- Japan

- /

- Renewable Energy

- /

- TSE:9513

Evaluating Electric Power Development (TSE:9513) Valuation Following Significant Share Buyback Initiative

Reviewed by Kshitija Bhandaru

Electric Power Development (TSE:9513) recently completed a significant phase of its share buyback program. The company repurchased nearly 2% of outstanding shares for over ¥10 billion. This move is catching investor attention as it relates to capital strategy.

See our latest analysis for Electric Power Development.

Electric Power Development’s recent share buyback comes after fresh investment in battery storage projects, sharpening its focus on both capital efficiency and the future of the grid. While share price returns have been relatively stable, the company’s 1-year total shareholder return stands at 0.19%, with longer-term figures building modestly. This suggests a steady momentum as the company continues to evolve its strategy.

If you’re watching how utility stocks position for the next phase of growth, now’s a great chance to discover fast growing stocks with high insider ownership

Yet with recent buybacks and strategic investments, there is debate about whether Electric Power Development shares reflect untapped value or if the market has already priced in future growth, leaving limited room for upside.

Price-to-Earnings of 4.4x: Is it justified?

Electric Power Development trades at a price-to-earnings (P/E) ratio of just 4.4x, which stands out as low when compared to both industry peers and the wider Japanese market. The last close price was ¥2,828, and this multiple suggests the stock is trading at a discount relative to sector averages.

The price-to-earnings ratio measures the market’s valuation of a company’s earnings and is calculated by dividing the current share price by earnings per share. For Electric Power Development, the low multiple invites the question of whether investors are underestimating its earnings durability in the context of the utilities sector.

According to the statement data, 9513 is considered good value based on its price-to-earnings ratio when compared to both Asian Renewable Energy industry peers at 16.2x and the general peer average at 14.6x. The current multiple also sits below an internally estimated “fair” price-to-earnings ratio of 5.5x. This may indicate additional headroom if the company maintains or grows earnings.

Explore the SWS fair ratio for Electric Power Development

Result: Price-to-Earnings of 4.4x (UNDERVALUED)

However, declining annual revenue and double-digit net income drops signal that headwinds in growth and profitability could challenge the current undervaluation story.

Find out about the key risks to this Electric Power Development narrative.

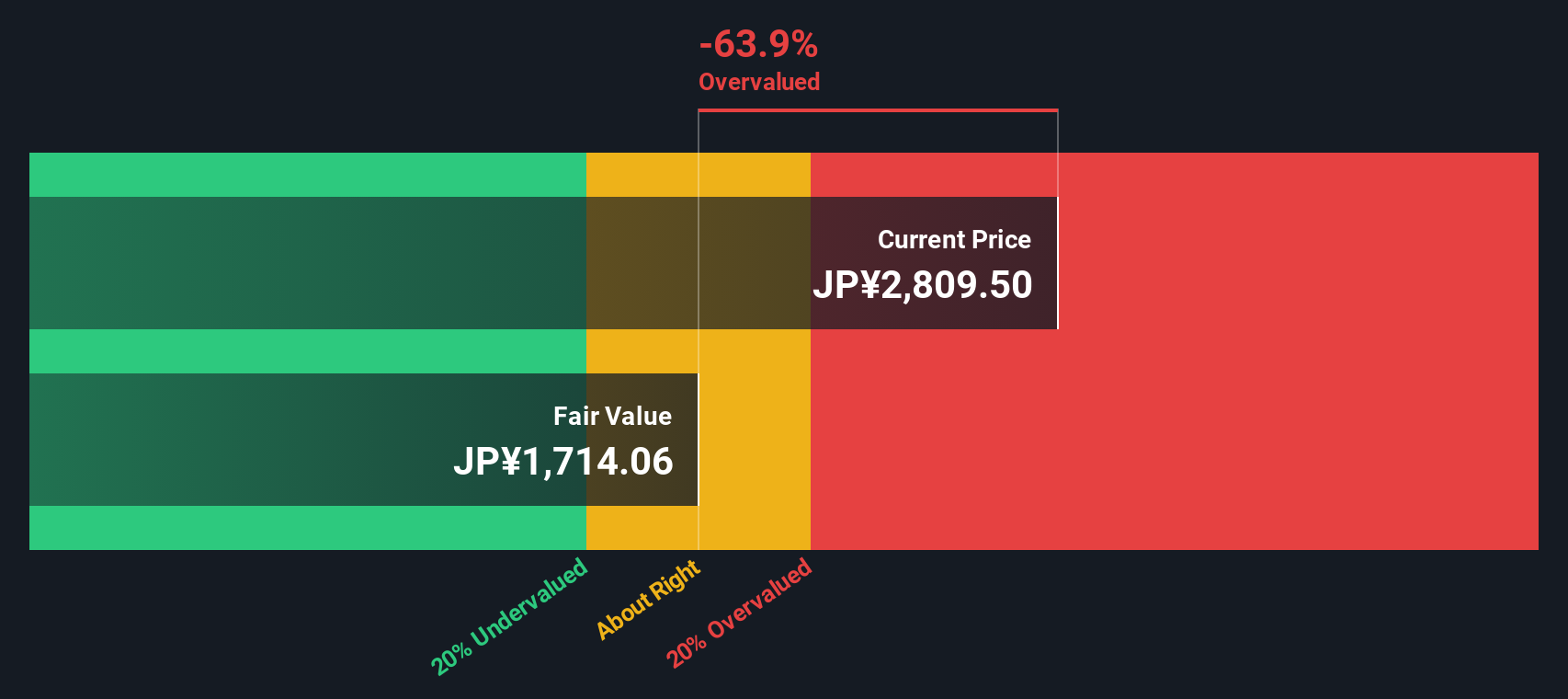

Another View: SWS DCF Model Raises New Questions

Looking from a different angle, the SWS DCF model estimates Electric Power Development’s fair value at ¥1,706.98, which is well below the current share price of ¥2,834. This suggests the stock may actually be overvalued when considering future cash flow forecasts. Does this finding challenge the narrative presented by traditional valuation metrics?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electric Power Development for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electric Power Development Narrative

If you have a different perspective on the numbers or want to dig deeper yourself, crafting your own view is quick and easy. It takes just a few minutes. Do it your way

A great starting point for your Electric Power Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors seize opportunities where others hesitate. Level up your research and spot tomorrow’s winners by checking out these exciting opportunities tailored for different strategies:

- Boost your portfolio’s income potential with these 19 dividend stocks with yields > 3%, which offers yields above 3% for a steady stream of returns.

- Seize the momentum in artificial intelligence by tracking these 24 AI penny stocks, positioned at the forefront of innovation and market disruption.

- Capitalize on overlooked value by analyzing these 887 undervalued stocks based on cash flows, known for attractive cash flow fundamentals and hidden upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Power Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9513

Electric Power Development

Operates as electric utility company in Japan.

Solid track record established dividend payer.

Market Insights

Community Narratives