:054940) Solid Earnings Have Been Accounted For Conservatively

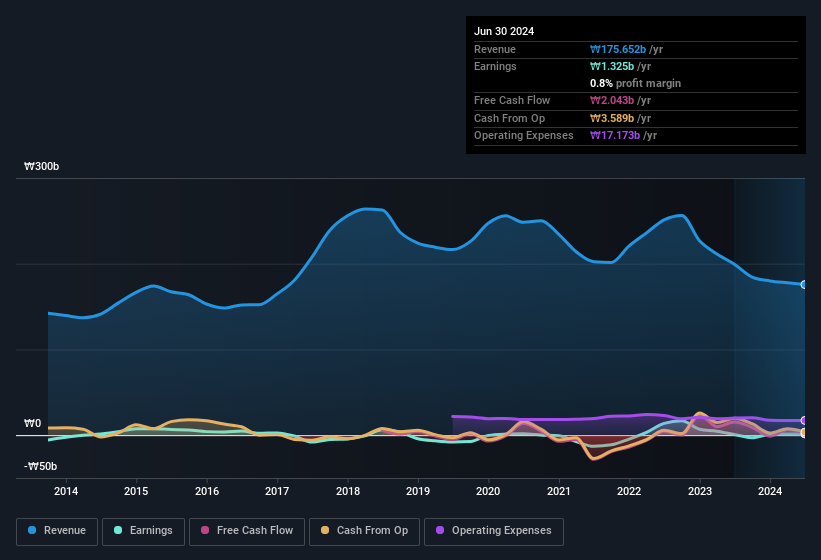

EXA E&C Inc.'s (KOSDAQ:054940) solid earnings announcement recently didn't do much to the stock price. Our analysis suggests that shareholders might be missing some positive underlying factors in the earnings report.

View our latest analysis for EXA E&C

How Do Unusual Items Influence Profit?

To properly understand EXA E&C's profit results, we need to consider the ₩791m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. If EXA E&C doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of EXA E&C.

Our Take On EXA E&C's Profit Performance

Unusual items (expenses) detracted from EXA E&C's earnings over the last year, but we might see an improvement next year. Based on this observation, we consider it likely that EXA E&C's statutory profit actually understates its earnings potential! Furthermore, it has done a great job growing EPS over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. You'd be interested to know, that we found 1 warning sign for EXA E&C and you'll want to know about this.

Today we've zoomed in on a single data point to better understand the nature of EXA E&C's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if EXA E&C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A054940

EXA E&C

Operates in the construction and interior design industry in South Korea.

Adequate balance sheet with questionable track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026