- South Korea

- /

- Auto Components

- /

- KOSE:A004100

Taeyang Metal Industrial (KRX:004100) jumps 13% this week, taking three-year gains to 166%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For instance the Taeyang Metal Industrial Co., Ltd. (KRX:004100) share price is 163% higher than it was three years ago. How nice for those who held the stock! And in the last month, the share price has gained 18%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Taeyang Metal Industrial

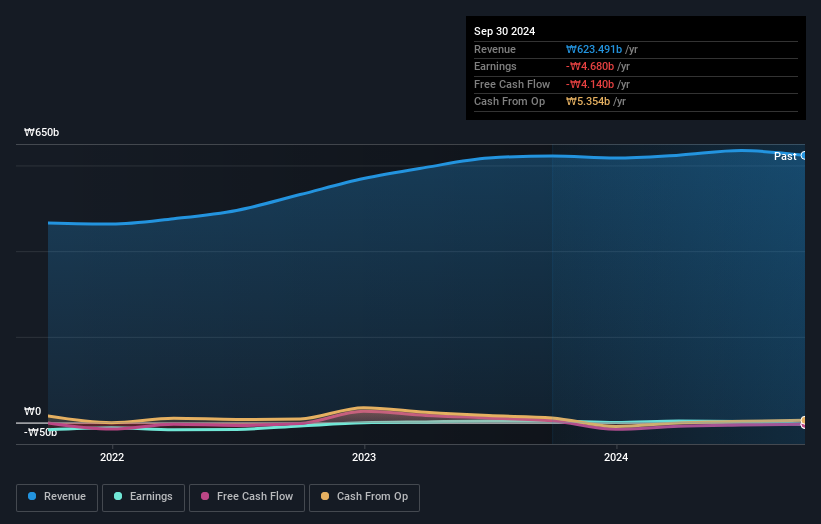

Taeyang Metal Industrial isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Taeyang Metal Industrial's revenue trended up 12% each year over three years. That's a very respectable growth rate. It's fair to say that the market has acknowledged the growth by pushing the share price up 38% per year. The business has made good progress on the top line, but the market is extrapolating the growth. Some investors like to buy in just after a company becomes profitable, since that can be a powerful inflexion point.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Taeyang Metal Industrial stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Taeyang Metal Industrial's TSR for the last 3 years was 166%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Taeyang Metal Industrial has rewarded shareholders with a total shareholder return of 28% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Taeyang Metal Industrial (1 shouldn't be ignored) that you should be aware of.

Of course Taeyang Metal Industrial may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Taeyang Metal Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSE:A004100

Taeyang Metal Industrial

Produces and sells cold forging and precision machining parts for automobiles in South Korea and internationally.

Imperfect balance sheet very low.

Market Insights

Community Narratives