- Japan

- /

- Gas Utilities

- /

- TSE:9532

Osaka Gas (TSE:9532): Exploring Valuation After Recent Quiet Share Price Strength

Reviewed by Kshitija Bhandaru

If you have been watching Osaka Gas (TSE:9532) lately, you might be wondering if the recent movement in its share price is the market signaling something deeper under the surface. There has not been a headline-grabbing event to explain the change, but even these quieter moves are sometimes a sign that investors are reassessing the business or seeing value where the crowd has not yet focused. For those weighing a new position or thinking about adjusting their stake, this is the kind of moment that deserves a closer look.

Taking a step back, Osaka Gas’s stock has quietly pressed higher in the past year, returning 34% to shareholders while recording an impressive 20% gain over the past three months alone. These moves are not fueled by explosive growth. Revenue and net income both dipped over the last year, yet there seems to be growing momentum in the share price beyond the past month. In the broader context, its multi-year returns are even more striking, suggesting some investors have held on through various cycles and are still in the green.

So, after this steady rally, does Osaka Gas offer genuine value right now, or is the market already pricing in all the growth that lies ahead?

Price-to-Earnings of 11.2x: Is it justified?

Osaka Gas currently trades at a price-to-earnings (P/E) ratio of 11.2x. This is lower than both the Japanese market average (14.9x) and the average for Asian Gas Utilities (13.2x). This suggests the stock may be undervalued relative to peers on this measure.

The P/E ratio is a widely used valuation tool that compares a company’s current share price to its per-share earnings. For a stable utility like Osaka Gas, the P/E helps assess whether the market is pricing in enough upside given the company’s earnings power and future growth prospects.

While the lower multiple hints at attractive value, it also reflects market concerns about the company’s future earnings trajectory. Analyst expectations point to declining revenue and profit growth over the coming years. Investors should weigh whether Osaka Gas’s historic performance, reliable dividends, and defensive sector position can offset these muted forecasts.

Result: Fair Value of ¥3,860 (ABOUT RIGHT)

See our latest analysis for Osaka Gas.However, slower revenue and profit growth or an unexpected industry shift could challenge the idea that Osaka Gas is undervalued at these levels.

Find out about the key risks to this Osaka Gas narrative.Another View: SWS DCF Model Offers a Different Perspective

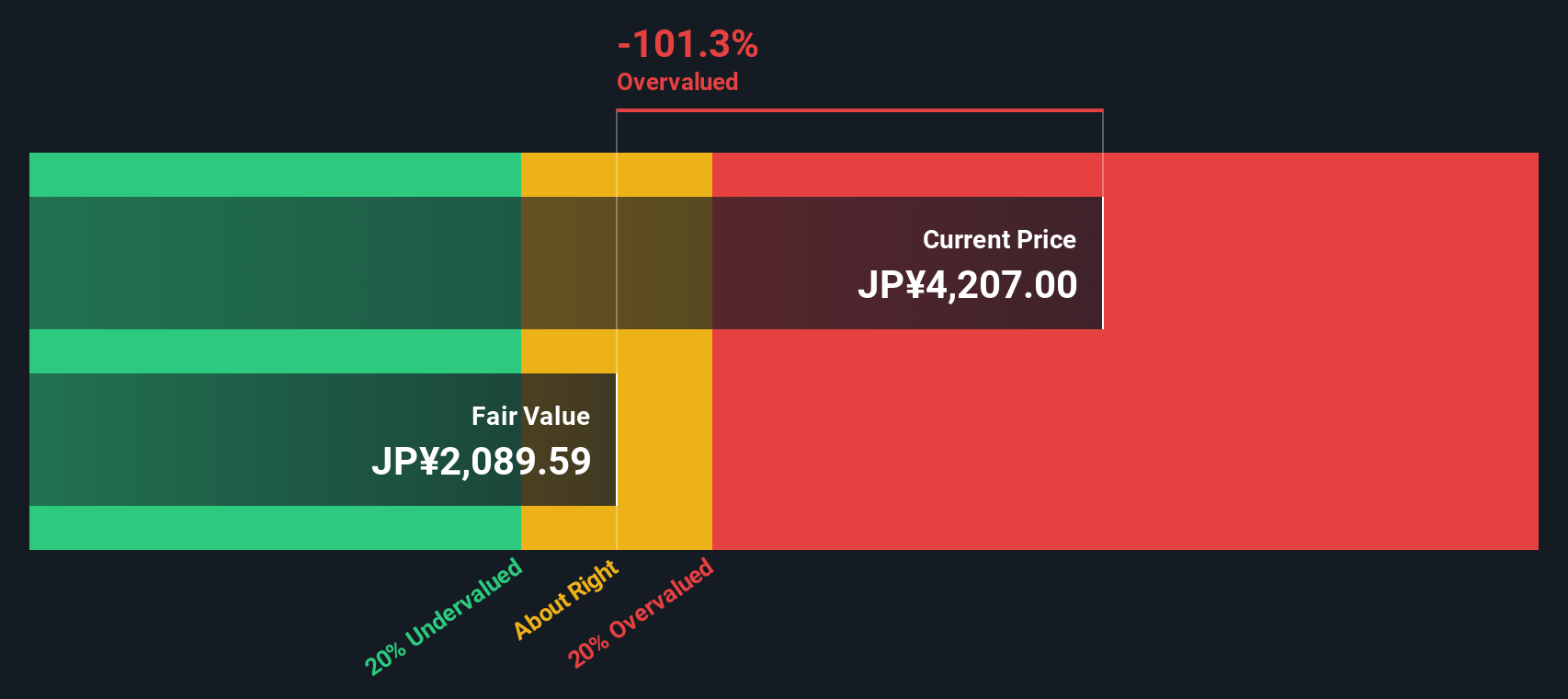

While Osaka Gas looks attractively valued with its earnings ratio, our SWS DCF model suggests the stock could be overvalued compared to its future cash flow potential. Can the optimism seen in market multiples hold up when compared to a more conservative outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Osaka Gas Narrative

If you see things differently or want to dig into the numbers yourself, you have the tools to shape your own story in just a few minutes. Do it your way

A great starting point for your Osaka Gas research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. If you want to get ahead of the curve, try looking beyond Osaka Gas at some of the market’s most compelling themes. These investment screens can help you spot your next big winner before the crowd catches on.

- Tap into rising income streams by finding companies with strong yields and steady payouts through our dividend stocks with yields > 3%.

- Unleash growth potential and uncover tech pioneers leading innovations in artificial intelligence using our AI penny stocks.

- Catch undervalued gems trading well below fair value and position yourself for attractive long-term returns with our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9532

Osaka Gas

Provides gas, electricity, and other energy products and services in Japan and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives