- South Korea

- /

- Auto

- /

- KOSE:A000270

Top Global Dividend Stocks For October 2025

Reviewed by Simply Wall St

In October 2025, global markets are experiencing heightened volatility due to renewed U.S.-China trade tensions and concerns over a prolonged U.S. government shutdown, leading to fluctuations in major stock indices. Amidst this uncertainty, investors are increasingly looking towards dividend stocks as a potential source of stability and income, given their ability to provide regular returns even when market conditions are unpredictable.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.76% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.05% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.74% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.96% | ★★★★★★ |

| NCD (TSE:4783) | 4.36% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.45% | ★★★★★★ |

| Daicel (TSE:4202) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.47% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.53% | ★★★★★★ |

Click here to see the full list of 1393 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

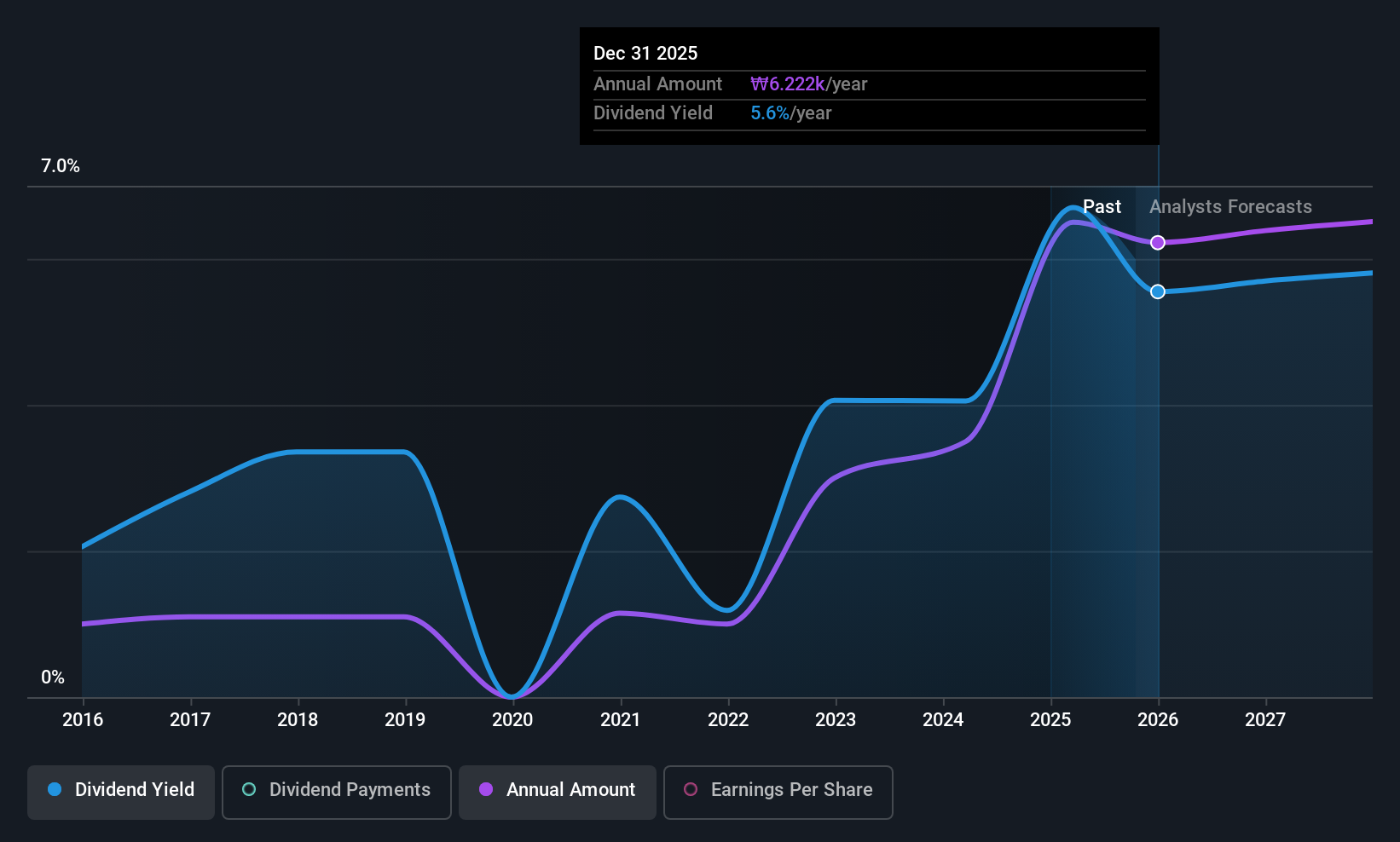

Kia (KOSE:A000270)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation manufactures and sells vehicles across South Korea, North America, and Europe, with a market cap of ₩42.95 trillion.

Operations: Kia Corporation's revenue from the Auto Manufacturers segment amounts to ₩111.04 billion.

Dividend Yield: 5.8%

Kia Corporation's dividend payments are well-supported by earnings and cash flows, with payout ratios of 29.4% and 36.7%, respectively. The company offers a high dividend yield of 5.78%, ranking in the top quartile among Korean stocks, and has demonstrated reliability over the past decade with stable growth in dividends. Additionally, Kia is trading at a significant discount to its estimated fair value, enhancing its appeal for value-focused investors.

- Dive into the specifics of Kia here with our thorough dividend report.

- The valuation report we've compiled suggests that Kia's current price could be quite moderate.

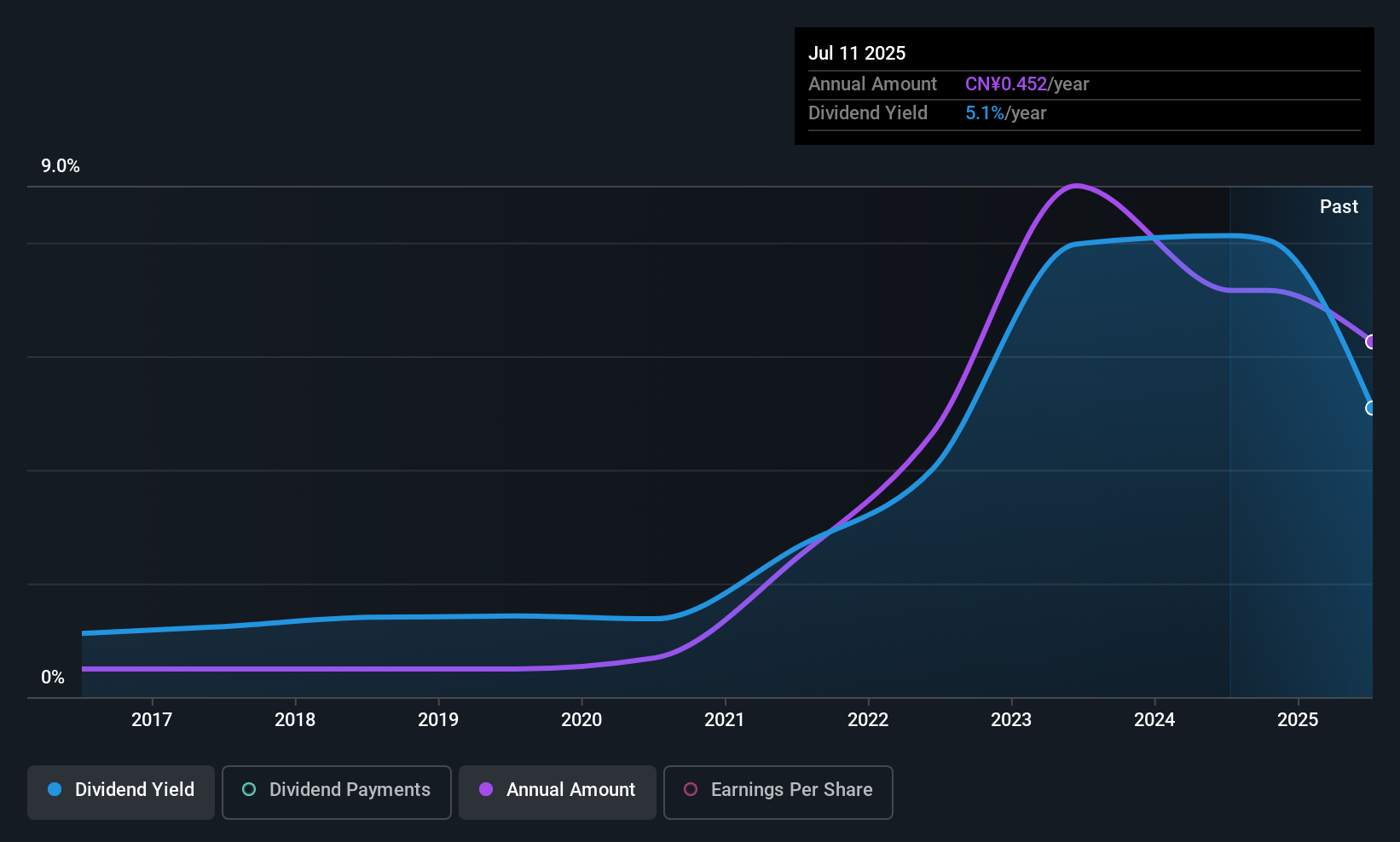

Sichuan Road & Bridge GroupLtd (SHSE:600039)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sichuan Road & Bridge Group Co., Ltd operates in the investment, development, construction, and operation of engineering construction, mining, clean energy, and new materials both in China and internationally with a market cap of CN¥74.26 billion.

Operations: Sichuan Road & Bridge Group Co., Ltd generates revenue through its core activities in engineering construction, mining, clean energy, and new materials across domestic and international markets.

Dividend Yield: 5.2%

Sichuan Road & Bridge Group Ltd's dividend yield of 5.23% ranks in the top quarter of Chinese dividend payers, yet its sustainability is questioned due to insufficient free cash flow coverage. Despite a reasonable payout ratio of 57.3%, dividends have been volatile over the past decade, reflecting inconsistency in reliability. The company has no free cash flows, and debt coverage by operating cash flow remains inadequate, presenting potential risks for income-focused investors seeking stability.

- Unlock comprehensive insights into our analysis of Sichuan Road & Bridge GroupLtd stock in this dividend report.

- Our expertly prepared valuation report Sichuan Road & Bridge GroupLtd implies its share price may be too high.

