Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A036930

Exploring Value Opportunities With JUSUNG ENGINEERINGLtd And 2 Other Stocks On The KRX

Reviewed by Simply Wall St

The South Korean stock market has experienced a slight decline of 2.1% over the last week, although it maintains a positive trajectory with an annual growth of 4.3%. In this context, where earnings are forecast to grow by 30% annually, identifying undervalued stocks like JUSUNG ENGINEERING Ltd and two others can offer potential value opportunities for investors attentive to both current performance and future growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PSK (KOSDAQ:A319660) | ₩31250.00 | ₩62309.91 | 49.8% |

| Caregen (KOSDAQ:A214370) | ₩23800.00 | ₩44549.16 | 46.6% |

| NEXTIN (KOSDAQ:A348210) | ₩56900.00 | ₩109824.99 | 48.2% |

| Cosmax (KOSE:A192820) | ₩152900.00 | ₩289996.90 | 47.3% |

| KidariStudio (KOSE:A020120) | ₩3810.00 | ₩7207.92 | 47.1% |

| ISU Petasys (KOSE:A007660) | ₩47200.00 | ₩83586.76 | 43.5% |

| Genomictree (KOSDAQ:A228760) | ₩20800.00 | ₩39033.21 | 46.7% |

| TSE (KOSDAQ:A131290) | ₩46350.00 | ₩82174.60 | 43.6% |

| Ray (KOSDAQ:A228670) | ₩11480.00 | ₩21191.01 | 45.8% |

| HD Hyundai Heavy IndustriesLtd (KOSE:A329180) | ₩170400.00 | ₩302604.08 | 43.7% |

We'll examine a selection from our screener results.

JUSUNG ENGINEERINGLtd (KOSDAQ:A036930)

Overview: JUSUNG ENGINEERING Co., Ltd. is a global provider of semiconductor, display, solar, and lighting equipment based in South Korea, with a market capitalization of approximately ₩1.43 trillion.

Operations: The company generates revenue primarily from its semiconductor equipment and services segment, totaling approximately ₩272.61 billion.

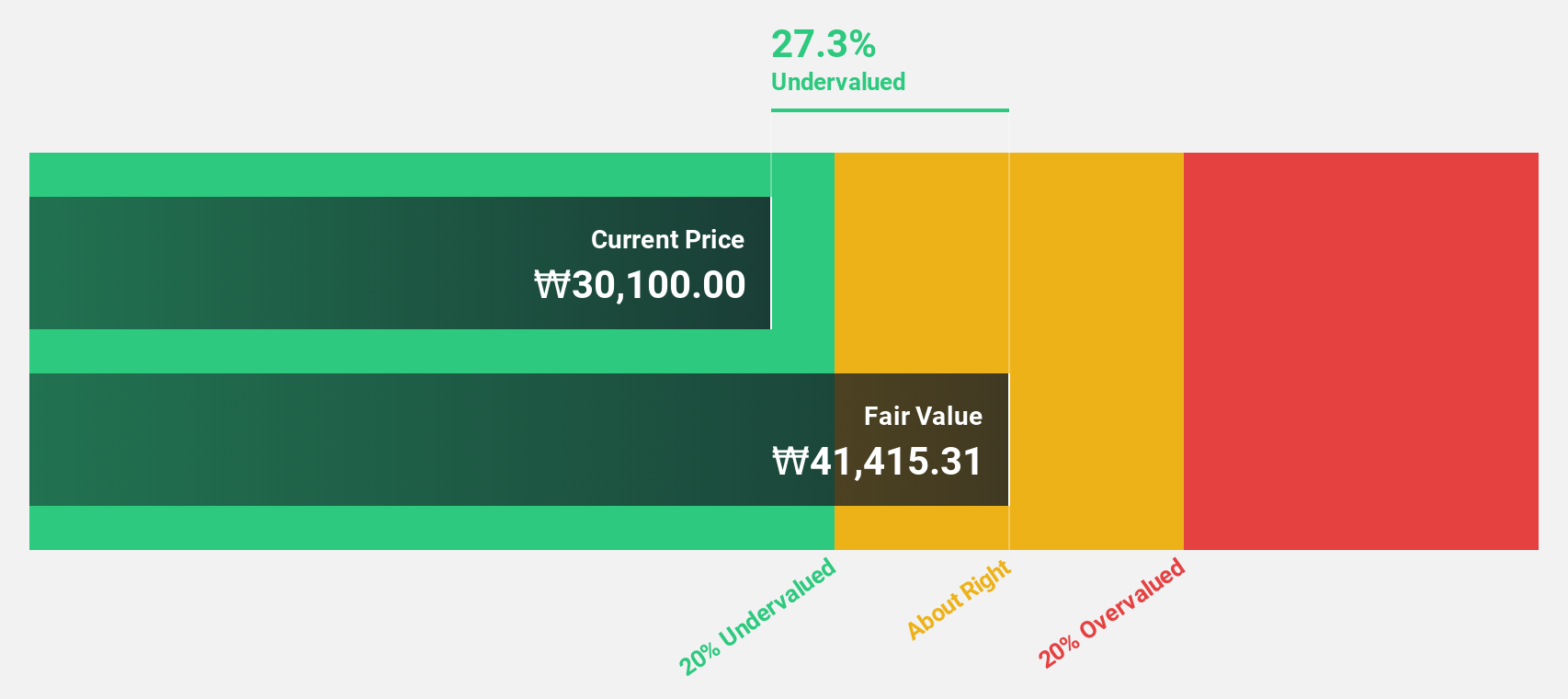

Estimated Discount To Fair Value: 16.1%

JUSUNG ENGINEERING Co., Ltd. is trading at ₩30,000, which is 16.1% below the estimated fair value of ₩35,765.96, indicating potential undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 23% to 14.6% over the past year, the company's revenue growth is robust at 23.9% annually—outpacing the South Korean market average of 10.6%. However, its Return on Equity is expected to be modest at 17.7% in three years' time.

- Upon reviewing our latest growth report, JUSUNG ENGINEERINGLtd's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of JUSUNG ENGINEERINGLtd.

Shinsung E&GLtd (KOSE:A011930)

Overview: Shinsung E&G Ltd. specializes in providing solar modules and solar systems both domestically in Korea and internationally, with a market capitalization of approximately ₩383.72 billion.

Operations: The company's revenue is primarily generated through its Renewable Energy and Clean Environment Business Divisions, contributing ₩0.53 billion and ₩533.30 billion respectively.

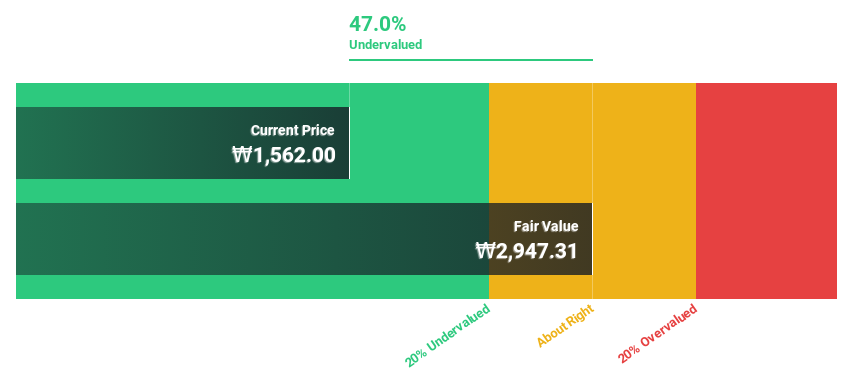

Estimated Discount To Fair Value: 31.3%

Shinsung E&G Ltd, priced at ₩1885, appears undervalued by 31.3% against a fair value of ₩2744.88, suggesting potential for appreciation. The company's earnings are set to increase significantly, with an annual growth forecast of 84.4%, outstripping the South Korean market’s average of 29.7%. However, its low profit margins and inadequate coverage of interest payments by earnings signal financial vulnerabilities that could temper its attractiveness despite the promising growth projections.

- In light of our recent growth report, it seems possible that Shinsung E&GLtd's financial performance will exceed current levels.

- Dive into the specifics of Shinsung E&GLtd here with our thorough financial health report.

Cosmax (KOSE:A192820)

Overview: Cosmax, Inc. is a company based in Korea that specializes in the research, development, production, and manufacturing of cosmetic and health function food products globally, with a market capitalization of approximately ₩1.73 trillion.

Operations: The cosmetics division generates ₩1.90 billion in revenue.

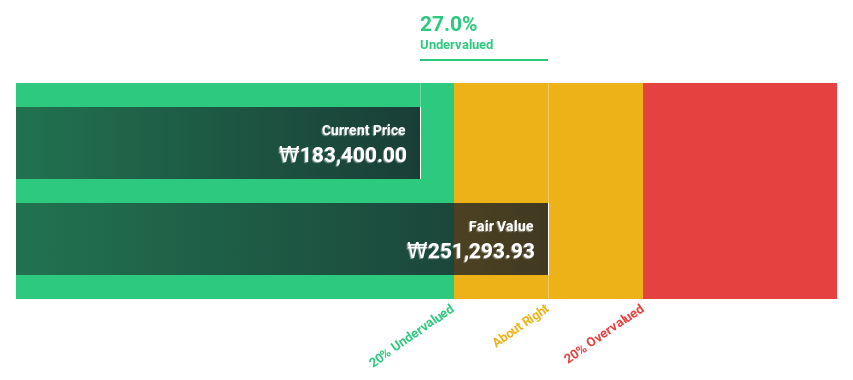

Estimated Discount To Fair Value: 47.3%

Cosmax, with a current price of ₩152,900, is significantly undervalued based on discounted cash flow analysis, showing a potential undervaluation of over 47%. Despite its high debt levels which pose some risk, the company's earnings have surged by a very large margin over the past year and are expected to grow by 27.4% annually. Analysts predict a substantial stock price increase of 39.3%, although revenue growth at 13.2% per year slightly trails the broader market forecast of 20%.

- The analysis detailed in our Cosmax growth report hints at robust future financial performance.

- Click here to discover the nuances of Cosmax with our detailed financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued KRX Stocks Based On Cash Flows list of 39 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether JUSUNG ENGINEERINGLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A036930

JUSUNG ENGINEERINGLtd

Manufactures and sells semiconductor, display, solar, and lighting equipment in South Korea and internationally.

Flawless balance sheet with high growth potential.