- South Korea

- /

- Machinery

- /

- KOSDAQ:A054180

MEDICOX (KOSDAQ:054180) Share Prices Have Dropped 71% In The Last Three Years

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So spare a thought for the long term shareholders of MEDICOX Co., Ltd. (KOSDAQ:054180); the share price is down a whopping 71% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The falls have accelerated recently, with the share price down 18% in the last three months. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Check out our latest analysis for MEDICOX

MEDICOX wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

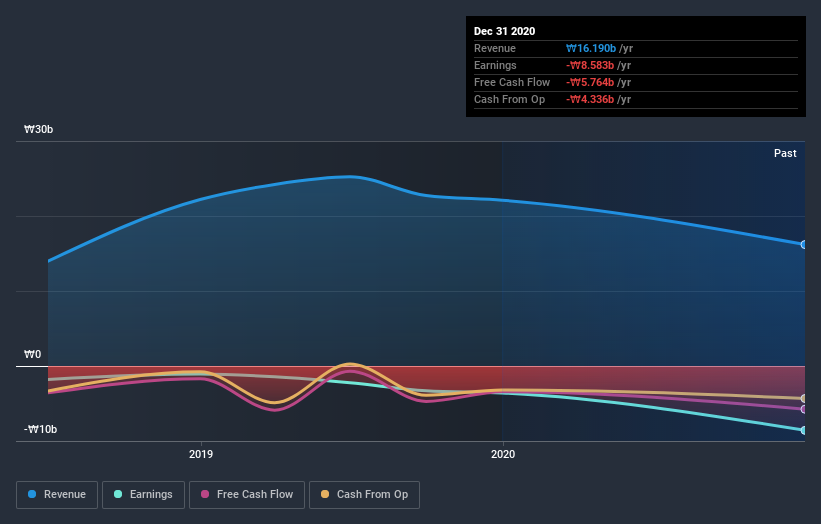

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on MEDICOX's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MEDICOX provided a TSR of 9.9% over the last twelve months. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand MEDICOX better, we need to consider many other factors. To that end, you should learn about the 5 warning signs we've spotted with MEDICOX (including 3 which are a bit unpleasant) .

We will like MEDICOX better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on KR exchanges.

If you’re looking to trade MEDICOX, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About KOSDAQ:A054180

MEDICOX

Operates in the shipbuilding equipment, electric motor, and generator businesses in South Korea and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives