- South Korea

- /

- Chemicals

- /

- KOSE:A298050

Dividend Decisions On The KRX: Avoid Hyosung Advanced Materials And Consider One Better Option

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide a reliable source of income. However, companies like Hyosung Advanced Materials, which have shown a decline in their dividend growth, may pose risks that warrant careful consideration. In the vibrant South Korean market, where many dividends have seen substantial growth, identifying those that fail to maintain or increase their payouts is crucial for investors looking to minimize exposure to unstable returns.

Top 10 Dividend Stocks In South Korea

| Name | Dividend Yield | Dividend Rating |

| Kia (KOSE:A000270) | 4.43% | ★★★★★★ |

| LOTTE Fine Chemical (KOSE:A004000) | 4.33% | ★★★★★☆ |

| NH Investment & Securities (KOSE:A005940) | 6.18% | ★★★★★☆ |

| Industrial Bank of Korea (KOSE:A024110) | 6.91% | ★★★★★☆ |

| KT (KOSE:A030200) | 5.50% | ★★★★★☆ |

| Shinhan Financial Group (KOSE:A055550) | 3.93% | ★★★★★☆ |

| Kyung Nong (KOSE:A002100) | 4.95% | ★★★★★☆ |

| HANYANG ENGLtd (KOSDAQ:A045100) | 3.16% | ★★★★★☆ |

| Cheil Worldwide (KOSE:A030000) | 6.00% | ★★★★☆☆ |

| Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.12% | ★★★★☆☆ |

Click here to see the full list of 72 stocks from our Top KRX Dividend Stocks screener.

Let's explore one of the standout options from the results in the screener and examine one not meeting the grade.

Top Pick

Hana Financial Group (KOSE:A086790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hana Financial Group Inc., a major financial services provider in South Korea, operates through its subsidiaries with a market capitalization of approximately ₩18.79 trillion.

Operations: The company generates revenue primarily through three segments: Banking (₩8.98 billion), Capital (₩1.01 billion), and Credit Card (₩0.52 billion).

