- South Korea

- /

- Auto Components

- /

- KOSDAQ:A008830

Recent 12% pullback isn't enough to hurt long-term Daedong Gear (KOSDAQ:008830) shareholders, they're still up 621% over 5 years

While Daedong Gear Co., Ltd. (KOSDAQ:008830) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 27% in the last quarter. But that does not change the realty that the stock's performance has been terrific, over five years. Indeed, the share price is up a whopping 598% in that time. Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. It really delights us to see such great share price performance for investors.

Although Daedong Gear has shed ₩22b from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Because Daedong Gear made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

For the last half decade, Daedong Gear can boast revenue growth at a rate of 13% per year. That's a fairly respectable growth rate. Arguably it's more than reflected in the very strong share price gain of 48% a year over a half a decade. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

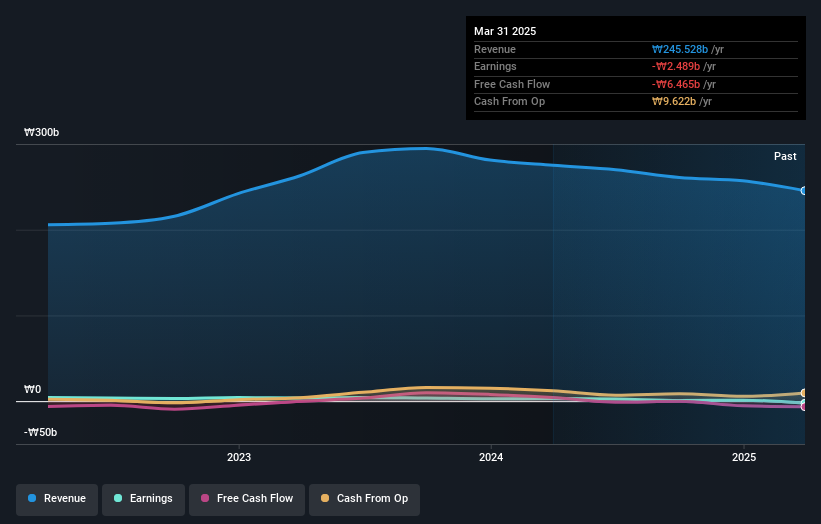

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Daedong Gear's TSR for the last 5 years was 621%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that Daedong Gear shareholders have received a total shareholder return of 86% over one year. That's including the dividend. That's better than the annualised return of 48% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Daedong Gear better, we need to consider many other factors. Even so, be aware that Daedong Gear is showing 3 warning signs in our investment analysis , and 2 of those make us uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KOSDAQ:A008830

Daedong Gear

Manufactures and sells power transmission parts in South Korea and internationally.

Low with imperfect balance sheet.