- South Korea

- /

- Machinery

- /

- KOSDAQ:A044490

Slammed 26% Taewoong Co.,Ltd (KOSDAQ:044490) Screens Well Here But There Might Be A Catch

To the annoyance of some shareholders, Taewoong Co.,Ltd (KOSDAQ:044490) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

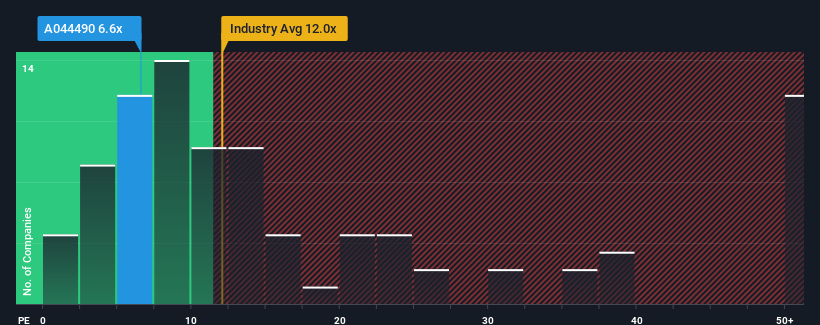

In spite of the heavy fall in price, TaewoongLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.6x, since almost half of all companies in Korea have P/E ratios greater than 11x and even P/E's higher than 21x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, TaewoongLtd has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for TaewoongLtd

How Is TaewoongLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as TaewoongLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 66% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the dual analysts following the company. With the market only predicted to deliver 15% each year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that TaewoongLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

TaewoongLtd's P/E has taken a tumble along with its share price. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of TaewoongLtd's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for TaewoongLtd with six simple checks on some of these key factors.

You might be able to find a better investment than TaewoongLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if TaewoongLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A044490

TaewoongLtd

Manufactures and sells open-die forgings and ring rolled products in South Korea and internationally.

Flawless balance sheet and good value.

Market Insights

Community Narratives