Stock Analysis

- South Korea

- /

- Banks

- /

- KOSE:A175330

KT And Two More Leading Dividend Stocks On KRX

Reviewed by Simply Wall St

In recent times, the South Korean market has experienced a modest decline of 2.1% over the past week, yet it maintains a positive trajectory with an annual growth of 4.3%. In this context, dividend stocks like KT that offer potential earnings growth and stability become particularly attractive to investors seeking reliable returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.83% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.26% | ★★★★★☆ |

| NH Investment & Securities (KOSE:A005940) | 5.98% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 7.04% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.33% | ★★★★★☆ |

| Samyang (KOSE:A145990) | 3.63% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.82% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.85% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.31% | ★★★★★☆ |

| Hansae Yes24 Holdings (KOSE:A016450) | 5.34% | ★★★★☆☆ |

Click here to see the full list of 69 stocks from our Top KRX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation operates as a provider of integrated telecommunications and platform services both in Korea and internationally, with a market capitalization of approximately ₩9.21 billion.

Operations: KT Corporation's revenue streams primarily include ₩18.77 billion from ICT, ₩3.71 billion from finance, ₩0.71 billion from satellite TV, and ₩0.52 billion from real estate operations.

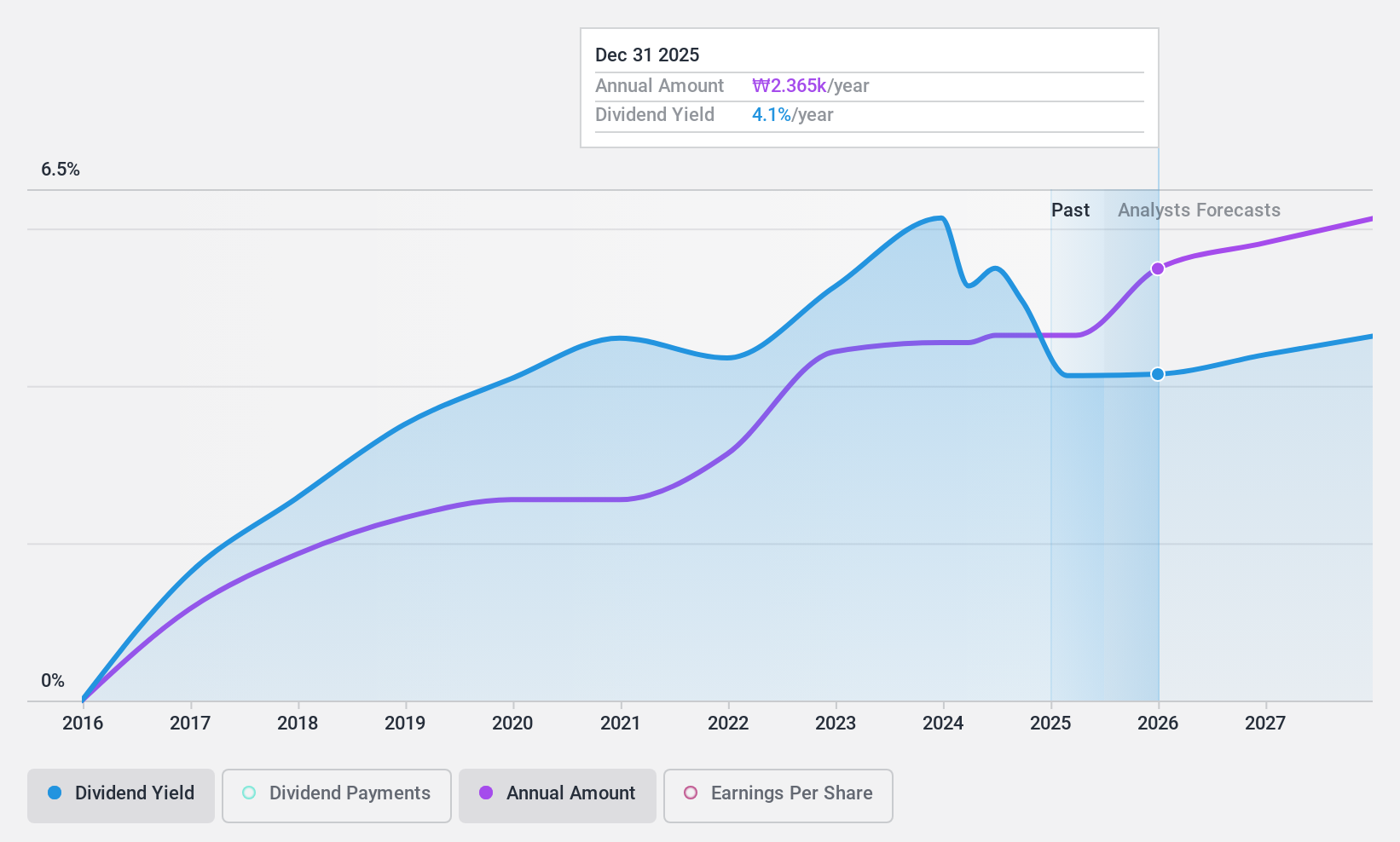

Dividend Yield: 5.3%

KT Corporation's dividends, with a yield of 5.33%, rank in the top 25% in the South Korean market. Despite this, its dividend history shows volatility and unreliability over the past decade, including significant annual drops. Recently, KT confirmed a quarterly dividend of KRW 500 per share for July 30, 2024. Financially, KT is trading at a substantial discount (76.7% below fair value) and analysts expect a potential price increase of 22.4%. Earnings have grown steadily with forecasts suggesting a continuation at 7.31% annually; dividends are well-supported by both earnings (payout ratio: 56.7%) and cash flows (cash payout ratio: 23.7%).

- Delve into the full analysis dividend report here for a deeper understanding of KT.

- Our expertly prepared valuation report KT implies its share price may be lower than expected.

DGB Financial Group (KOSE:A139130)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DGB Financial Group Co., Ltd. operates primarily in South Korea, offering a wide range of banking products and services through its subsidiaries, with a market capitalization of approximately ₩1.33 trillion.

Operations: DGB Financial Group Co., Ltd. generates revenue primarily from banking (₩2.74 billion), securities investment (₩2.22 billion), life insurance (₩0.58 billion), credit sector (₩0.20 billion), and asset management (₩0.01 billion).

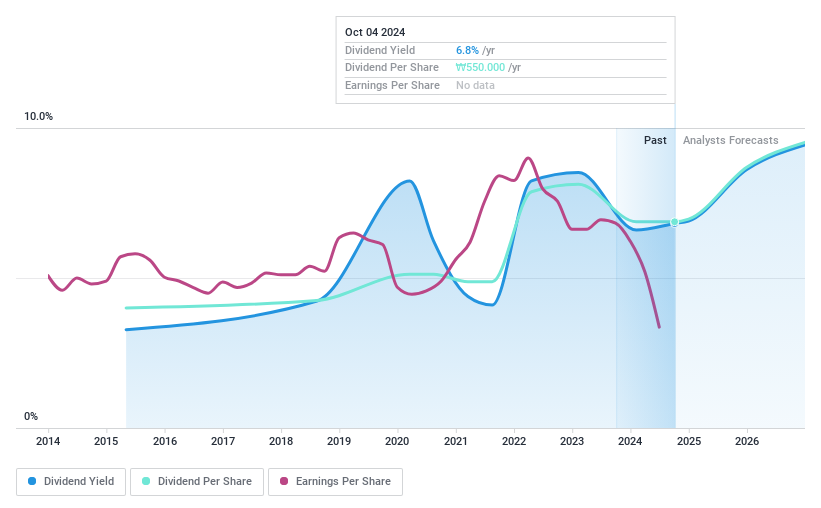

Dividend Yield: 6.9%

DGB Financial Group has demonstrated a robust dividend profile, with a yield of 6.86% that places it in the top quartile of South Korean dividend payers. Despite recent earnings declines in Q1 2024, where net income dropped to KRW 111.72 billion from KRW 168 billion year-over-year, the company maintains a low payout ratio of 29.9%. Analysts predict earnings growth of approximately 17.74% per annum and expect dividends to be well-covered by earnings over the next three years, indicating both sustainability and potential for growth in shareholder returns.

- Click here to discover the nuances of DGB Financial Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility DGB Financial Group's shares may be trading at a discount.

JB Financial Group (KOSE:A175330)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JB Financial Group Co., Ltd. operates as a financial institution offering banking products and services both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.87 billion.

Operations: JB Financial Group Co., Ltd. generates revenue primarily through three segments: Banking Sector with ₩1.20 billion, Capital Segment at ₩0.36 billion, and Asset Management Division contributing ₩0.02 billion.

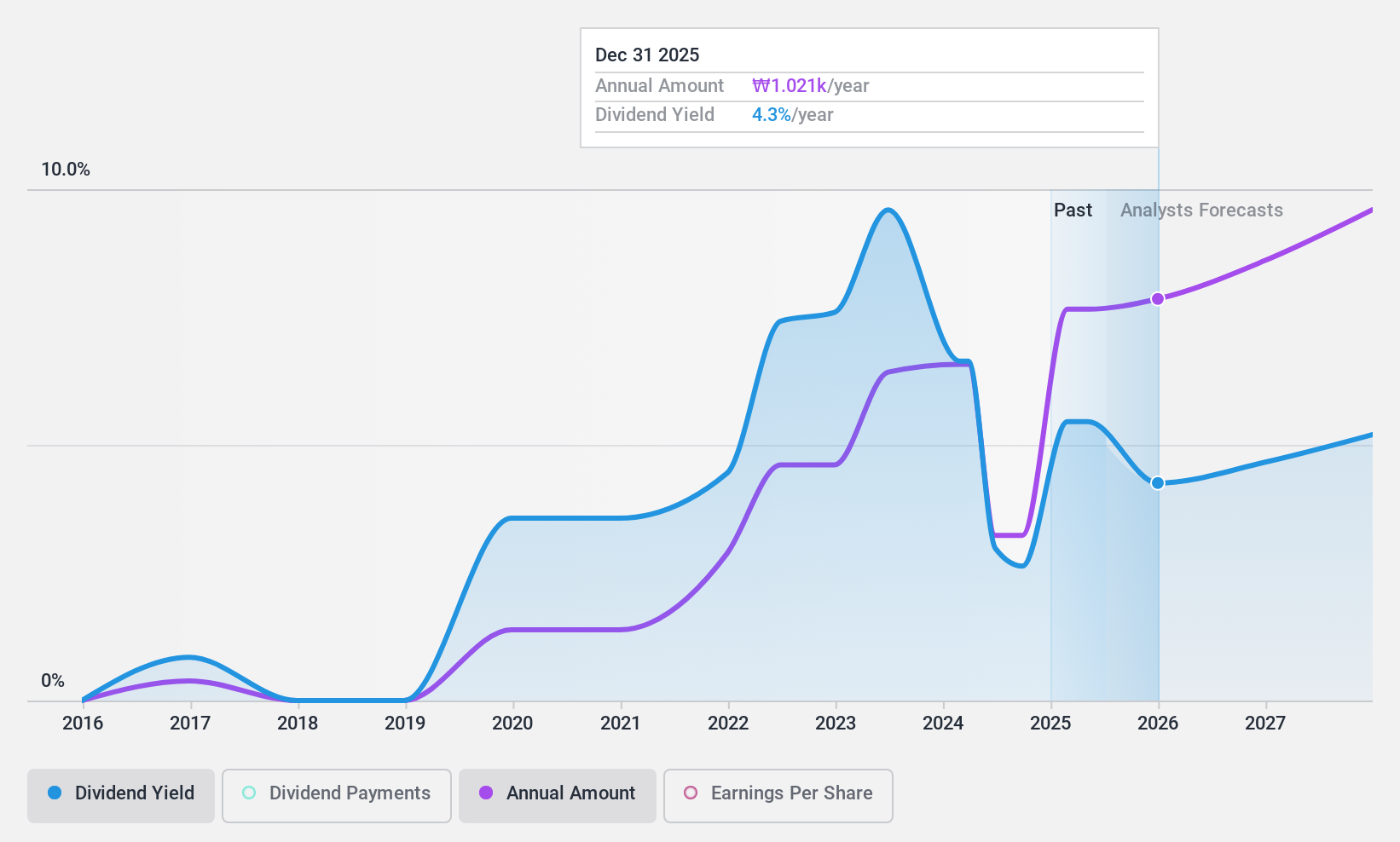

Dividend Yield: 5.7%

JB Financial Group maintains a conservative payout ratio of 28.8%, ensuring that dividends are comfortably covered by earnings, with expectations to remain so over the next three years (29.6%). While the company's dividend history spans just eight years, making its track record somewhat limited, dividend payments have shown stability and growth within this period. Additionally, JB Financial trades at a significant discount to estimated fair value (68.5% below), suggesting potential undervaluation relative to intrinsic worth. Recent events include a cash dividend payment on June 27, 2024.

- Take a closer look at JB Financial Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of JB Financial Group shares in the market.

Taking Advantage

- Access the full spectrum of 69 Top KRX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether JB Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A175330

JB Financial Group

Through its subsidiaries, provides banking products and services in South Korea and internationally.

Undervalued with adequate balance sheet and pays a dividend.