- South Korea

- /

- Construction

- /

- KOSDAQ:A001840

Some Confidence Is Lacking In EE-HWA Construction Co., Ltd. (KOSDAQ:001840) As Shares Slide 33%

EE-HWA Construction Co., Ltd. (KOSDAQ:001840) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 36% share price drop.

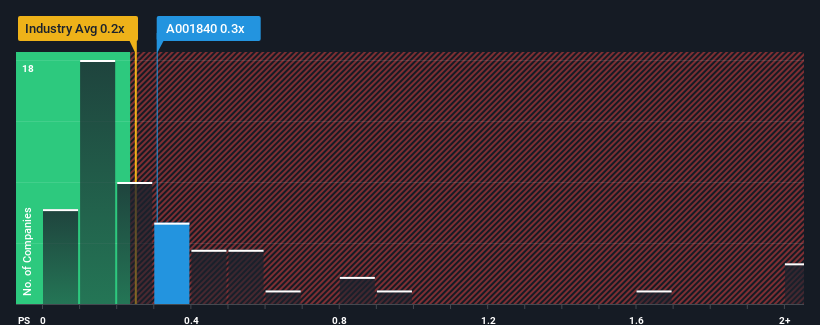

In spite of the heavy fall in price, there still wouldn't be many who think EE-HWA Construction's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in Korea's Construction industry is similar at about 0.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for EE-HWA Construction

What Does EE-HWA Construction's P/S Mean For Shareholders?

We'd have to say that with no tangible growth over the last year, EE-HWA Construction's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. Those who are bullish on EE-HWA Construction will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on EE-HWA Construction will help you shine a light on its historical performance.How Is EE-HWA Construction's Revenue Growth Trending?

EE-HWA Construction's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. This isn't what shareholders were looking for as it means they've been left with a 16% decline in revenue over the last three years in total. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 2.9% over the next year, or less than the company's recent medium-term annualised revenue decline.

With this information, it's perhaps strange that EE-HWA Construction is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On EE-HWA Construction's P/S

With its share price dropping off a cliff, the P/S for EE-HWA Construction looks to be in line with the rest of the Construction industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of EE-HWA Construction revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. Unless the company's relative performance improves, it's challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for EE-HWA Construction (1 is a bit unpleasant!) that you need to take into consideration.

If these risks are making you reconsider your opinion on EE-HWA Construction, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if EE-HWA Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A001840

Adequate balance sheet low.

Market Insights

Community Narratives