Dividend Yield: 9.7%

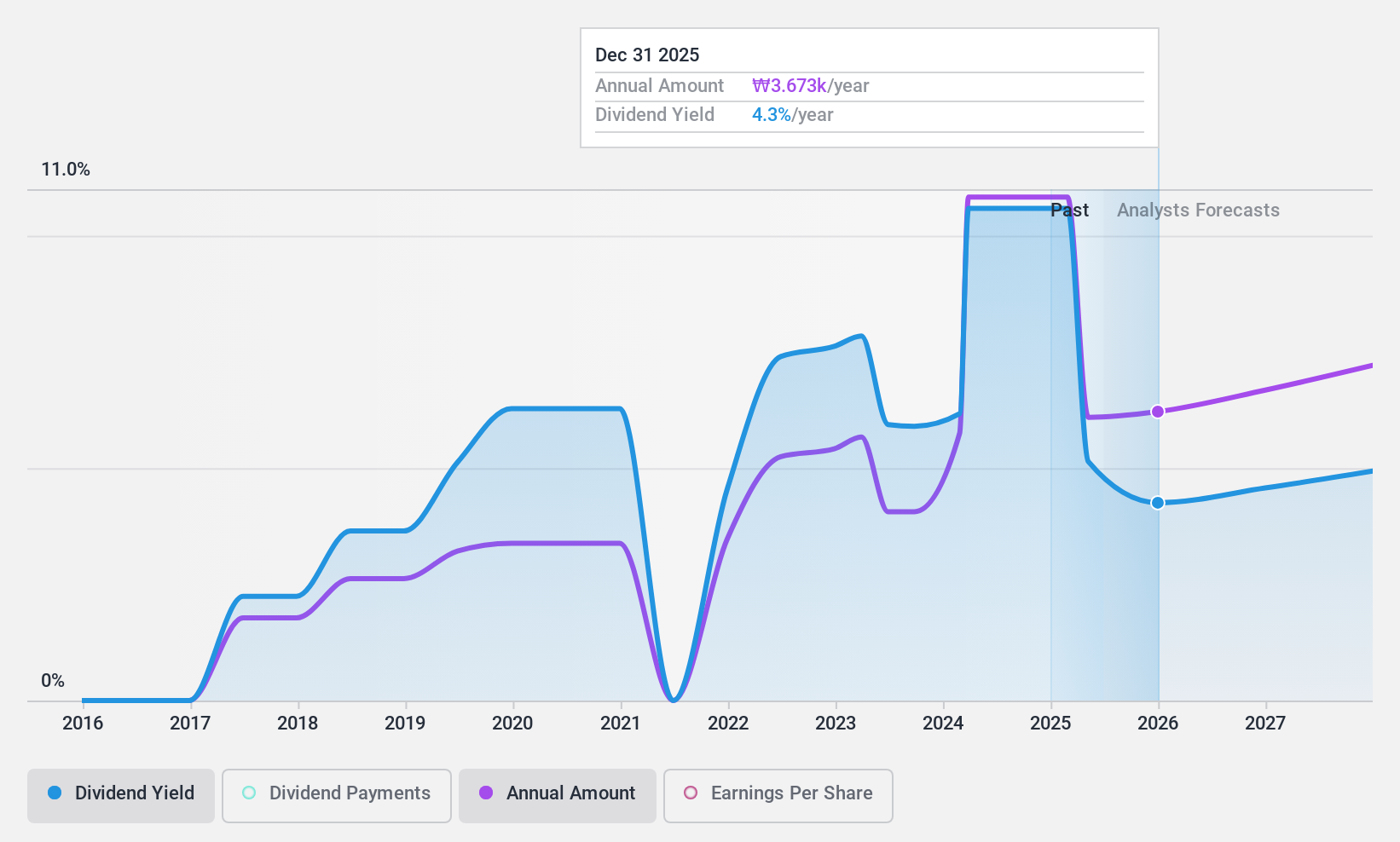

Hana Financial Group, trading at 62.3% below our fair value estimate, offers a compelling value in the South Korean dividend stock market. Despite its relatively short dividend history of 7 years marked by volatility, the company's dividends are well-covered by earnings with a current payout ratio of 30.5%. The forecast suggests a similar coverage in three years (28.6% payout ratio). Notably, Hana's dividend yield stands at 9.67%, placing it in the top quartile of KR market payers. Recent activities include a cash dividend payment and participation in multiple investor conferences, underscoring its active engagement with the financial community.

- Click here to discover the nuances of Hana Financial Group with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Hana Financial Group's current price could be quite moderate.

One To Reconsider

Hyosung Advanced Materials (KOSE:A298050)

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Hyosung Advanced Materials Corporation, with a market cap of approximately ₩1.55 trillion, is engaged in the manufacturing and global distribution of industrial, polyester, nylon, and carpet yarns.

Operations: Hyosung Advanced Materials' revenue is primarily derived from its Industrial Materials Sector, generating ₩3.14 billion, followed by the Textile Sector at ₩0.36 billion.

Dividend Yield: 1.9%

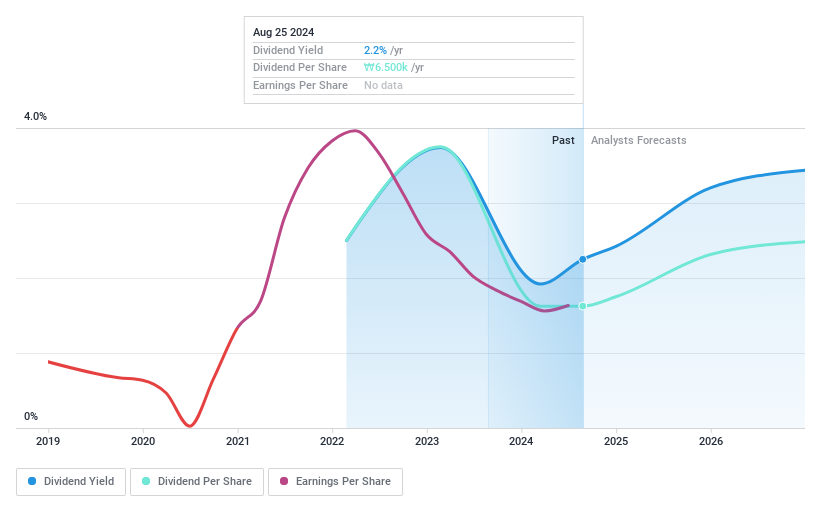

Hyosung Advanced Materials exhibits concerning signs for dividend investors, with a declining dividend over its short two-year history and a current yield of 1.87%, below the top quartile in South Korea's market (3.58%). The company's dividends are not well-supported, evidenced by a high payout ratio of 127.9% and lack of free cash flows. Recent financials show a downturn, with net income dropping from KRW 33.05 billion to KRW 20.21 billion year-over-year, further straining its dividend sustainability.

Key Takeaways

- Explore the 72 names from our Top KRX Dividend Stocks screener here.

- Shareholder in one of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hs Hyosung Advanced Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A298050

Hs Hyosung Advanced Materials

Manufactures and sells industrial, polyester, nylon, and carpet yarns in South Korea and internationally.

Moderate growth potential low.