Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that HL Mando Corporation (KRX:204320) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for HL Mando

What Is HL Mando's Net Debt?

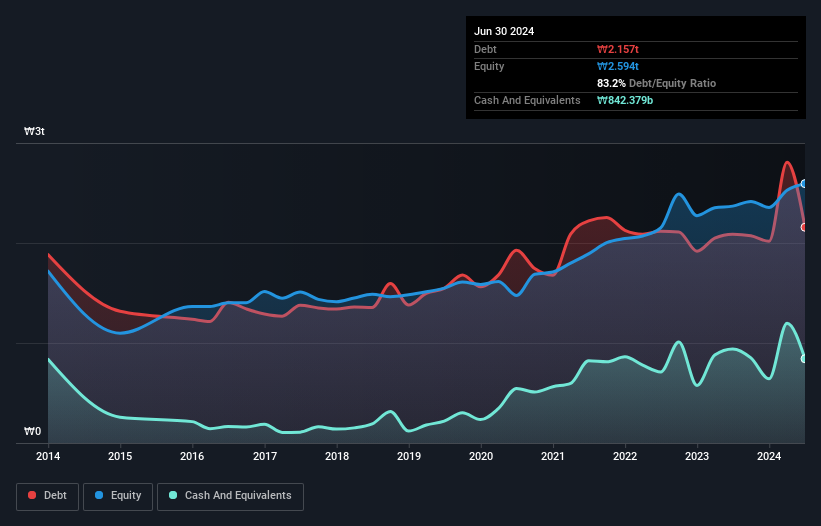

As you can see below, HL Mando had ₩2.16t of debt, at June 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has ₩842.4b in cash leading to net debt of about ₩1.32t.

How Healthy Is HL Mando's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that HL Mando had liabilities of ₩2.55t due within 12 months and liabilities of ₩1.67t due beyond that. Offsetting this, it had ₩842.4b in cash and ₩1.69t in receivables that were due within 12 months. So it has liabilities totalling ₩1.69t more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of ₩1.59t, we think shareholders really should watch HL Mando's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

HL Mando's net debt is sitting at a very reasonable 2.1 times its EBITDA, while its EBIT covered its interest expense just 4.7 times last year. In large part that's due to the company's significant depreciation and amortisation charges, which arguably mean its EBITDA is a very generous measure of earnings, and its debt may be more of a burden than it first appears. We saw HL Mando grow its EBIT by 5.8% in the last twelve months. Whilst that hardly knocks our socks off it is a positive when it comes to debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine HL Mando's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, HL Mando recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

We'd go so far as to say HL Mando's conversion of EBIT to free cash flow was disappointing. But at least its EBIT growth rate is not so bad. Looking at the bigger picture, it seems clear to us that HL Mando's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for HL Mando (1 is significant!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if HL Mando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A204320

HL Mando

An electric vehicle and autonomous driving solutions company, provides automotive parts and services in Korea, China, the United States, India, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026