- South Korea

- /

- Auto

- /

- KOSE:A005380

Hyundai Motor Company (KRX:005380) Looks Inexpensive But Perhaps Not Attractive Enough

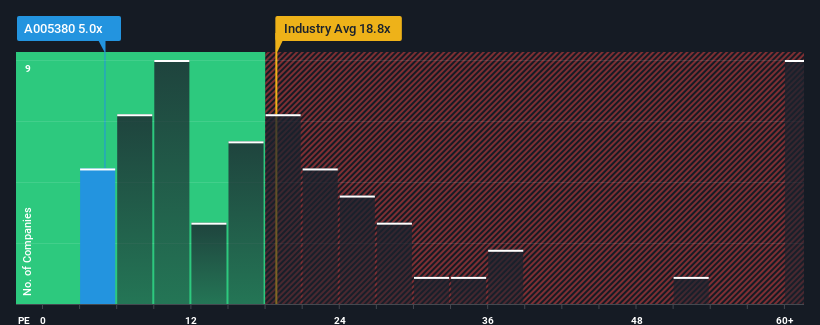

With a price-to-earnings (or "P/E") ratio of 5x Hyundai Motor Company (KRX:005380) may be sending very bullish signals at the moment, given that almost half of all companies in Korea have P/E ratios greater than 12x and even P/E's higher than 23x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been advantageous for Hyundai Motor as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Hyundai Motor

Is There Any Growth For Hyundai Motor?

Hyundai Motor's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen an excellent 108% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 5.2% during the coming year according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 34%, which is noticeably more attractive.

With this information, we can see why Hyundai Motor is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hyundai Motor's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Hyundai Motor (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

Of course, you might also be able to find a better stock than Hyundai Motor. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hyundai Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A005380

Hyundai Motor

Manufactures and distributes motor vehicles and parts worldwide.

Very undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success