- Japan

- /

- Renewable Energy

- /

- TSE:9513

Electric Power Development (TSE:9513) Valuation Check After Ongoing Share Buyback Update

Reviewed by Simply Wall St

Electric Power Development (TSE:9513) just updated investors on its ongoing share buyback, reporting fresh purchases under a 20 billion yen program designed to streamline its balance sheet and quietly support shareholder value.

See our latest analysis for Electric Power Development.

The buyback comes after a solid run, with a 17.2% year to date share price return and a strong 26.2% one year total shareholder return signaling that momentum is still broadly constructive despite recent short term weakness.

If this capital return story has you rethinking your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas alongside Electric Power Development.

Yet with earnings under pressure, a modest value score, and the stock now trading above analyst targets, investors must ask: Is Electric Power Development still a mispriced opportunity, or is the market already baking in future growth?

Price-to-Earnings of 5x: Is it justified?

On a trailing price-to-earnings ratio of roughly 5x at a last close of ¥3006, Electric Power Development screens as undervalued against both the broader Japanese market and its regional renewable energy peers.

The price-to-earnings multiple compares what investors are currently paying for each unit of the company’s earnings, a key yardstick for mature, profit generating utilities. For Electric Power Development, that low multiple sits alongside high quality earnings and an improving net profit margin. This suggests the market is not paying a premium for profitability that has, so far, been resilient.

Relative to the Asian renewable energy industry’s average multiple of about 16.8x and a peer average of 13.5x, the company’s 5x ratio looks deeply discounted. This implies investors are pricing in weaker future performance than the sector. Even when set against an estimated fair price-to-earnings ratio of 7.3x, the current valuation appears conservative. This leaves room for the market multiple to move closer to that fair level if sentiment improves.

Explore the SWS fair ratio for Electric Power Development

Result: Price-to-Earnings of 5x (UNDERVALUED)

However, with earnings contracting and the share price already above consensus targets, any further profit pressure or guidance downgrade could quickly challenge the undervaluation thesis.

Find out about the key risks to this Electric Power Development narrative.

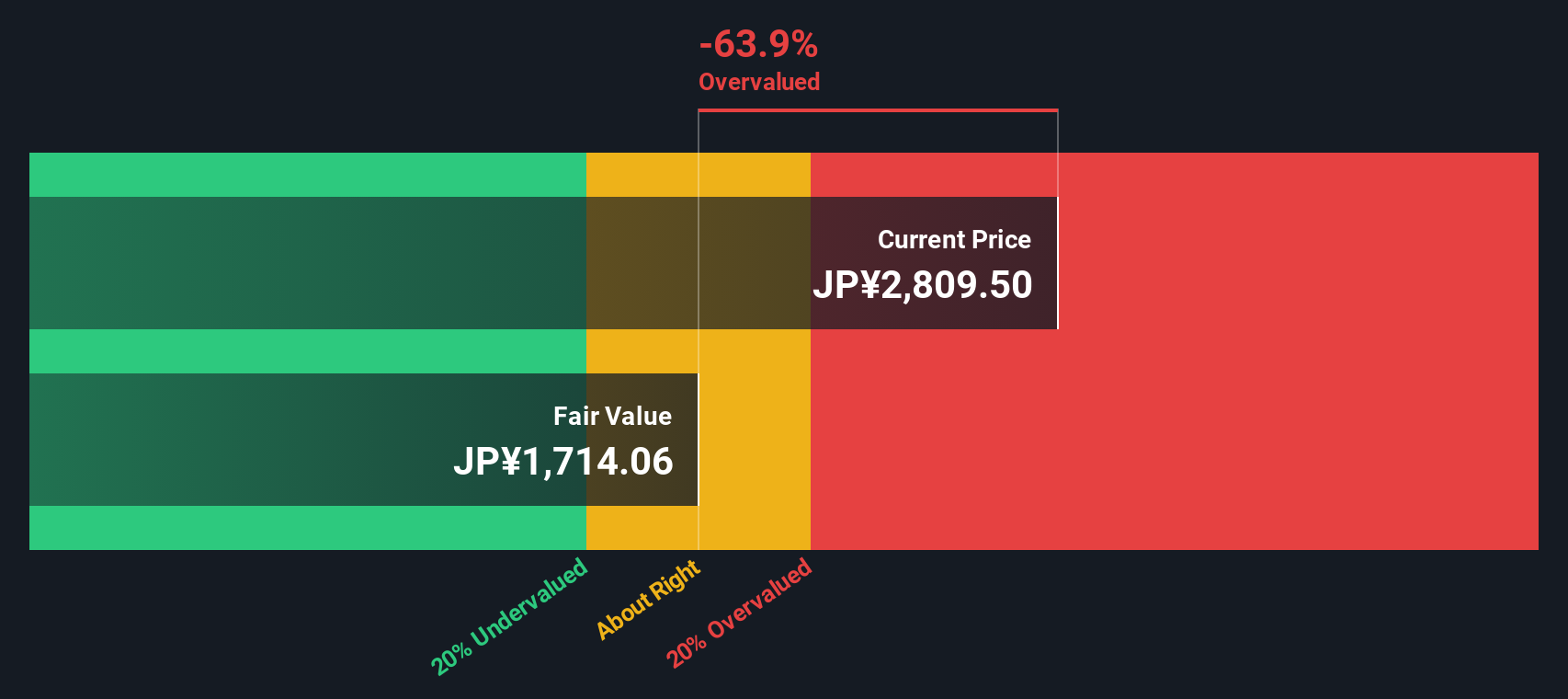

Another View: DCF Flags Overvaluation Risk

While a 5x earnings multiple suggests value, our DCF model paints a different picture. On that view, fair value sits closer to ¥1710 per share versus today’s ¥3006, which implies Electric Power Development could be significantly overvalued if cash flows disappoint.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Electric Power Development for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Electric Power Development Narrative

If you see the story differently, or would rather rely on your own analysis, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Electric Power Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop building their watchlist, so use Simply Wall St's powerful screener tools today or risk missing the next wave of standout opportunities.

- Capitalize on potential mispricings by targeting companies trading below intrinsic value through these 915 undervalued stocks based on cash flows that align with your long term strategy.

- Explore developments in digital assets by scanning these 81 cryptocurrency and blockchain stocks to pinpoint listed businesses involved in blockchain adoption and cryptocurrency-related activities.

- Focus on these 14 dividend stocks with yields > 3% to identify companies that currently offer dividend income and have fundamentals that may support ongoing payouts across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electric Power Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9513

Electric Power Development

Operates as electric utility company in Japan.

Established dividend payer with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026