Stock Analysis

- South Korea

- /

- Auto

- /

- KOSE:A003620

Exploring Undiscovered Gems In South Korea For July 2024

Reviewed by Simply Wall St

The South Korean stock market has experienced a slight decline of 2.1% over the past week, although it has gained 4.3% over the last year with earnings projected to grow by 30% annually. In this dynamic environment, identifying stocks with strong growth potential and solid fundamentals can be particularly rewarding for investors looking to uncover hidden value.

Top 10 Undiscovered Gems With Strong Fundamentals In South Korea

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Samyang | 47.03% | 6.61% | 22.07% | ★★★★★★ |

| CYMECHS | 10.99% | 11.45% | 3.52% | ★★★★★★ |

| Korea Cast Iron Pipe Ind | NA | 2.58% | 14.14% | ★★★★★★ |

| Korea Ratings | NA | 1.74% | 0.87% | ★★★★★★ |

| NOROO PAINT & COATINGS | 17.16% | 5.11% | 6.31% | ★★★★★★ |

| Kyung Dong Navien | 26.97% | 11.54% | 19.49% | ★★★★★★ |

| Hansae Yes24 Holdings | 97.82% | 2.74% | 18.89% | ★★★★★☆ |

| Daewon Cable | 24.70% | 8.50% | 62.14% | ★★★★★☆ |

| Ubiquoss Holdings | 2.69% | 9.93% | 14.22% | ★★★★★☆ |

| Kwang Dong Pharmaceutical | 40.57% | 5.48% | 4.75% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

VT (KOSDAQ:A018290)

Simply Wall St Value Rating: ★★★★★★

Overview: VT Co., Ltd. is a diversified company engaged in the production and global export of laminating machines and films, with a market capitalization of ₩1.35 trillion.

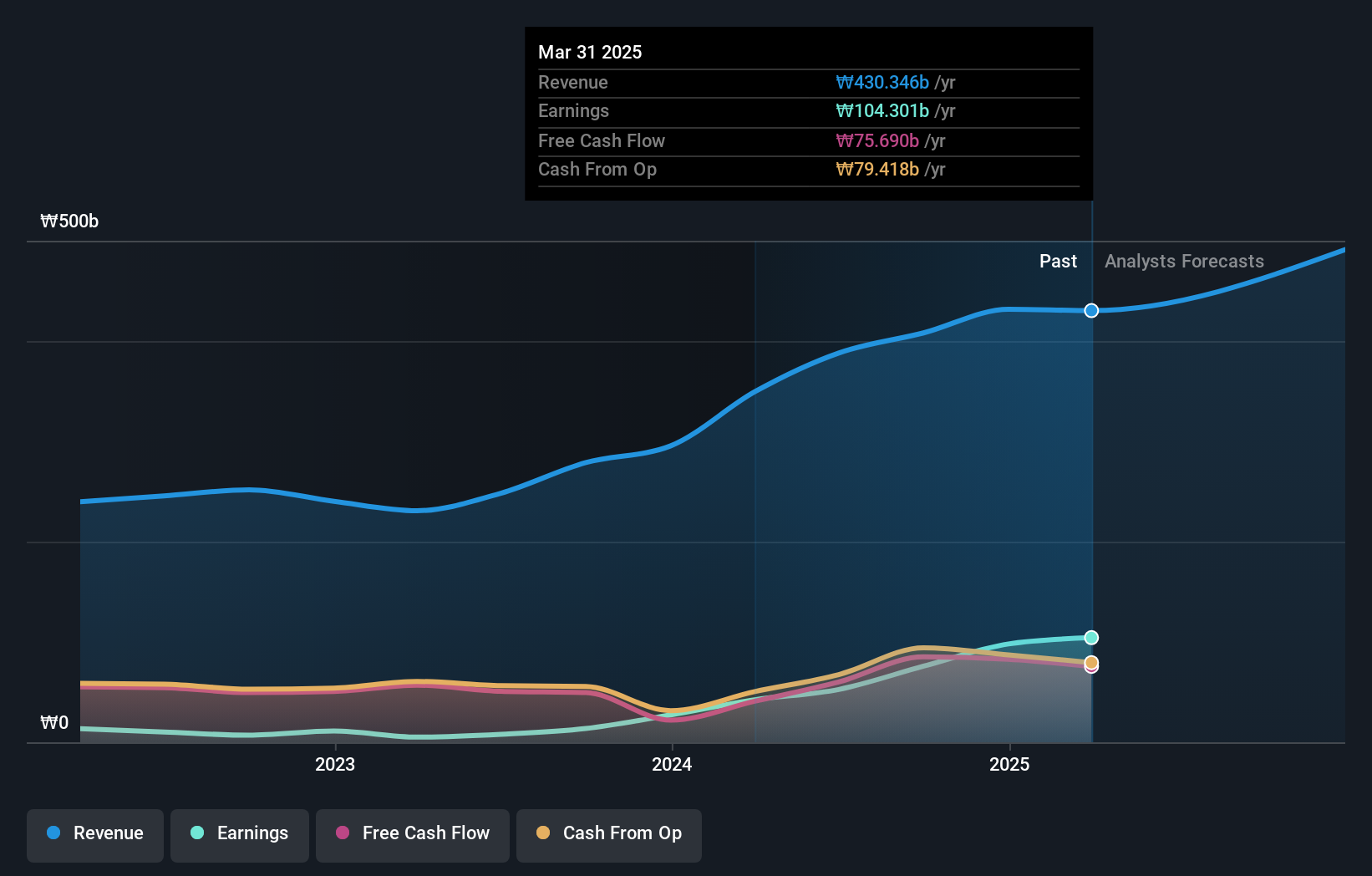

Operations: VT operates primarily in the cosmetics, laminating, and entertainment sectors, generating significant portions of its revenue from these areas with respective contributions of ₩213.71 billion, ₩33.15 billion, and ₩98.08 billion. The company has shown a notable increase in net income margin over recent periods, reaching 12.11% by mid-2024, reflecting improved operational efficiency and financial management despite varied performance in earlier years.

VT, a lesser-known entity in South Korea's bustling market, has recently demonstrated remarkable financial agility. With earnings growth soaring by 727% last year, far outpacing the industry's 37%, VT is carving a niche for itself. The company boasts more cash than debt and maintains a robust EBIT coverage of 319 times its interest expenses, reflecting strong operational efficiency. Despite recent share price volatility, VT’s strategic maneuvers suggest potential for sustained growth amidst competitive dynamics.

- Navigate through the intricacies of VT with our comprehensive health report here.

Examine VT's past performance report to understand how it has performed in the past.

KG Mobility (KOSE:A003620)

Simply Wall St Value Rating: ★★★★★★

Overview: KG Mobility Corp. is a global manufacturer and seller of automobiles and parts, based in South Korea, with a market capitalization of ₩1.21 trillion.

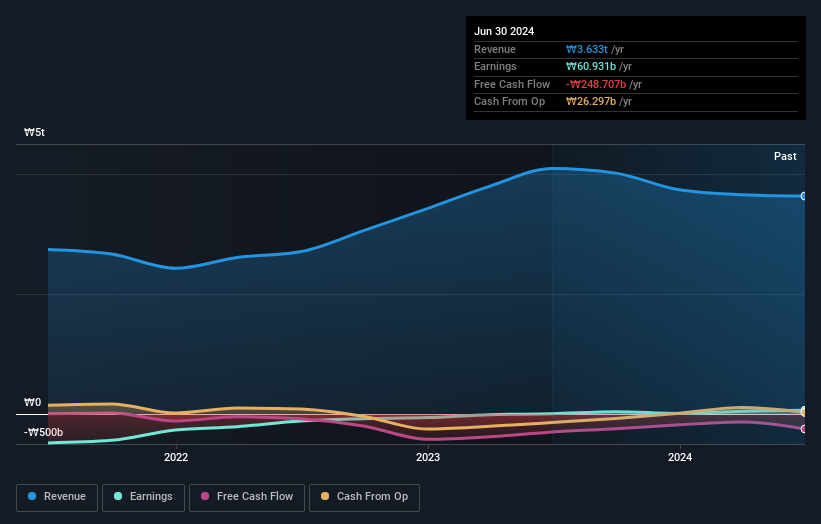

Operations: The company generates revenue primarily through the sale of goods, evidenced by consistent gross profit margins averaging around 10.63% to 11.57% in recent quarters. Significant operating expenses, including sales & marketing and R&D, impact net income, occasionally resulting in net losses despite substantial revenues exceeding ₩3 billion annually.

KG Mobility, a lesser-known entity in South Korea's automotive sector, recently showcased robust growth with first-quarter sales rising to KRW 48.3 billion from KRW 46.9 billion year-over-year. Net income surged impressively to KRW 53.9 million from KRW 16.5 million, reflecting strong operational efficiency and market acceptance of its offerings. Additionally, the company's debt-to-equity ratio improved significantly from 44.1% to 16.2% over five years, underscoring prudent financial management and enhanced shareholder value through strategic investments and cost controls.

- Delve into the full analysis health report here for a deeper understanding of KG Mobility.

Review our historical performance report to gain insights into KG Mobility's's past performance.

STX Heavy Industries (KOSE:A071970)

Simply Wall St Value Rating: ★★★★★☆

Overview: STX Heavy Industries Co., Ltd. is a South Korean company engaged in the manufacturing and sale of marine engines, industrial facilities, and plants both domestically and globally, with a market capitalization of approximately ₩605.32 billion.

Operations: The company primarily generates revenue through the sale of goods, with a significant portion of its costs attributed to the cost of goods sold (COGS). Over recent periods, it has experienced fluctuations in gross profit margins, highlighting challenges in managing production or supply chain efficiencies.

Amidst the bustling industrial landscape of South Korea, STX Heavy Industries emerges as an intriguing investment prospect. The company's debt to equity ratio has impressively decreased from 107% to 37.5% over five years, underscoring a robust financial restructuring. Over the past year, its earnings surged by 148.6%, significantly outpacing the machinery industry's decline of 1.9%. Currently trading at a striking 80.8% below its estimated fair value, STX Heavy Industries also boasts well-covered interest payments with an EBIT coverage ratio of 6.6 times and maintains a satisfactory net debt to equity ratio at just 8.6%.

- Click here and access our complete health analysis report to understand the dynamics of STX Heavy Industries.

Evaluate STX Heavy Industries' historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 205 hidden gems among our KRX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether KG Mobility is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A003620

KG Mobility

Manufactures and sells automobiles and parts in the South Korea and internationally.

Flawless balance sheet with acceptable track record.