- Japan

- /

- Transportation

- /

- TSE:9619

Top 3 Japanese Dividend Stocks Yielding Up To 3.5%

Reviewed by Simply Wall St

Japan’s stock markets have experienced significant volatility recently, driven by a rebounding yen and the Bank of Japan's hawkish monetary policy stance. However, dovish comments from central bank officials have helped stabilize the market, making it an opportune time to explore dividend stocks. In this environment, dividend stocks can offer a reliable income stream and potential for capital appreciation. Here are three top Japanese dividend stocks yielding up to 3.5%.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Globeride (TSE:7990) | 4.21% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.04% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.97% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.91% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.17% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.86% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.95% | ★★★★★★ |

| Innotech (TSE:9880) | 4.90% | ★★★★★★ |

Click here to see the full list of 472 stocks from our Top Japanese Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

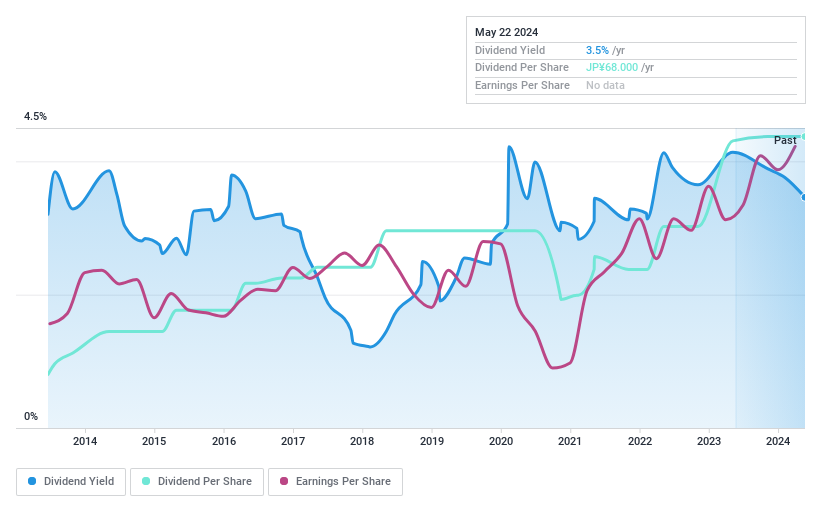

Persol HoldingsLtd (TSE:2181)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Persol Holdings Co., Ltd., with a market cap of ¥615.39 billion, provides human resource services globally under the PERSOL brand.

Operations: Persol Holdings Co., Ltd. generates revenue through several segments including BPO (¥110.80 million), Career (¥128.28 million), Technology (¥102.38 million), Asia Pacific (¥412.77 million), and Staffing excluding BPO (¥575.80 million).

Dividend Yield: 3.3%

Persol Holdings Ltd. has a reasonable payout ratio of 65.1%, ensuring dividends are covered by earnings, and a cash payout ratio of 32.8%, indicating strong coverage by cash flows. However, the dividend yield at 3.32% is lower than Japan's top-tier payers and has been volatile over the past decade despite recent growth in payments. The company recently completed a buyback program repurchasing shares worth ¥3,589.49 million to enhance shareholder returns.

- Delve into the full analysis dividend report here for a deeper understanding of Persol HoldingsLtd.

- Our expertly prepared valuation report Persol HoldingsLtd implies its share price may be lower than expected.

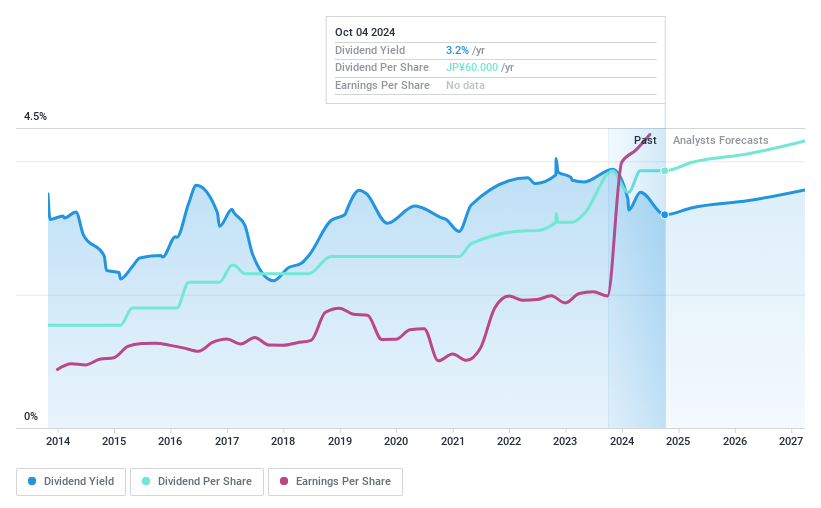

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YAMADA Consulting Group Co., Ltd. offers a range of consulting services across Japan, Asia, the United States, and internationally, with a market cap of ¥41.36 billion.

Operations: YAMADA Consulting Group Co., Ltd. generates its revenue from providing diverse consulting services across various regions, including Japan, Asia, and the United States.

Dividend Yield: 3.5%

YAMADA Consulting Group Ltd. maintains a sustainable dividend payout with a 36.9% earnings coverage and 24.8% cash flow coverage, though its dividend track record has been volatile over the past decade. The company recently announced an increase in its second-quarter dividend to ¥38 per share from ¥33 per share last year but expects to pay ¥38 for the fiscal year ending March 31, 2025, down from ¥43 previously. Earnings grew by 73.6% last year, supporting future payouts despite past volatility.

- Click to explore a detailed breakdown of our findings in YAMADA Consulting GroupLtd's dividend report.

- Our valuation report unveils the possibility YAMADA Consulting GroupLtd's shares may be trading at a premium.

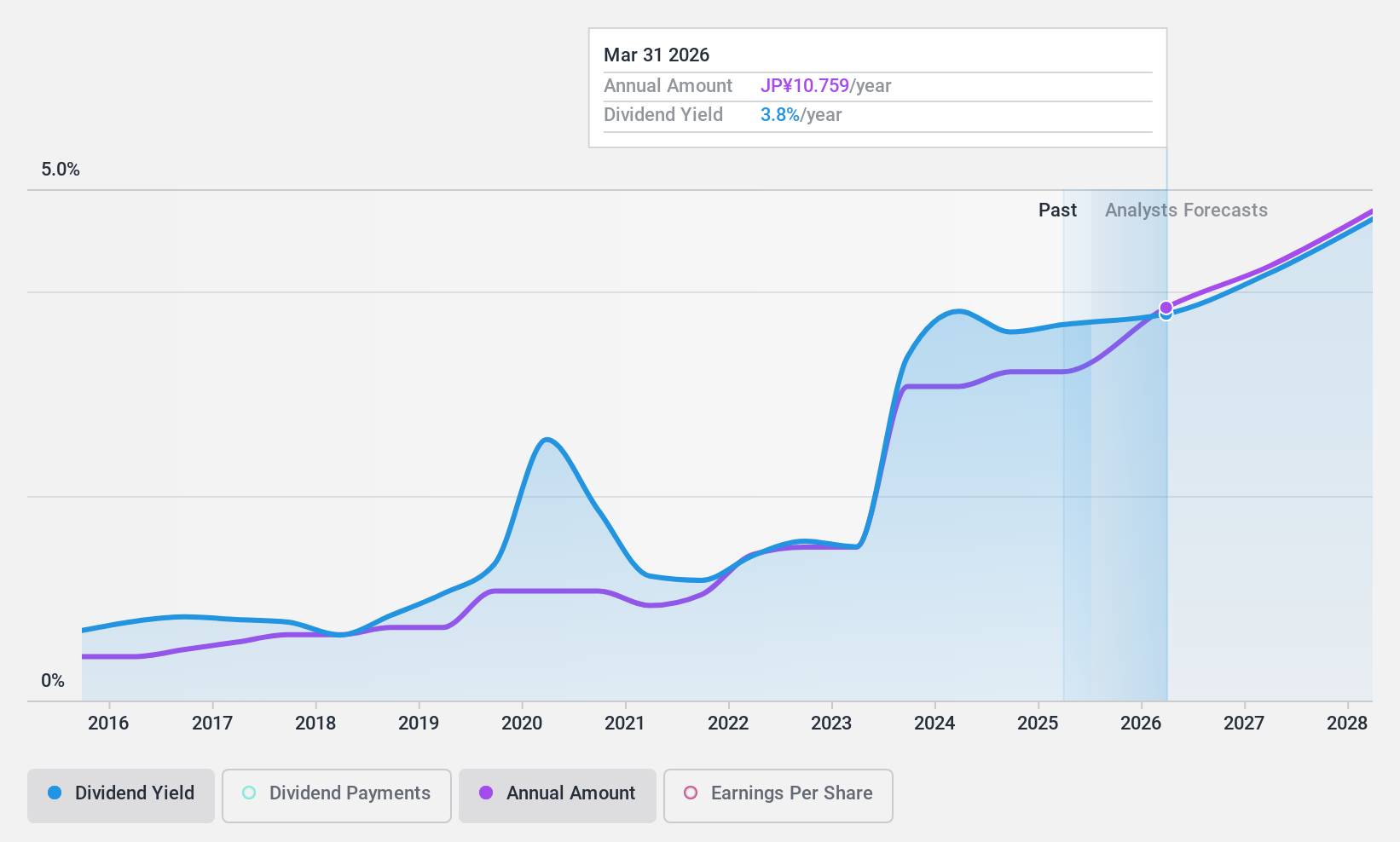

Ichinen HoldingsLtd (TSE:9619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ichinen Holdings Co., Ltd. operates in automotive leasing, chemical, parking, machine tool sales, and synthetic resin businesses in Japan with a market cap of ¥40.10 billion.

Operations: Ichinen Holdings Co., Ltd. generates revenue from several segments including Automobile Leasing Related Business (¥58.67 billion), Machine Tool Sales Business (¥36.19 billion), Synthetic Resin Business (¥17.33 billion), Chemical Business (¥11.92 billion), Agriculture Related Business (¥5.67 billion), and Parking Business (¥7.50 billion).

Dividend Yield: 3.6%

Ichinen Holdings Ltd. maintains a sustainable dividend payout with an 11.8% earnings coverage and 39.3% cash flow coverage, despite a volatile dividend history over the past decade. The company recently announced a share repurchase program worth ¥1 billion to enhance shareholder returns and improve capital efficiency. Trading at a P/E ratio of 3.3x, Ichinen offers good relative value compared to peers, though its earnings are forecasted to decline by an average of 21.3% annually over the next three years.

- Unlock comprehensive insights into our analysis of Ichinen HoldingsLtd stock in this dividend report.

- Our valuation report here indicates Ichinen HoldingsLtd may be undervalued.

Where To Now?

- Take a closer look at our Top Japanese Dividend Stocks list of 472 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9619

Ichinen HoldingsLtd

Engages in automotive leasing, chemical, parking, machine tool sales, and synthetic resin businesses in Japan.

Undervalued with proven track record and pays a dividend.