- Japan

- /

- Gas Utilities

- /

- TSE:3361

ToellLtd (TSE:3361) Q2 EPS Slowdown Tests Bullish Discount-to-DCF Narrative

Reviewed by Simply Wall St

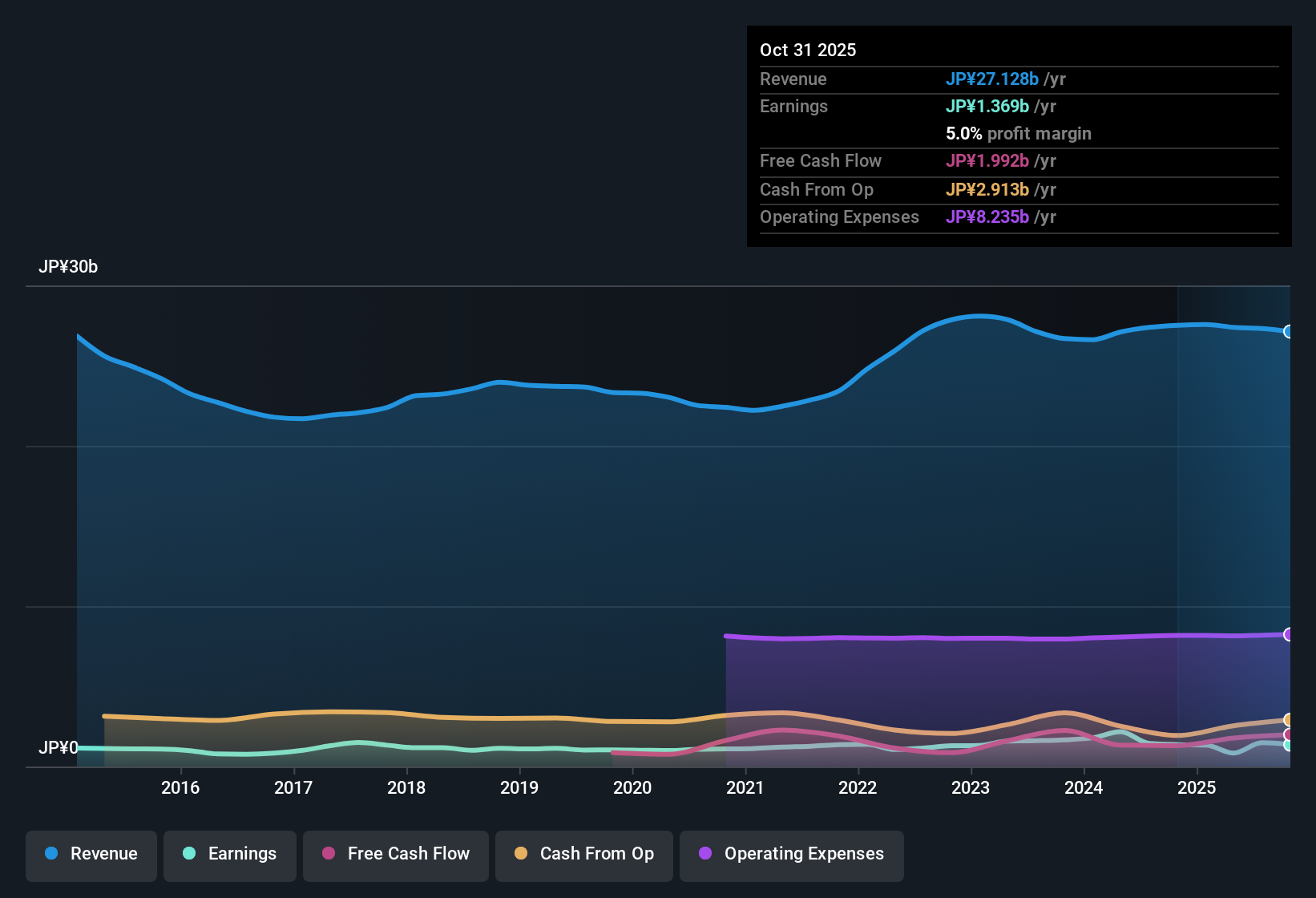

ToellLtd (TSE:3361) has posted its Q2 2026 numbers with revenue of ¥5.5 billion and net income of ¥225 million, translating into basic EPS of ¥11.98. The company has seen revenue move from ¥5.7 billion and EPS of ¥17.30 in Q2 2025 to ¥5.5 billion and EPS of ¥11.98 in the latest quarter, while trailing twelve month EPS sits at ¥72.77 on net income of ¥1.37 billion, providing a clear backdrop for how profit margins are shaping investor expectations.

See our full analysis for ToellLtd.With the headline figures on the table, the next step is to weigh them against the dominant narratives around ToellLtd, highlighting where the latest margins support the prevailing story and where they call it into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

LTM EPS Near ¥72.8 Highlights Recovery From 2025 Volatility

- On a trailing twelve month basis, EPS is ¥72.77 on net income of ¥1,369 million from ¥27.1 billion in revenue, which smooths out the sharp swing from the loss in Q1 2025 and the stronger profits later in 2025.

- What stands out for a bullish take is how this five year earnings growth of 4.2 percent a year, plus a 5 percent trailing net margin, coexists with a very weak one year earnings growth figure of 0.07 percent. This suggests steady underlying earnings power but limited recent acceleration.

- Bulls can point to the high quality label on past earnings and the move from a Q1 2025 loss of ¥367 million to positive TTM net income of ¥1,369 million as evidence that the business absorbs rough patches and still delivers profits.

- At the same time, the flat one year growth forces a check on bullish growth stories, because the recent trend does not yet match the longer term 4.2 percent annual pace implied by the last five years.

5 percent Net Margin Versus Slower Near Term Progress

- Trailing net profit margin is reported at 5 percent, higher than the prior year, while quarterly net income has moved from ¥476 million in Q3 2025 to ¥225 million in Q2 2026 as revenue stepped down from ¥7.8 billion in Q4 2025 to ¥5.5 billion most recently.

- Critics looking for a bearish angle may focus on the combination of that 5 percent margin and the 0.07 percent one year earnings growth, arguing that profitability is respectable but that recent profit growth is hardly moving.

- The sequence from Q3 2025 net income of ¥476 million to ¥394 million in Q4 2025 and then ¥274 million in Q1 2026 and ¥225 million in Q2 2026 shows that quarterly profit has been easing even as the trailing margin reads as improved.

- This pattern gives bears room to say that while the margin level looks fine on a trailing view, the shorter term direction of net income does not yet back a strong acceleration story.

Valuation Gap, P E 11.4x, And A 2.77 percent Yield

- With the share price at ¥830 versus a DCF fair value of ¥1,971.76, the stock trades about 57.9 percent below that DCF figure, while the trailing P E of 11.4 times sits below the Asian Gas Utilities average of 13.3 times but above the 8.7 times peer group average alongside a 2.77 percent dividend yield.

- From a bullish perspective on valuation, supporters can argue that this large gap to DCF fair value and the mid range P E multiple together suggest the market is pricing in the slower one year earnings growth much more heavily than the five year 4.2 percent annual expansion and the steady dividend.

- The fact that the stock is cheaper than the broader industry on P E while still offering a 2.77 percent yield and high quality past earnings gives bulls a concrete case that investors are not paying up for these traits yet.

- However, trading richer than peers on P E means that any continued 0.07 percent style growth will be closely watched, because peers may look more attractive on a simple multiple screen if ToellLtd does not re accelerate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ToellLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While ToellLtd's margins and valuation look respectable on a trailing view, the recent slowdown in quarterly earnings and muted one year growth undermine a strong acceleration story.

If that stalling momentum makes you uneasy, use our stable growth stocks screener (2093 results) to quickly zero in on businesses already proving they can compound earnings and revenue more reliably through different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ToellLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3361

Flawless balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion