- South Korea

- /

- Auto Components

- /

- KOSDAQ:A013720

Cube & (KOSDAQ:013720) shareholders are up 13% this past week, but still in the red over the last three years

This week we saw the The Cube & Inc. (KOSDAQ:013720) share price climb by 13%. But the last three years have seen a terrible decline. Indeed, the share price is down a whopping 78% in the last three years. So it's about time shareholders saw some gains. Only time will tell if the company can sustain the turnaround.

While the stock has risen 13% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Cube & isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Cube & saw its revenue shrink by 8.9% per year. That is not a good result. Having said that the 21% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

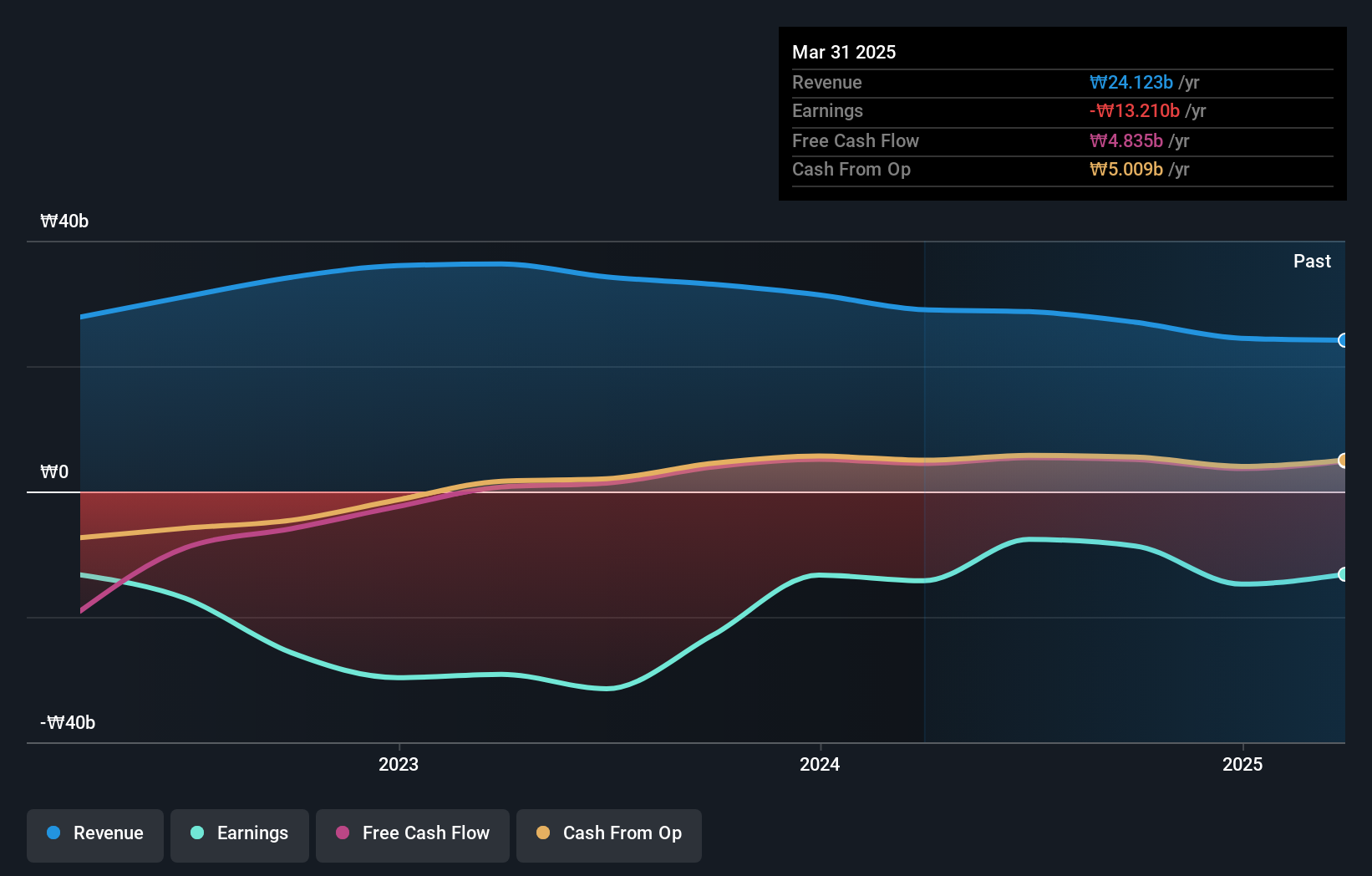

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Cube & stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Cube & shareholders gained a total return of 5.3% during the year. But that return falls short of the market. But at least that's still a gain! Over five years the TSR has been a reduction of 8% per year, over five years. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Cube & (of which 2 shouldn't be ignored!) you should know about.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A013720

Cube &

Manufactures and sells motor vehicles parts and accessories in South Korea, rest of Asia, the United States, Europe, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives