- Japan

- /

- Marine and Shipping

- /

- TSE:9384

Three Top Dividend Stocks For Reliable Income

Reviewed by Simply Wall St

As global markets react to policy shifts and economic indicators, major indices like the S&P 500 have reached new highs amid optimism over trade developments and AI investments. In such a dynamic environment, dividend stocks can offer a stable source of income, providing investors with consistent returns through regular payouts while potentially benefiting from market growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.48% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

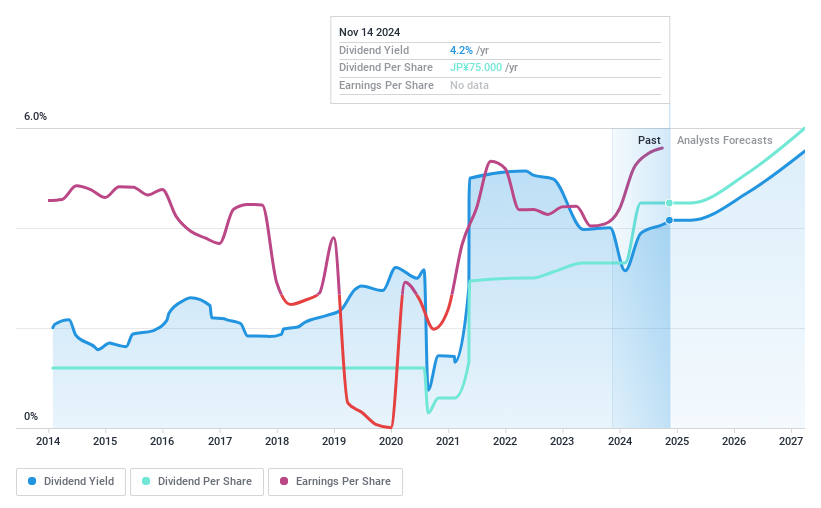

FukokuLtd (TSE:5185)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fukoku Co., Ltd. produces and sells rubber products both in Japan and internationally, with a market cap of ¥28.43 billion.

Operations: Fukoku Co., Ltd. generates revenue from several segments, including Hose (¥5.14 billion), Metal (¥5.94 billion), Anti-Vibration (¥38.71 billion), and Functional Product (¥39.19 billion).

Dividend Yield: 4.2%

Fukoku Ltd. offers a compelling dividend profile with a low payout ratio of 31.8%, indicating dividends are well covered by earnings, though not by cash flows due to a high cash payout ratio of 90%. The company recently increased its interim dividend from ¥27.50 to ¥37.50 per share, reflecting consistent growth over the past decade and stability in payments. Trading at 63.1% below estimated fair value suggests potential for capital appreciation alongside dividends.

- Click to explore a detailed breakdown of our findings in FukokuLtd's dividend report.

- In light of our recent valuation report, it seems possible that FukokuLtd is trading behind its estimated value.

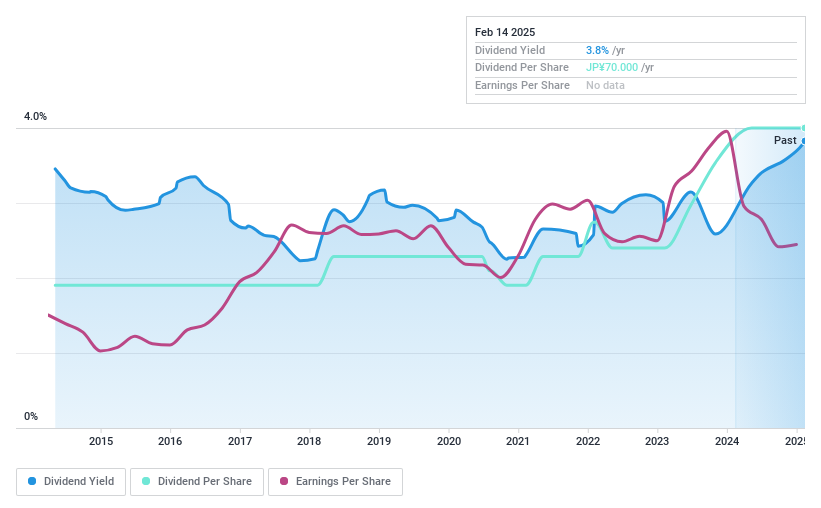

Aichi Tokei Denki (TSE:7723)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aichi Tokei Denki Co., Ltd. provides water and gas meters, along with related equipment, serving both domestic and international markets, with a market cap of ¥29.15 billion.

Operations: Aichi Tokei Denki Co., Ltd.'s revenue primarily comes from its Measuring Instrument Business, which generated ¥52.02 billion.

Dividend Yield: 3.6%

Aichi Tokei Denki's dividends are well covered by both earnings and cash flows, with payout ratios of 40.2% and 37.5%, respectively. However, the dividend history is unreliable due to volatility over the past decade despite some growth. The current yield of 3.59% is slightly below Japan's top quartile dividend payers. While profit margins have decreased from last year, the stock trades at a significant discount to its estimated fair value, offering potential upside alongside dividends.

- Get an in-depth perspective on Aichi Tokei Denki's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Aichi Tokei Denki shares in the market.

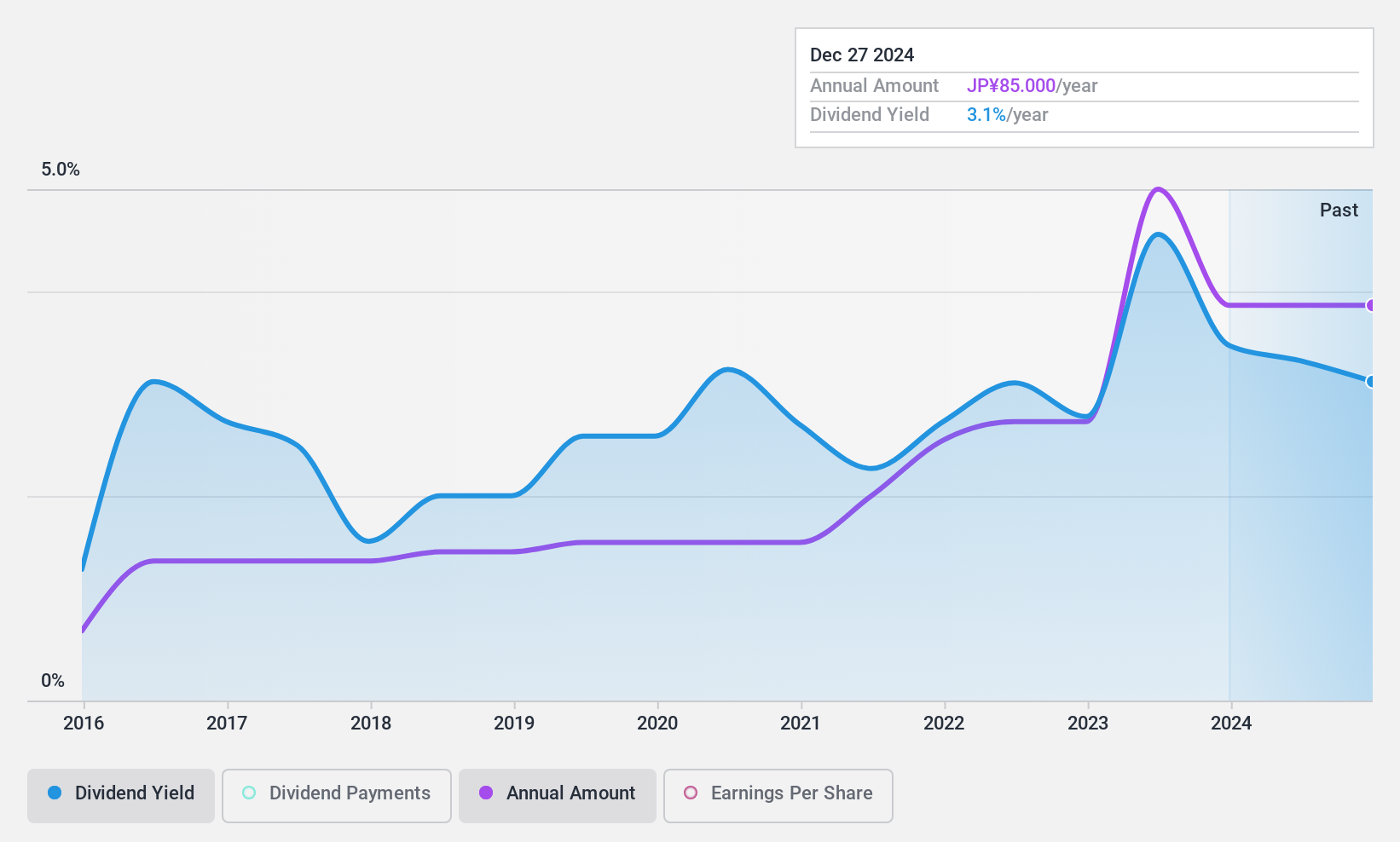

Naigai Trans Line (TSE:9384)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Naigai Trans Line Ltd., with a market cap of ¥25.37 billion, offers integrated logistics services by ship across Japan, the rest of Asia, and internationally through its subsidiaries.

Operations: Naigai Trans Line Ltd. generates its revenue primarily from its operations in Japan, amounting to ¥24.36 billion, and from overseas activities, contributing ¥14.17 billion.

Dividend Yield: 3.2%

Naigai Trans Line's dividends are supported by both earnings and cash flows, with payout ratios of 29.7% and 39.9%, respectively, indicating sustainability despite a volatile dividend history over the past decade. Recent ex-dividend date news highlights a ¥45 cash dividend for December 2024. The current yield of 3.23% is below Japan's top quartile, but the stock trades at a significant discount to its estimated fair value, suggesting potential value for investors seeking dividends.

- Take a closer look at Naigai Trans Line's potential here in our dividend report.

- Upon reviewing our latest valuation report, Naigai Trans Line's share price might be too pessimistic.

Turning Ideas Into Actions

- Gain an insight into the universe of 1955 Top Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Naigai Trans Line might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9384

Naigai Trans Line

Provides integrated logistics services by ship in Japan, rest of Asia, and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives