- Japan

- /

- Renewable Energy

- /

- TSE:9522

Renewable Japan Co., Ltd.'s (TSE:9522) Share Price Is Still Matching Investor Opinion Despite 26% Slump

The Renewable Japan Co., Ltd. (TSE:9522) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 183%.

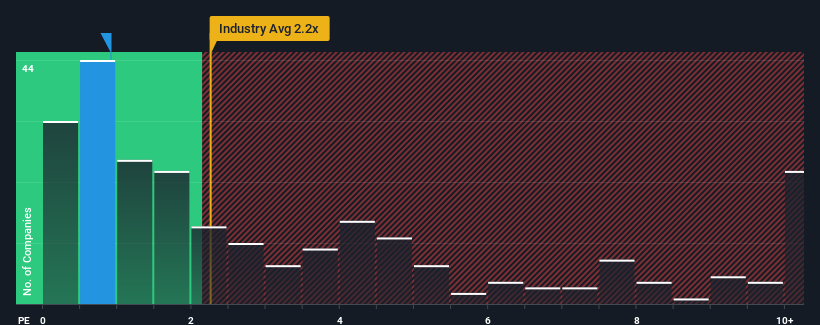

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Renewable Japan's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Renewable Energy industry in Japan is also close to 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Renewable Japan

What Does Renewable Japan's Recent Performance Look Like?

Recent times have been quite advantageous for Renewable Japan as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. Those who are bullish on Renewable Japan will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Renewable Japan, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Renewable Japan's Revenue Growth Trending?

In order to justify its P/S ratio, Renewable Japan would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 90%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 14% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this in consideration, it's clear to see why Renewable Japan's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

The Bottom Line On Renewable Japan's P/S

Following Renewable Japan's share price tumble, its P/S is just clinging on to the industry median P/S. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It appears to us that Renewable Japan maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. Given the current circumstances, it seems improbable that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Renewable Japan (2 are concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:9522

Renewable Japan

Engages in the development, generation, operation, and management of renewable energy power plants in Japan.

Proven track record and slightly overvalued.

Market Insights

Community Narratives