- Norway

- /

- Semiconductors

- /

- OB:NOD

Top Growth Picks With High Insider Stakes

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes nearing record highs and smaller-cap stocks outperforming their larger counterparts, investors are increasingly focused on growth opportunities amidst geopolitical uncertainties and evolving economic policies. In this context, companies with high insider ownership often attract attention as they can signal confidence in the business's future prospects, aligning management interests with those of shareholders and potentially offering resilience during market fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Underneath we present a selection of stocks filtered out by our screen.

Sung Kwang BendLtd (KOSDAQ:A014620)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sung Kwang Bend Co., Ltd. is involved in the manufacture and sale of pipe fittings globally, with a market cap of approximately ₩590.69 billion.

Operations: Sung Kwang Bend Co., Ltd. generates revenue through its global operations in the production and distribution of pipe fittings.

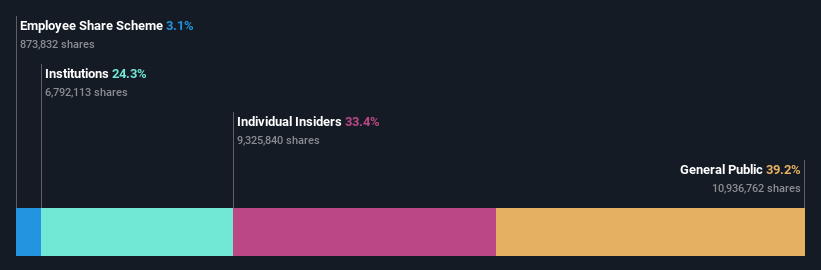

Insider Ownership: 33.4%

Sung Kwang Bend Ltd. is trading significantly below its estimated fair value and has a forecasted earnings growth of 30.6% per year, outpacing the KR market's growth rate. Despite a volatile share price recently, the company shows potential for substantial profit increases over the next three years. Recent buybacks totaling KRW 19.94 billion highlight management's confidence in its valuation, although insider trading activity remains unreported over the past three months.

- Click here to discover the nuances of Sung Kwang BendLtd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Sung Kwang BendLtd is priced lower than what may be justified by its financials.

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that designs, sells, and delivers integrated circuits and related products for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK19.16 billion.

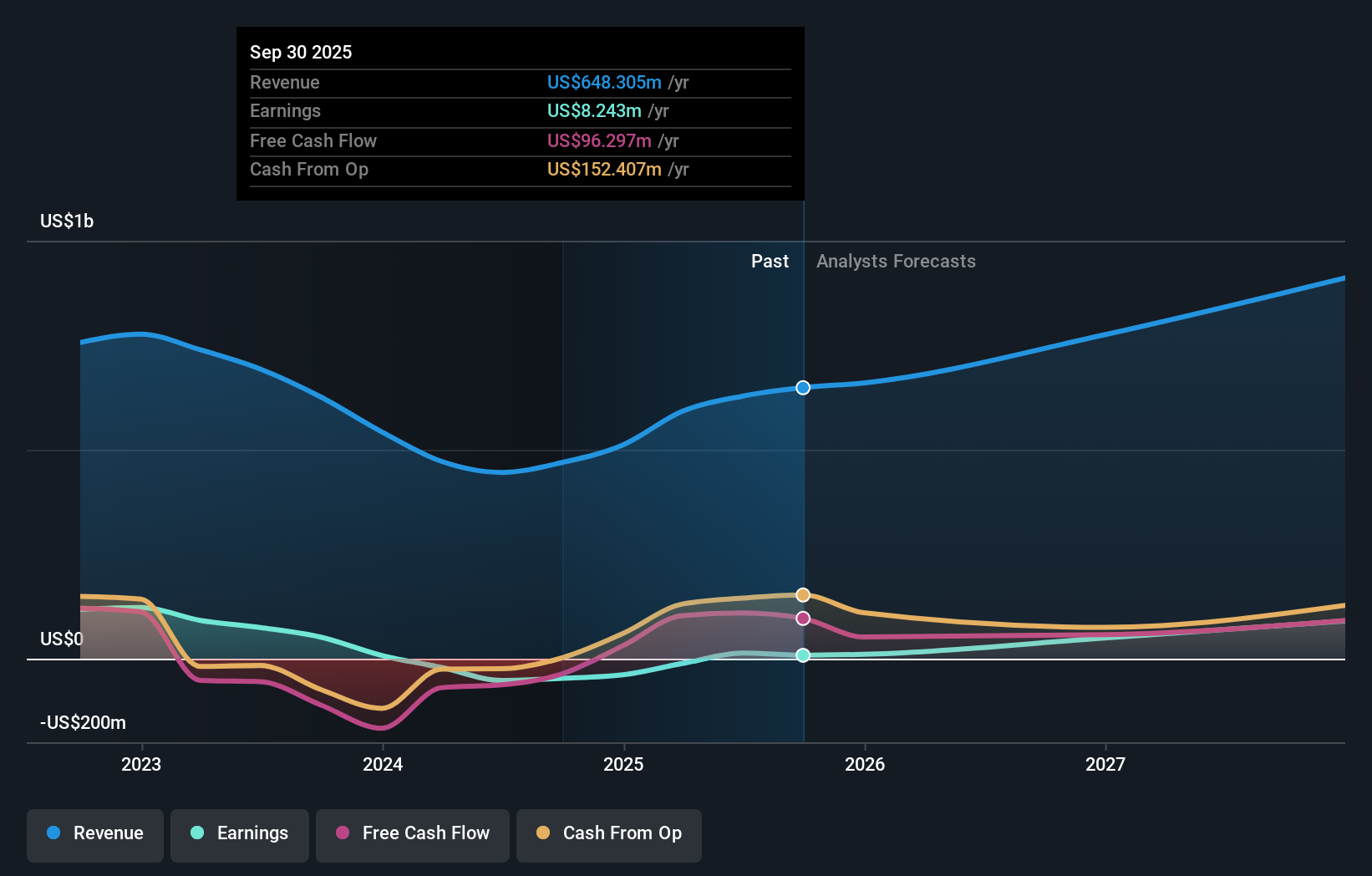

Operations: The company's revenue from the design and sale of integrated circuits and related solutions amounts to $469.41 million.

Insider Ownership: 10.7%

Nordic Semiconductor's recent earnings report showed a significant increase in quarterly net income to US$6.17 million, up from US$1.18 million the previous year, despite a nine-month net loss of US$34.61 million. The company is forecasted for annual revenue growth of 17.4%, surpassing the Norwegian market average, and is expected to become profitable within three years. Insider activity indicates confidence, with substantial insider buying observed over the past three months amidst share price volatility.

- Unlock comprehensive insights into our analysis of Nordic Semiconductor stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Nordic Semiconductor shares in the market.

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market in Poland and Ukraine, with a market capitalization of PLN3.88 billion.

Operations: The company generates revenue from its operations in the digital recruitment sector across Poland and Ukraine.

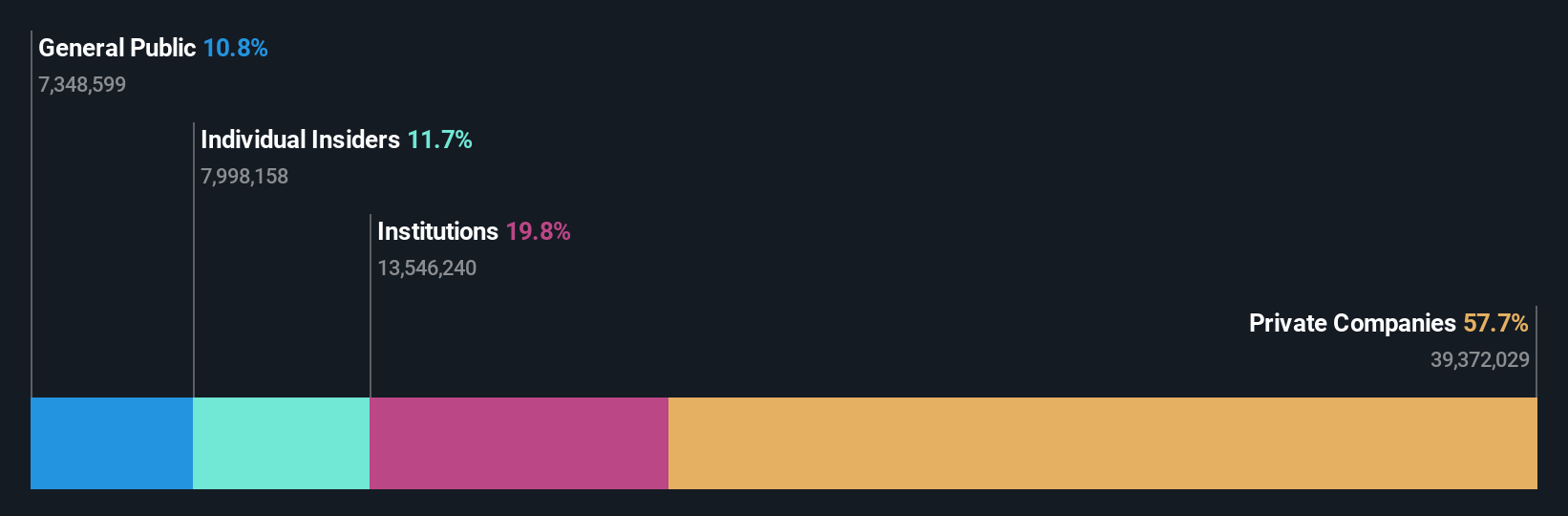

Insider Ownership: 11.7%

Grupa Pracuj's recent earnings indicate steady growth, with third-quarter sales rising to PLN 192.95 million from PLN 181.16 million a year ago and net income increasing to PLN 60.59 million. The company is trading at a significant discount to its estimated fair value, suggesting potential undervaluation. Forecasted earnings growth of 15.82% annually exceeds the Polish market average, although revenue growth is slower than desired for high-growth companies, and dividend stability remains uncertain.

- Get an in-depth perspective on Grupa Pracuj's performance by reading our analyst estimates report here.

- Our valuation report here indicates Grupa Pracuj may be overvalued.

Key Takeaways

- Reveal the 1524 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, designs, sells, and delivers integrated circuits (ICs) and related products and services for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.