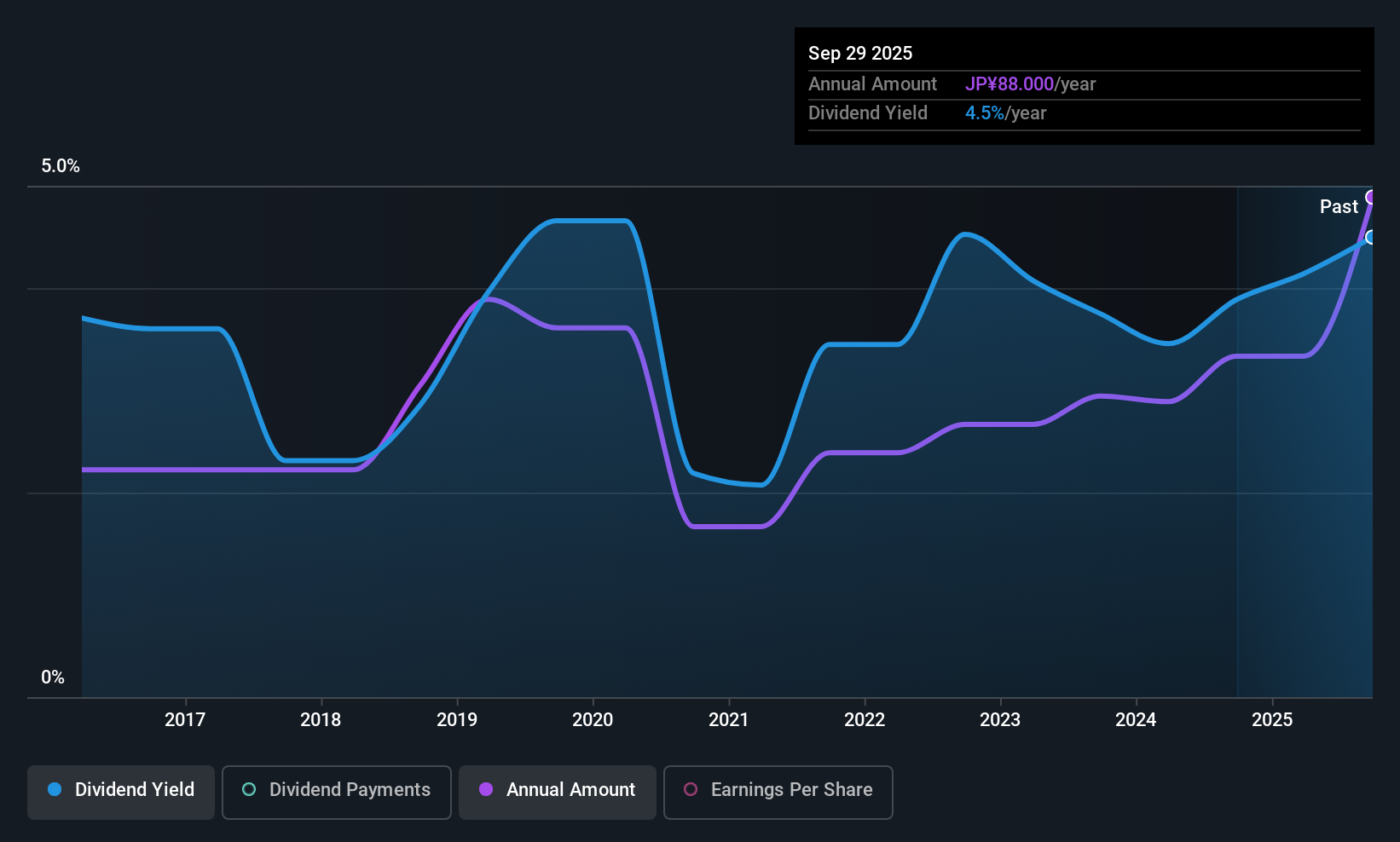

Meiji Electric IndustriesLtd (TSE:3388)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Meiji Electric Industries Co., Ltd. engages in the import, export, and sale of electrical devices, measuring instruments, electrical equipment, and automation and energy-saving components with a market cap of ¥27.56 billion.

Operations: Meiji Electric Industries Ltd. generates revenue of ¥80.40 billion from its Control Equipment, Industrial Equipment, and Measuring Equipment segments.

Dividend Yield: 4.1%

Meiji Electric Industries Ltd. offers a dividend yield of 4.09%, placing it among the top 25% of Japanese dividend payers. However, its dividend history has been volatile and unreliable over the past decade, despite a low payout ratio of 27.9%. The dividends are adequately covered by earnings but less so by cash flows, with an 87% cash payout ratio. Recent financial performance showed significant growth in earnings and sales for Q1 2025, indicating potential future stability.

- Take a closer look at Meiji Electric IndustriesLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Meiji Electric IndustriesLtd's shares may be trading at a premium.

Next Steps

- Reveal the 1393 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A000270

Kia

Manufactures and sells vehicles in South Korea, North America, and Europe.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives